European Markets Push Higher, CCA Workshop Recap, RGGI & WCA Auction Results

3 Min. Read Time

California

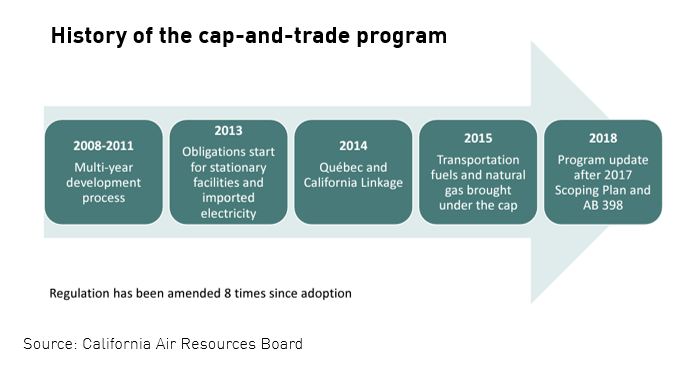

This week, California’s Air Resources Board (CARB) staff held a public workshop to present an update on the reform process for the cap-and-trade market. This meeting comes as CARB regulators review measures to tighten the market through the end of the decade to ensure the program aligns with the state’s emissions reduction goals. Following the presentation, attendees were permitted to provide input on ways to improve the program/ regulatory policies. The Board staff noted that rulemaking would likely begin later this year.

Current emissions reduction goals are as follows:

- 48% below 1990 levels by 2030 under the 2022 Scoping Plan, up from the 40% under the original Senate Bill (SB)-32 legislation that created the market

- 85% below 1990 levels by 2045, a target that was enacted into law in 2022

- Carbon neutrality by 2045, which means that any remaining emissions in the state must be balanced by an equivalent amount of emissions removed from the atmosphere into carbon sinks (Assembly Bill-1279)

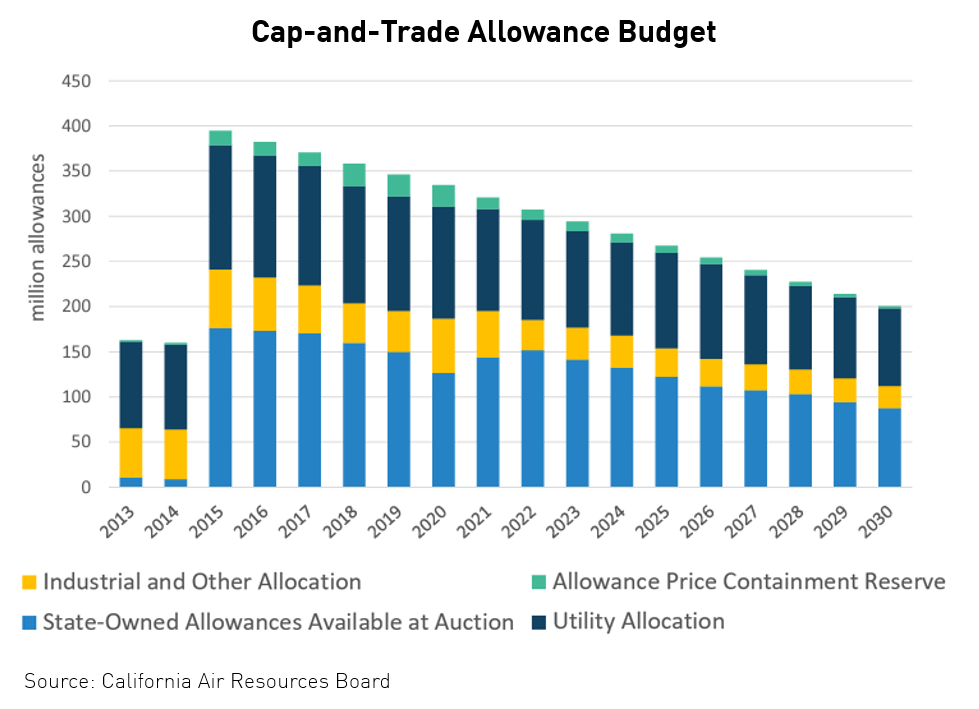

CARB staff listed a number of elements to the potential reforms being evaluated through scenario modelings, such as allowance (supply) budgets under different 2030 reduction targets of 40%, 48%, and 55%, both with and without the overarching 85% goal by 2045. Since any reductions in the allowance supply would likely lead to higher prices, the state is also looking at whether and how the Allowance Price Containment Reserve (APCR) would need to be revamped and whether price ceiling trigger levels should be adjusted. The APCR acts as a safety valve in the event that allowance prices rise too high for the market by offering additional allowances through a reserve sale.

The board is also looking at whether changes to the existing holding limits would need to be enacted. Additionally, the state is evaluating potential changes to the rules governing the “banking” of unused allowances from one compliance period to the next. CARB staff said they were reviewing the impact of setting a limit on banking 5% of the total supply.

The market cap started in 2015 at just below 400 million tonnes/yr, and declines by around 4% a year. Currently, the cap is set just below 300 million tonnes/yr.

Modeling based on the recently adopted 85% reduction target for 2045 has also highlighted the desirability of bringing carbon removal into the scope of the market. Last year, an executive letter from Governor Gavin Newsom called for a target of 20 million tonnes of sequestration by 2030 and 100 million tonnes by 2045. Furthermore, SB 905, passed last year, requires CARB to evaluate carbon capture and storage and to develop a permitting process to approve such projects by 2025.

To view the full workshop presentation, click here.

RGGI

Meanwhile, RGGI held its second allowance auction of 2023 on June 7, selling 22 million RGAs at $12.73/short ton, up from the $12.50 sale in March, the lowest auction price in over a year. This latest sale cleared 30 cents below the June futures price.

The sale was notable for the strong participation by non-compliance entities (typically investors) who bought 37% of the allowances on offer--the highest share of an auction bought by investors since September 2021. This increased participation suggests a renewed interest in the regional market after many months dogged by political uncertainty surrounding the inclusion of Virginia and Pennsylvania in the program.

Member states are presently working on a review of the market parameters ahead of reforms to be proposed by the end of 2023.

Washington

Washington state’s second allowance sale of 8.6 million current-vintage allowances on May 31 cleared at $56.01 against a floor price of $22.20, with just over 10% of the supply bought by investors. Because this sale exceeded the Allowance Price Containment Reserve (APCR) trigger price of $51.90, an additional 1.054 million allowances will be released from the reserve and auctioned separately in the next sale on August 9. Half of these additional permits – 527,000 – will be offered at the Tier 1 price of $51.90 and the other half at the Tier 2 price of $66.68.

The sale of 2.45 million advance-vintage (2026) allowances cleared at $31.12, with just over 26% of the permits bought by non-compliance entities.

Carbon Markets Roundup

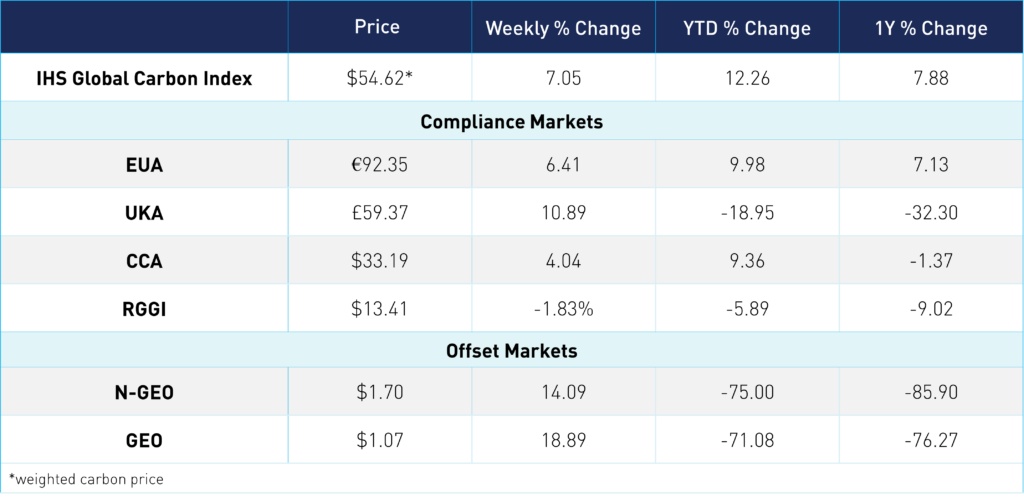

The global price of carbon was up 9.46% this week, ending at $54.62. Both EUAs and UKAs had a strong week, with EUAs hitting a two-month high. EUAs were up 6.4% for the week to end at €92.35. The market started the week up and on Wednesday closed nearly 4% higher, pushing prices over the €90 level to €93.32. Prices came down slightly as the week progressed but maintained the €92 level. Volatility in the energy markets and some technical factors like short covering are purportedly driving this price action. UKAs rose an impressive 10.9% to close at £59.37. Meanwhile, CCAs pushed up to $33.19, up 4.0% week over week—finally breaking out of the $31 level after nearly 5 weeks. RGGI continued to trade in a narrow range, down a slight 1.8% for the week at $13.41. In the offsets market, N-GEOs and GEOs saw strong upward momentum throughout the week, with the contracts currently trading at $1.70 and $1.07, respectively.

To learn more about our carbon credit ETFs, click here.