Carbon Market Review, Live at COP27 Policy Highlights

4 Min. Read Time

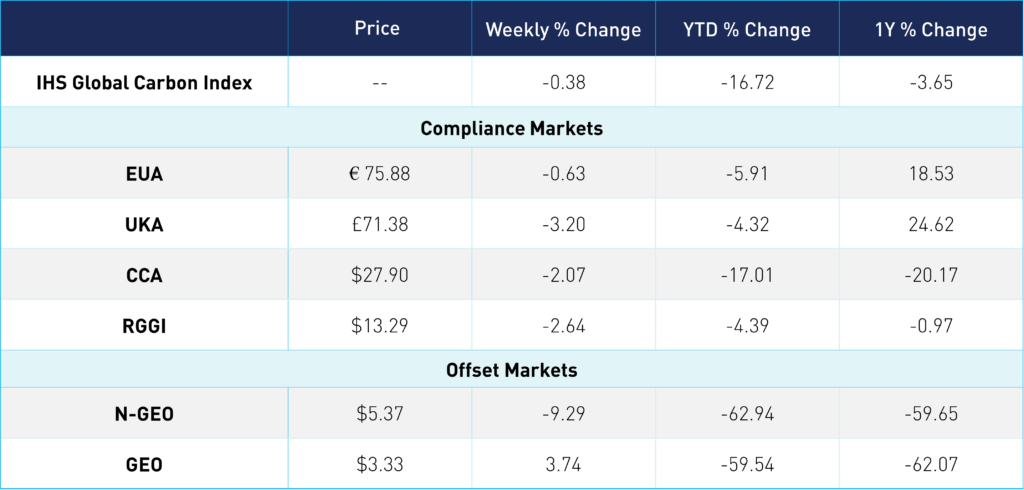

NGO and GEO

The third quarter and October have seen a continuance of the 2022 general price decline in the offset markets. Over the combined Q3+Oct period, NGO declined about 20% to $6.86, with GEO tracking it down 16% to end up October at the $3.49 level. Both markets were around 60% down from their peak in January.

EUA and UK ETS

EUA had a turbulent period last quarter, testing €100 levels in August by reaching the year’s high of €98.01 before dropping to the €66 level at the end of the quarter. October saw a recovery of EUAs back to the €80 levels where it started the year, with the combined Q3+Oct return of down 11%. UKAs followed this pattern closely, reaching the year’s high of £97.75 in August and ending October at £77.65, with the combined Q3+Oct period return of down 8.6%.

CCA

CCAs had a relatively flat Q3+Oct period, declining 4.5%; however, with some volatility: 14.5% drop in Q3 and 11.6% recovery in October, ending the period at a price of $29.84. CCA’s fundamentals have benefited from high inflation rates, as the CCA’s price floor is adjusted annually by 5% + Inflation (CPI), sending a supporting signal to market participants. The floor increased 11.2% in 2022, reflecting a 6.2% inflation. With the latest 12mo inflation of 7.7% in October (according to the US BLS), a further increase of 12.7% of auction floor prices is expected next year, bringing the floor to $22.20 in 2023.

RGGI

RGGI market has tracked CCAs during the combined period of Q3+Oct, declining 4% to $13.5 levels, but with less volatility: down 6.6% in Q3 and up 2.7% in October. The uncertainty of Pennsylvania’s and Virginia’s participation in RGGI has had a short-term impact on the price; however, the Dec22 prices traded in a relatively narrow range between $13 and $14 during this period.

Negotiators squabble over details, voluntary carbon markets step forward

This year's UN climate summit in Sharm El-Sheikh, Egypt, is barely underway but is already sending strong signals to corporate sustainability execs worldwide.

Technical experts and negotiators began work on the weekend, ahead of the formal launch of the summit on Sunday. The new UN carbon market regulator worked through the night on Saturday to finalize draft rules that 194 countries will consider over the coming two weeks.

The so-called Article 6.4 Supervisory Body has only just started setting up an entire rulebook, ranging from what offset projects should be eligible for under the new system to technical specifications for an electronic registry to track offsets.

So far this week, discussions have focused on rules governing how and when countries can authorize the issuance of credits from projects and how to treat verified emissions reductions that aren't formally authorized under Article 6. Discussions will continue through the weekend before draft decisions are sent to the plenary for discussion and adoption next week.

While technical negotiators are deep in the detailed work of setting up the new Paris-era carbon market, a UN-appointed High-Level Expert Group (HLEG) on net-zero commitments of non-state entities published recommendations and principles on how to set and achieve voluntary net-zero and net-zero aligned targets.

"High integrity credits can have a role to play, but in addition to the hard work that you must do to decarbonize," Catherine McKenna, former Canadian climate minister and chair of the HLEG, said at the launch of the report.

"The message is clear to all those managing existing voluntary initiatives – as well as CEOs, mayors, and governors committing to net-zero: abide by this standard and update your guidelines right away – and certainly no later than COP28," UN Secretary-General Antonio Guterres added.

The HLEG report endorsed the work of existing voluntary carbon initiatives, the Integrity Council on the VCM (IC-VCM) and the VCM Integrity Initiative (VCMI), as well as the Science-Based Targets Initiative (SBTI).

These programs provide detailed recommendations on implementing net zero strategies, while the HLEG report aims to encourage greater ambition and environmental integrity in those strategies.

The HLEG report is one of several significant announcements that could impact the voluntary carbon market. Also on Tuesday, the African Carbon Market Initiative (ACMI) was launched to generate – and retire – 300 million tonnes of reductions a year by 2030 and 1.5 billion tonnes a year by 2050.

Africa has been vastly under-represented in carbon markets. Its contribution is split between big, high-profile projects like the Mai Ndombe REDD+ initiative and small-scale but highly sustainable projects that distribute clean cookstoves to replace open fires.

The ACMI hopes that scaling up carbon market activity in the continent will bring as many as 30 million new jobs and mobilize up to $100 billion a year by 2050, all while ensuring that a significant proportion of the revenue and benefits from these projects flow to local communities.

The United States also weighed in on carbon markets, with the country's climate envoy John Kerry unveiling the Energy Transition Partnership (ETP), a proposal to encourage corporates worldwide to take on ambitious, science-based decarbonization targets and use voluntary carbon offsets to complement those internal reductions.

The ETP is supported by the Rockefeller Foundation and the Bezos Earth Fund and aims to prepare a framework for corporates and countries to invest in transitioning developing economies from fossil fuels to renewables and earn carbon credits that they can set against their targets.

With so many separate efforts underway to drive greater ambition and encourage the private sector to take on climate targets, it's only natural to need clarification about what guidelines and methodology to adopt.

The International Standards Organisation will unveil its Net Zero Guidelines later this week. The agency intends for the guidelines to serve as "a common reference for collective efforts, offering a global basis for harmonizing, understanding, and planning for net zero for actors at the state, regional, city, and organizational level."

Carbon Future Prices