EU Carbon Market Reform Gets the Green Light

3 Min. Read Time

Great news coming out of the EU this week. On Tuesday, the European Parliament approved several key elements of the Fit for 55 climate package, boosting long-term sentiment in the bloc’s carbon market and paving the way for a carbon border levy on energy-intensive materials. We've watched as policymakers went back and forth on provisions to the package throughout all last year, so seeing a final agreement on the reform is a major step forward for the EU carbon market.

Below are the final provisions of the policy reform.

- EU ETS reform – an increase in the linear reduction factor (the annual cut in the market cap) to 4.3% from 2024 and to 4.4% from 2028.

- EU ETS reform – one-off reductions in the cap of 90 million EUAs in 2024 and 27 million in 2026.

- EU ETS reform – widening of the EU ETS to include maritime shipping emissions from 2024. Shipowners will need to surrender EUAs covering 40% of their emissions next year, rising to 100% by 2026. To account for the added emissions from the shipping industry, the cap will be increased by 79 million tonnes.

- EU ETS reform – launch of a separate emissions trading system covering emissions from fuels used in the domestic and transport sectors. The cap for this stand-alone ETS will be published at the start of 2024.

- EU ETS reform – The issuance of free EUAs to energy-intensive trade-exposed industries will be gradually reduced from 2026, and end by 2034.

- EU ETS reform – The issuance of free EUAs to aviation operators in the market will be phased out by 2026.

The Parliament had previously approved the extension of the market stability reserve’s 24% withdrawal rate through to 2030.

The impact of these and other changes to the market gives the EU ETS an emission reduction target of 62% below 2005 levels by 2030, up from 43%.

CBAM – Parliament also approved the introduction of the Carbon Border Adjustment Mechanism.

Under CBAM, EU imports of iron, steel, cement, aluminum, fertilizers, electricity, and hydrogen will have an added cost to account for the carbon emissions generated during production based on the weekly EU carbon price.

The levy, which will begin being phased in starting in 2026, will take the form of payments for certificates that are retired annually but which are not fungible in the EU ETS. However, experts believe that exposed importers will choose to hedge their exposure to CBAM by buying EUA futures.

CBAM is significant because it will prevent carbon leakage by establishing a more level playing field across borders and will replace free allowance allocations. It will also indirectly bring more foreign companies into the program as they could potentially hedge the tariffs in the EUA market. Essentially, it should doubly raise revenues through both the tariff and entities having to now pay for previously free allowances.

Non-trading sectors – Last month, the Parliament voted to approve the EU’s Effort-Sharing Regulation (ESD), which outlines how member states should reduce emissions from sectors not covered by the EU ETS. The law raises the ESD reduction target from 30% to 40% below 2005 levels by 2030.

Carbon sinks – Parliament also approved proposals to increase the target for the land-use and forestry sector to cut emissions by 57% from 1990 levels by 2030. Any surplus reductions from land use can be sold to other member state governments under the Effort Sharing Directive.

Vehicles – Lawmakers also approved regulations that will set a 100% emissions reduction target for cars and light trucks in 2035.

Next steps: the Fit for 55 Package now goes to the European Council for final approval and becomes law 20 days after publication in the bloc’s Official Journal.

Market reaction to the Parliament’s vote has been positive in the two days since. EUA prices have risen from their closing level of €93.04 on April 17 to as high as €96.47 on April 19, helped by the fortnightly gap in the EUA auction program.

The market is also seeing support from the last surge in compliance buying by covered installations before the April 30 compliance deadline. Compliance entities are required to surrender allowances equivalent to their 2022 emissions. Buyers need to account for the time needed to transfer EUAs from trading to operator accounts and ensure they are delivered to the European Commission’s account in time.

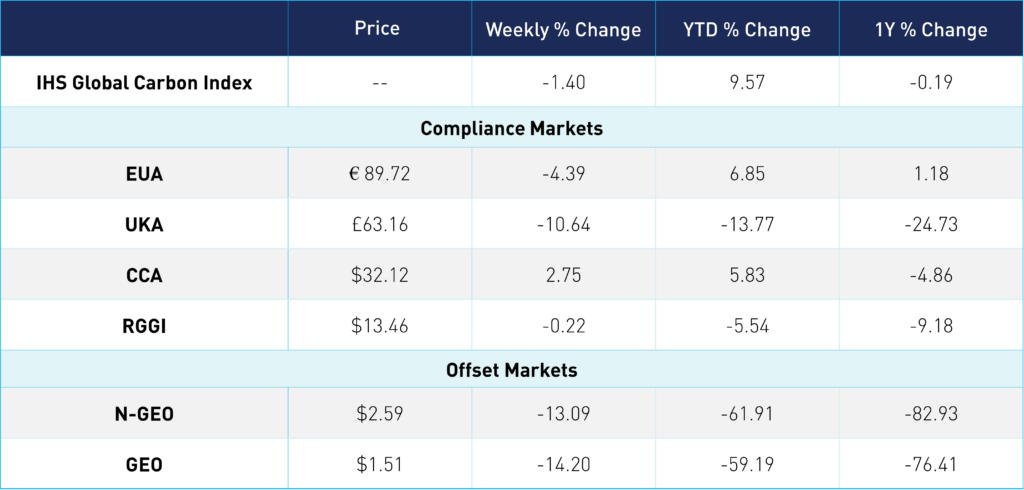

Carbon Market Roundup

The EUA market started the week off strong on positive news following Parliment's vote. By Wednesday, prices began a steady decline to finish the week down 4.39% at €89.72. UKAs trended down during the week as the market held its last auction before its compliance deadline. Overall, UKAs were down 10.64% at £63.16. CCAs moved higher on Monday, though have traded in a narrow range since, up 2.75% for the week at $32.12. RGGI prices remained relatively unchanged, down 0.22% over the week at $13.46. Both offset markets had a down week, with N-GEOs ending at $2.59 and GEOs at $1.51.