CCAs Climb Higher on Record Q3 Auction Results

2 Min. Read Time

CCA futures prices pushed higher following the release of all-time-high auction results for the joint California-Quebec Western Climate Initiative (WCI). CCA futures traded in a narrow range since the auction was held last August 16 on low volume but saw a notable pick up market activity on Wednesday's results announcement, closing up 2.5% for the day at $36.92.

Joint Auction #36 marks the first auction following the market regulator's announcement of a significant tightening of the cap-and-trade program. The auction clearance price was consistent with the secondary market price at the time. While the current auction cleared at $35.20—$5 higher than the previous auction—the bid ratio remained on the lower side, even with increased investor participation.

The #36th WCI auction was fully subscribed with 55.76 M current vintages and 7.57 million advanced vintages sold. The auction settled at a price of $35.20 per MtCO2 and featured a bid-to-cover ratio of 1.59, while the advance auction settled at $34.16 with a bid-to-cover ratio of 2.02.

A total of 121 qualified bidders participated in this auction, 90 from California and 31 from Quebec. Financial participation increased slightly from 13.6% in the previous auction to 16.6% in the current one. Investor participation in auctions continues to be in the 15-20% range for current auctions and 15-25% range for advance auctions. Although the rate of new financial entities entering the market has slowed, the rise of CCAs over the last few months is likely to attract new participants.

The markets have reacted very positively to the potential tightening, and it is likely that the market will keep climbing and converge towards its fundamentals. The major driving force continues to be the overarching program review, which is expected to dominate market movements until 2025. The impact of the three scenarios currently modeled by CARB (the market regulator) shows a rapid decline in the surplus bank. In the most likely tightening scenario, which predicts a 48% reduction, the surplus bank is projected to fall to 70 million allowances by 2030, down from the current 330 million. This rapid decline in the bank is expected to lead to quick price escalation.

CCA prices leading up to and after JA #36

In the months of June and July leading up to the auction, CCAs saw a steady rise from $30.72 at the start of June to $36.19 on August 1. A July 27th CARB workshop outlining the three target scenarios under consideration accounts for the jump on that day. Over the month of August, prices ranged between $36.50 and $35.10. The day before the auction itself, CCAs were trading at $35.18, almost exactly where the auction would clear.

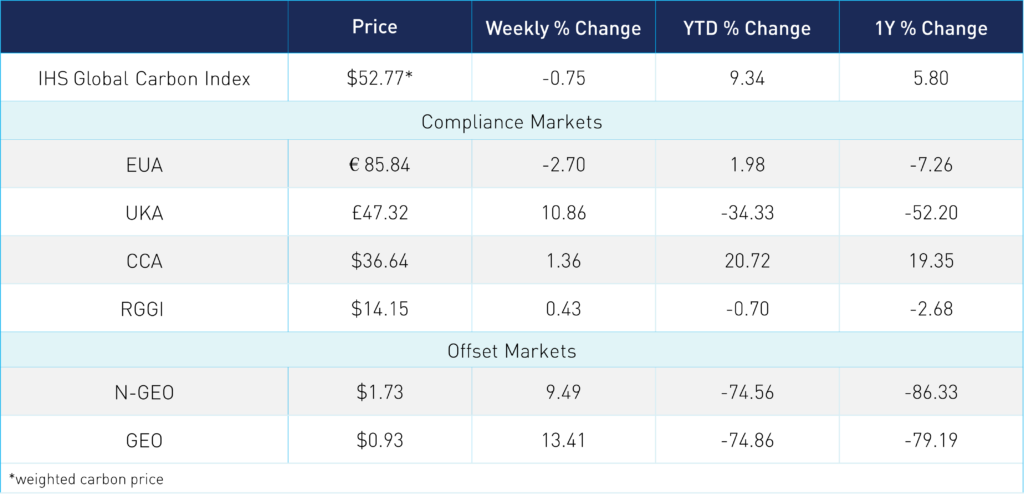

Carbon Market Roundup

The global price of carbon is $52.77, down a slight 0.8% from a week prior. EUAs fell 2.7% week over week to close at €85.84. UKAs made a comeback, up 10.9% at £47.32. CCAs have held strong above the $36 level throughout the week. Volumes remained low leading up to the auction release and then ticked up following the results, though have since come back down. Overall, CCAs were up 1.4% at $36.64. RGGI continues to trade in a tight range, up just 0.4% at $14.15. The offsets contracts performed well this week, with N-GEOs up 9.5% and GEOs up 13.4% though prices still remain low at $1.73 and $0.93, respectively.