Zimbabwe Makes Carbon Offset Waves, Energy Prices Impact EUAs

2 Min. Read Time

Carbon offsets were back in the news recently thanks to new regulations announced by major offset producer Zimbabwe. As a preface, carbon offsets are a distinct market from carbon allowance cap-and-trade markets, which are what we primarily focus on. We often refer to the offset market as being akin to emerging markets, while the more established, government-regulated carbon allowance markets are like that of developed markets. However, offsets tend to get a lot of press coverage compared to allowances despite being the smaller market. For more details on the distinction between markets, see our previous blog.

As one of the world's top issuers of carbon offsets, Zimbabwe made headlines after the government announced plans to increase regulation of its voluntary offset market in an effort to increase transparency and control in the market. Going forward, all offset contracts must be registered with the state, and revenues from the projects will be split 50/50 between private investors and the government. Foreign investors can receive up to 30% of the revenue share, while domestic participants take a minimum of 20%. Initially, reports indicated that the government would render existing credits null and void while it sorts out its new regulatory framework, shaking confidence in the market. However, recent statements have said this will likely not happen but that developers will have 2 months to be in compliance with the new regulations.

These changes are intended to protect the local community and level the playing field between offset producers and foreign investors. Moreover, Zimbabwe wants to further establish itself as the central hub in Africa for trading carbon credits, which would also necessitate a tighter regulatory environment. The decision also highlighted the voluntary carbon market's present struggle against low prices. With some offsets changing hands at around $1/tonne, there is a relatively little revenue stream for some investors, and this has driven investment towards higher-cost reductions such as forestry, carbon removals, and cookstoves.

Under the Paris Accord, all countries set their own carbon-cutting goals, known as Nationally Determined Contributions (NDCs), and may generate, sell and buy carbon credits to help them achieve these targets. Countries like Zimbabwe, which have historically been big sellers of carbon credits, are now finding that credit sales put them at a disadvantage. By selling relatively inexpensive reductions now, they may need to make potentially more expensive reductions later to achieve their NDCs. Some stakeholders have pointed out that project host countries may need to invest in as many low-cost reductions as possible to meet their NDC goals, and only then, once the target is reached, should they sell credits abroad. This approach would ensure that higher-cost reductions are funded by foreign investors rather than the "lowest hanging fruit." Additionally, bringing carbon credit projects under government regulation and oversight will enable host countries to understand better their progress toward achieving their national emissions reduction goals.

Carbon Market Roundup

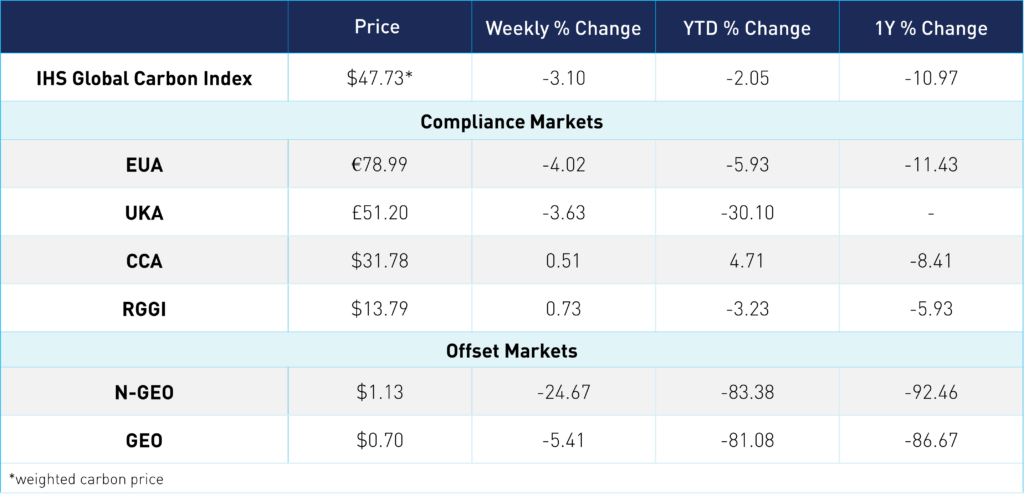

The global price of carbon is currently $47.73, down 1.8% from last week. EUAs saw a 4% decline this week to settle at €78.99. The market ended slightly higher on Monday at €82.86 but by Thursday drifted below the €80 level, following weakened natural gas prices and reports of industrial emissions falling below 2020 COVID levels. UKA prices fell 3.6% to £51.20. Following the market holiday on Monday, the UKAs ended 6% lower at £49.80, though rebounded slightly throughout the rest of the week. CCA and RGGI prices held steady in the higher ranges of the $31 and $13 levels, respectively. CCAs are trading at $31.78, up 0.5% week-over-week, while RGGI is at $13.79, up 0.7%. N-GEOs and GEOs fell further, at $1.13 and $0.70.