CCA Market to Shift into Supply Deficit

3 Min. Read Time

Over the last few years, California's cap-and-trade allowance market has brought in many investors by offering attractive characteristics:

- The auction reserve (floor) price increases annually by a rate of 5% plus inflation, providing price support by limiting potential downside risk, especially with recent inflation levels (the reserve price increased by 12.74% in 2023 to $22.21);

- The Cost Containment Reserve (CCR) price levels are much higher than the current price, leaving significant room for price appreciation (CCR Tier 1 price of $51.92 is more than 70% higher than May's auction settlement price of $30.331);

- The CCA market is the second most liquid carbon market in the world, trading at $44.5 billion in 2022.2

More recently, California's revised climate strategy sets more ambitious 2030 emissions reduction goals, with the cap-and-trade program set to serve as a major policy tool. To achieve these new targets, regulators plan to introduce new supply-tightening measures to California's market, which should support higher carbon prices and help accelerate decarbonization among industries.

In December 2022, the California Air Resources Board (CARB), i.e., the market regulator, updated its 2022 Climate Change Scoping Plan to identify "a technologically feasible and cost-effective path to achieve carbon neutrality by 2045." They found that California needs to reduce its emissions by at least 48% lower vs. 1990 levels by 2030, up from its previous 40% target.3

Last month, CARB held a much-anticipated workshop to discuss various new measures for the state cap-and-trade program (covered previously in our blog). The board's intentions were summarized right from the start of the workshop by Rajinder Sahota, deputy executive officer at CARB: "We are talking about tightening the program to increase ambition for this decade and beyond."4

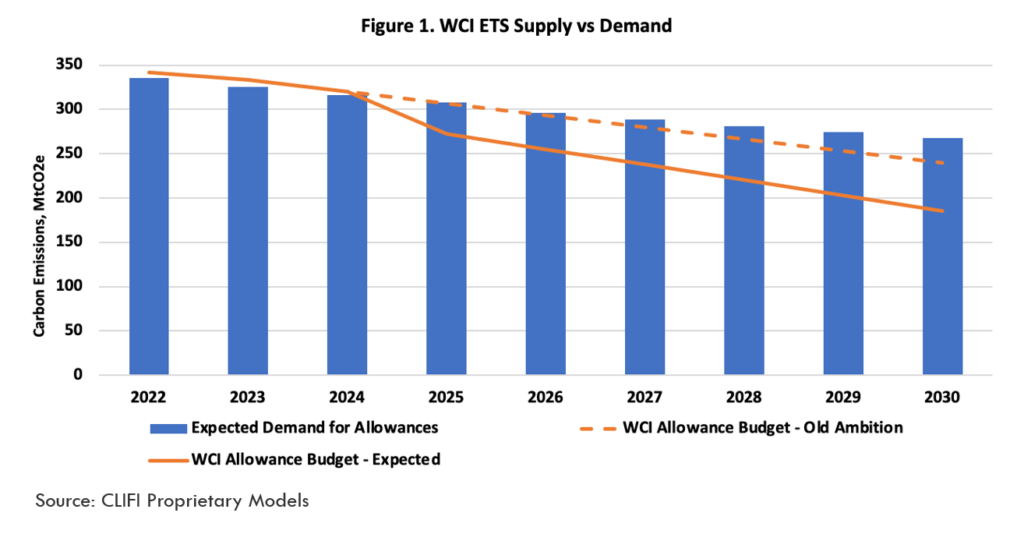

While further details on the tightening are still being worked out and expected to be finalized by 2024, a couple of tightening measures are very likely: 1) an acceleration of the annual emission cap reduction rate and 2) some form of a reduction mechanism for banked allowances. These two measures are expected to lower the remaining 2025-2030 allowance budget by an estimated 15%.5 Figure 1 below shows the expected impact of these measures by comparing the Western Climate Initiative (WCI) annual allowance budget before and after the regulatory reforms to the annual expected demand. Note WCI is the joint cap-and-trade program between California and Quebec.

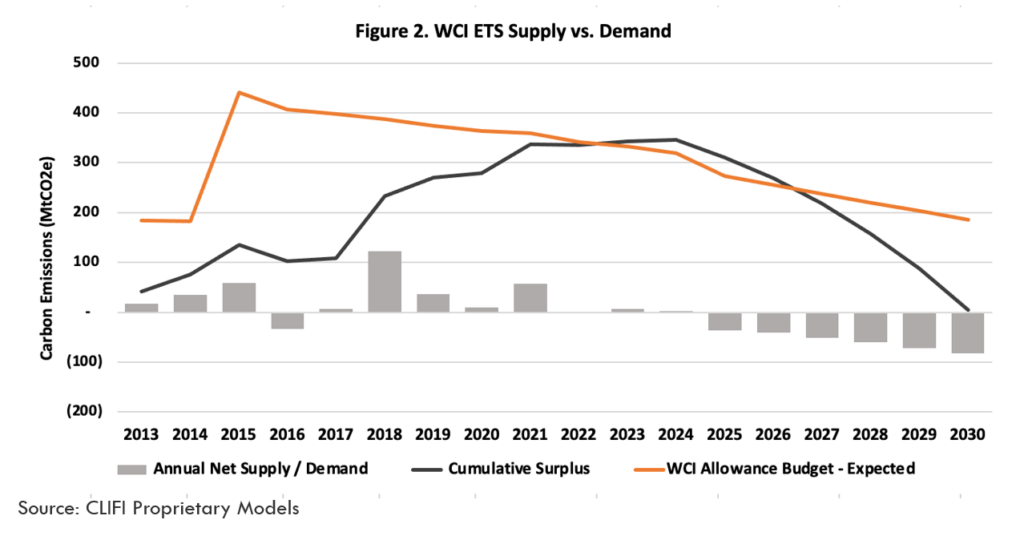

The annual budget is expected to hover just above the annual demand numbers until 2024 (slight surpluses). However, with the new stringency measures to start from 2025, it dips below the annual demand expectations, leading to significant annual deficits through the end of the decade. Figure 2 below shows the net result as annual surpluses and deficits (grey bars) as well as their cumulative total (dark line) since the inception of the cap-and-trade program:

The market is expected to enter a tightening mode starting around 2025, getting very close to being in a deficit by the end of the decade. This shift is expected to add appreciation pressure on prices to balance supply and demand in the system. CARB supports this trajectory, with regulators intending to adjust the CCR Tier 1 and Tier 2 price levels higher to avoid a "premature trip" into these cost containment reserves.6 The markets have been enthusiastic about regulatory developments in the cap-and-trade program, appreciating by 3% in Q1 and 6% in Q2.7 The bulk of the action, however, is yet to come once the details of the tightening reforms start coming out later this year.

Carbon Market Roundup

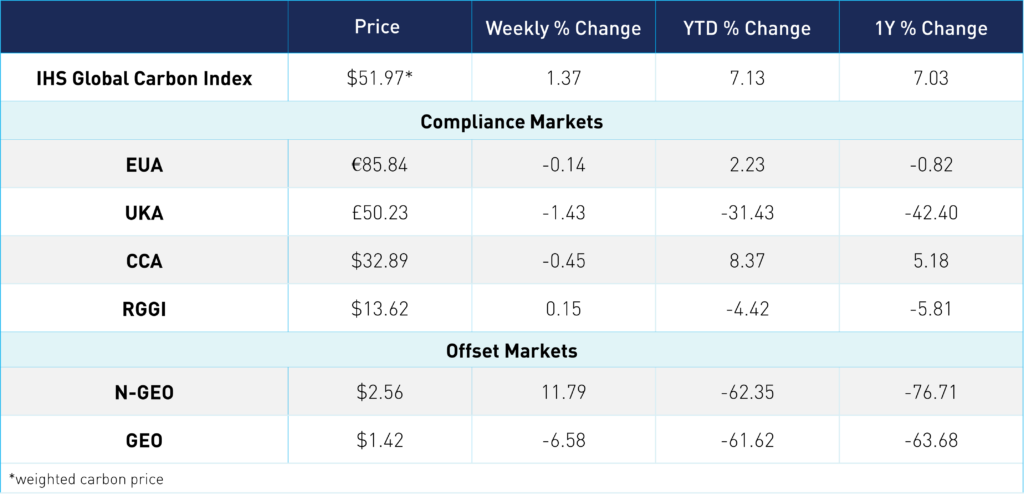

The global price of carbon is $51.97, up 1.4% for the week. EUAs closed at €85.84, which is 0.2% lower than a week prior. UKAs were down 1.4% at £50.23. CCAs closed at $32.89, down 0.5% over the week. CCAs moved above $33 briefly at the end of Wednesday following CARB's unexpected announcement on the date of the July public workshop for evaluating the cap-and-trade program. RGGI has been stuck in the $13.60-$13.65 range for the week. N-GEOs trended higher to $2.56, while GEOs lost last week's momentum, falling to $1.42.

- CARB, "Cost Containment Information," https://ww2.arb.ca.gov/

- ICE California Carbon Allowances Futures data

- CARB, "2022 Scoping Plan for Achieving Carbon Neutrality," November 16, 2022

- CARB, "Joint California-Québec Workshop: Potential Amendments to the Cap-and-Trade Regulation," June 14, 2023

- CLIFI Models

- CARB, "Joint California-Québec Workshop: Potential Amendments to the Cap-and-Trade Regulation," June 14, 2023

- ICE, CCA Vintage 2023 December 2023 Futures