Voluntary Carbon Market Leads Talks at COP27

2 Min. Read Time

The voluntary carbon marketplace has been the big winner at this year’s UN climate summit. The number of announcements, deals, initiatives, and discussions around the halls of COP27 is a clear indication that more countries are coming on board with carbon pricing to drive emissions down and reach the 2050 net-zero target enshrined in the Paris Agreement.

In Sharm El-Sheikh over the past ten days, there has been an explosion of interest, ranging from countries like Papua New Guinea touting their “REDD+” market for forestry credits to Nigeria announcing its intention to start a national compliance market to Cambodia signing a deal to sell 10 million REDD+ offsets and Senegal agreeing on a sale of offsets to a consortium of investors and developers.

Countries were lining up to host events explaining how they intend to participate in the carbon credit market, and there has been a steady stream of deals, MOUs, and launches over the past ten days.

But the attention has been captured by a number of high-level initiatives launched the first week of COP27 that show how carbon markets are increasingly viewed as an integral part of the effort to achieve net zero and how carbon credits should be seen as incremental to internal reductions. We discussed the development of the main initiatives in our previous blog post.

And while the voluntary markets were winning the attention of delegates, the technical negotiations to set up the UN’s voluntary carbon market, known as Article 6, stumbled from one disagreement to the next this week as countries bumped heads on complex issues of legal interpretation of the Paris Agreement text.

A section of the proposal, known as Article 6.4, will generate a system for countries to create and sell carbon credits to other parties and commercial entities worldwide but isn’t expected to become operational for another two to three years. Negotiators are working to agree on the foundational legal principles that will govern how the market works, and this process will likely take some time.

For comparison, the Kyoto Protocol was signed in 1997, but the Clean Development Mechanism market rules were only finalized at the COP four years later.

Nations currently disagree on a wide variety of issues, including:

- how to report their emissions reductions

- whether a host country should be able to revoke the authorization of carbon credits after they’ve been issued

- whether UN-approved projects can sell credits to non-UN voluntary markets

- how to transition Kyoto-era projects and credits into the new Article 6 market.

These disputes reflect the competing priorities of more than 190 countries, all of whom have equal access to the UN carbon markets and have differing ideas on how the system should be structured. We should expect to wait until 2025 before this market is fully operational.

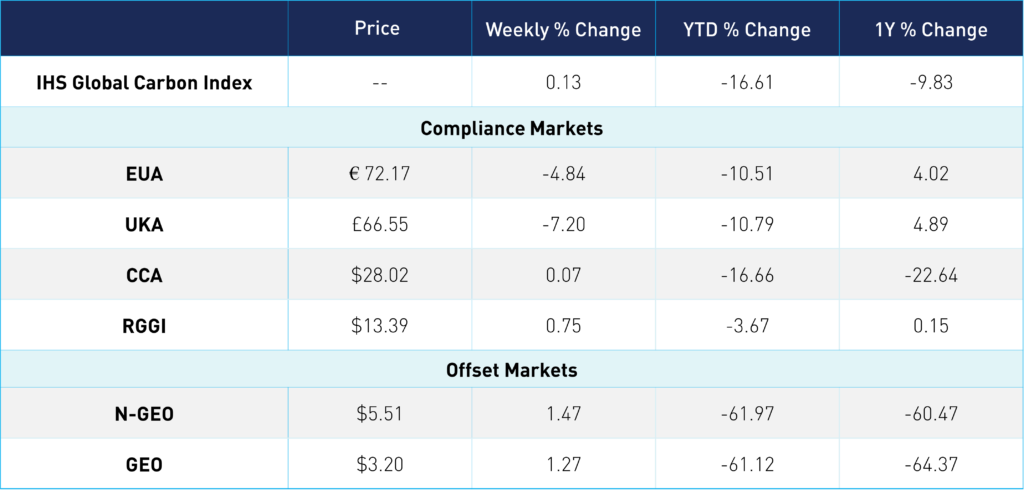

Carbon Market Roundup

EUAs trended down for the week, from nearly €76 last Friday to €72 today. UKEs followed a similar path, currently at £66 from £71 the week prior. Meanwhile, CCAs moved up this week, just over $28. RGGI traded in a narrow range, remaining at a low $13 level. The offset futures barely moved for the week, with N-GEOs staying within the $5 range and GEOs within $3.

EU lawmakers decided to push back trilogue discussions to December, and will take place over the course of several days instead of the original one-day comprehensive meeting. They did decide on a revision to the cost containment mechanism under Article 29a, which will now be triggered if, for six consecutive months, the average EUA price is greater than 2.4 times the 2-year average. This revision lowers the current threshold, which triggers at 3x the 2-year average. Discussions on the Carbon Border Adjustment Mechanism (CBAM) and the EU ETS are scheduled for the third week in December.

California’s final 2022 Scoping Plan was published Wednesday. The main highlight was the updated economy-wide emissions reduction target, now 48% below 1990 levels by 2030, which is up from the previous 40% level.

Carbon Futures Prices