What’s Driving Recent EUA Price Action

2 Min. Read Time

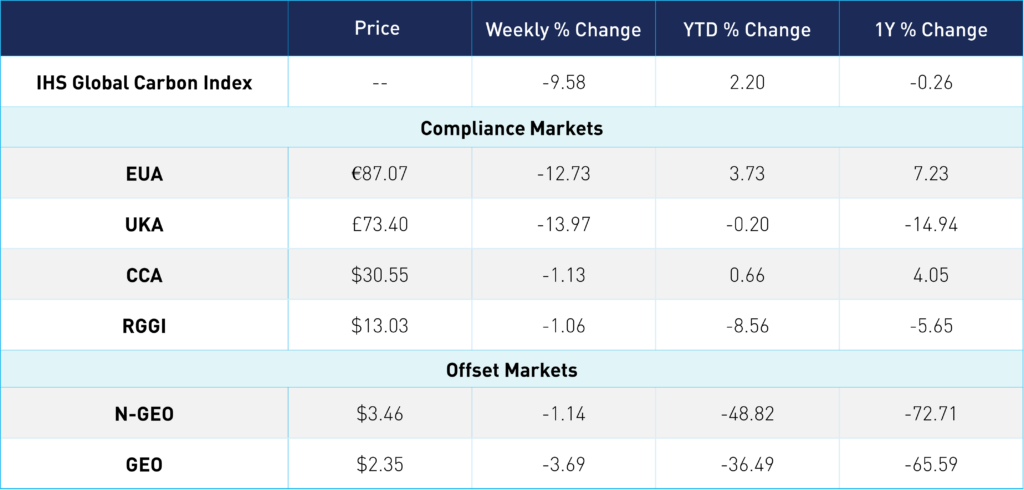

In the past week, we've seen the global price of carbon (as measured by the IHS Markit Global Carbon Allowance Index) fall 10%. This price action was largely driven by European allowances (EUAs), the largest share of the index, which was down 13%. The UK market was also down roughly the same amount. Meanwhile, California and RGGI prices have remained stable. Remember, carbon markets can be volatile, so these numbers are not materially outside normalcy.

Digging deeper, there are a few things at play for the EU market. Of course, risk assets are taking a hit following the US bank fallout, and lower liquidity will always be a headwind for newer, smaller asset classes. However, carbon-specific drivers are also influencing price action. Natural gas has normalized, which drives lower emissions in the short term and less demand for EUAs. We also saw a bearish signal with lower auction volumes this week clearing at a discount to spot prices (€83.25 vs. €85.62) and generally lower hedging forecasts. As with all of these short-term drivers, the tightening of the markets combined with emissions reduction ambitions will keep the upward pressure. As we’ve said before, we expect there to be lower beta to the down markets and higher beta to the up markets.

Other big news out of Europe is the Net Zero Industry Act (NZIA), which is their answer to the $369 billion investment in clean energy under the US Inflation Reduction Act (IRA). The Act will incentivize European Union countries to compete with US and China in creating clean technologies and sets a goal of producing at least 40% of its clean tech needs within the EU bloc by 2030. There are 8 strategic net zero technologies of focus under NZIA: i) solar photovoltaic and solar thermal technologies; ii) onshore wind and offshore renewable energy; iii) batteries and storage; iv) heat pumps and geothermal energy; v) electrolyzers and fuel cells; vi) biogas/biomethane; vii) carbon capture and storage (CCS); and viii) grid technologies. EU legislators outlined additional targets, including:

- Domestic mining should account for 10% of the critical raw materials it consumes, such as lithium, copper, and nickel (the latter two have solely come from imports previously); and at least 15% for recycled materials

- No more than 65% of any key raw material should be sourced from a single country outside the EU

- Establish the European Critical Raw Materials Board, which would identify “strategic projects” that receive improved/ accelerated access to financing

- Goal of having 50 million tonnes of annual CO2 storage capacity by 2030, with oil and gas producers required to contribute

Carbon Price Roundup

Both the EU and UK markets took a hit this week, down 12.73% and 13.97%, respectively. Compliance demand for EUAs picked up, as entities look to buy ahead of the compliance deadline, especially now that prices have come down slightly. US allowances traded in a narrow range, with both markets down 1% for the week. CCAs closed at $30.55 while RGGI prices closed at $13.03. The California Senate committee endorsed a bill that would increase the state's emissions reduction target to 55% below 1990 levels by 2030, up from the Scoping Plan's 48% target. The offset market saw less volatility this week, with N-GEOs down just 1.14% and GEOs down 3.69%.