Searching for the Signal: Making Sense of Last Week’s EU and US Policy Noise

5 Min. Read Time

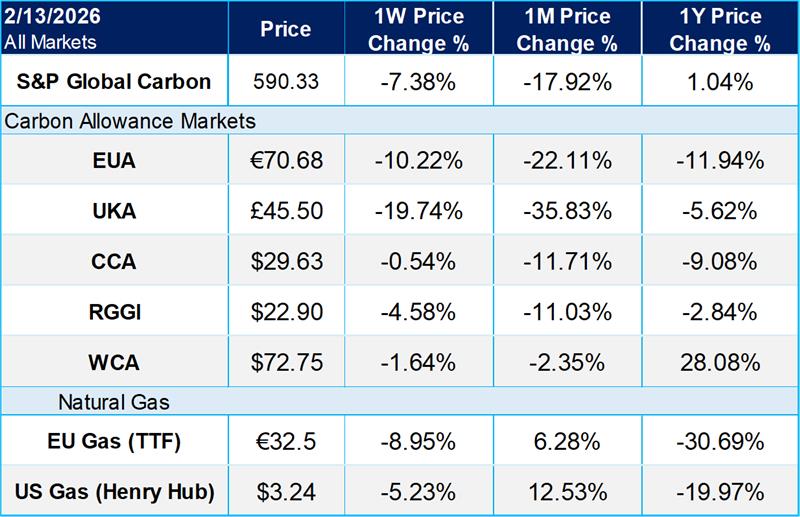

Last week saw a flurry of policy headlines in both EU and US carbon, and, in the case of the EU, this policy noise has had a significant impact on EUA and UKA prices. EUA prices closed last week at €70.68/t, down 10% on the previous week’s close, and dropped again Monday to €69.18/t, the lowest settle since July 24 last year. UKAs fared even worse, dropping 20% on the week to £45.50/t before recovering marginally to £46.40/t Monday. This means that EUAs and UKAs are now down 21% and 30% respectively YTD, and that we therefore need to step back and try to make sense of what is a meaningful signal and what is just distracting noise in all the policy chatter of the last two weeks. On balance, we think the market has overreacted, but it is clear that there is now political momentum to slow down both the phase-out of free allowances to industry and the speed of the reduction in the EU-ETS cap beyond 2030. But it is vital to keep things in perspective.

Meanwhile, in the US, the EPA officially rescinded the “Endangerment Finding” on February 12. The Endangerment Finding (EF) is the key legal framework that underpins the regulation of greenhouse-gas emissions at the federal level. The move ditches federal tailpipe standards and weakens regulations on power-plant emissions. Environmental groups are already planning legal challenges, though these court cases could take years to resolve. We expect no immediate impact on state-level emission trading programs following the repeal. US compliance markets remain unaffected by the EPA’s ruling as they are state-based and derive their authority from state law, not federal EPA authority. Notably, CCA prices were unaffected by the news.

EUAs: political pressure building ahead of Q3 EU-ETS Review, March EU Summit now in view

As we have explained in recent blog posts, rising political pressure on the EU-ETS over the last few weeks culminated in several high-profile interventions from senior EU policymakers, prompting a sharp correction in both EUA prices and speculative positioning in the last 10 days. Our analyst Mark Lewis also appeared on the Smarter Markets podcast over the weekend and covered these interventions and their implications in detail.

When we separate the signal from the noise in these interventions, three concrete proposals stand out, and in our view, these proposals are a sensible contribution to the debate over EU-ETS reform that will take place in earnest in Q3. The proposals are as follows:

1) On February 5, former EU Director General for Climate Action, Jos Delbeke, suggested that the allowances held in the so-called CSCF (Cross-Sectoral Correction Factor) buffer reserve should be allocated to industry free of charge (rather than auctioned back to the market as foreseen in the current legislation) in exchange for a commitment from the recipients of such free allowances that they make low-carbon investments. We explained the background to and mechanics of Delbeke’s proposal on this point in our blog post, and we think this idea is likely to find favor with EU politicians. For context, the CSCF is a safeguard within the EU ETS that would proportionally reduce free allocations to industry if demand exceeds the available free allocation budget, although an additional buffer of allowances now exists to help top up allocations and avoid triggering the correction.

2) Delbeke also proposed that the cancellation of EUAs in the Market Stability Reserve (MSR) above the threshold of 400m should cease from 2027 onwards, and, again, we think this is likely to be taken up seriously by EU politicians. The MSR is a mechanism within the EU ETS that automatically adjusts the supply of allowances by removing or releasing permits from auction in response to the total number of allowances in circulation (TNAC), to support price stability and prevent structural oversupply.

3) On February 10, well-known Member of the European Parliament (MEP), Pieter Liese – who previously led the Parliament’s work on the EU-ETS – suggested that the Linear Reduction Factor (LRF), i.e., the rate of the annual cap reduction, should be reduced to 3.4% from 4.4% under the forthcoming EU-ETS Review. Liese suggested that this could happen from as early as 2029, although we think that it would make much more sense to make any change to the LRF from 2031 rather than from 2029, as 2031 marks the start of the next trading period in the EU-ETS. We explained the background to and mechanics of Liese’s proposal on the LRF in our blog post, and we think that it is now inevitable that the LRF will be reduced. The only questions are whether it's in line with Liese’s proposal or by more, and whether from 2029 or 2031.

Overall, the combined impact of these proposals would be to increase the size of the overall cap beyond 2030, to extend the duration of the cap by a few years beyond 2039 (which is the date by which the cap falls to zero under the current legislation), and to increase the total amount of free allowances awarded to industry rather than auctioned.

However, while undoubtedly implying lower long-term prices than the current legislation and a slower take-up of full carbon-price internalization for industry, such changes would retain the fundamental integrity of the EU-ETS and long-term upward direction in pricing, while crucially making the system politically sustainable over the long term.

At the moment, the proposals put forward by Delbeke and Liese are just that – proposals – and it remains to be seen exactly how the EU-ETS Review in Q3 will reshape the future of the EU carbon market. However, we should get some strong indications at the forthcoming EU Council Summit on March 19-20 in Brussels, and we think Delbeke’s and Liese’s proposals will be received positively.

In the meantime, we think the market’s reaction to the turmoil of the last two weeks has more than priced in the risks inherent in the EU-ETS Review process, as the EU-ETS remains by far the single most important policy tool for achieving the EU’s legally binding 2040 Climate Law and its legally binding 2050 Net Zero Law, and a robust sustainable carbon market will therefore still be crucial to achieving these longer-term policy objectives.

Accordingly, while we would not rule out further price downside in the short term if more of the remaining net speculative length in EUAs is liquidated, we think that the actual policy risk posed by the EU-ETS Review has now been fully priced in and more.

US news: EPA repeal of Endangerment Finding not an issue for US carbon markets

On 12 February, the EPA announced its definitive intention to repeal the EF, but there is no immediate impact on state-level emission trading programs, which rely on state law and are not tied to federal authority. Ever since the Presidential Executive Order of April 2025 targeting state-level carbon trading programs, observers and participants have been expecting a federal move against these markets. Paradoxically, however, rescinding the EF may, in practice, impact federal claims against state programs, as by renouncing its authority to regulate GHGs, the federal government may call into question its right to invoke the “Supremacy Clause” (federal pre-emption) to interfere in state-level initiatives. However, this will likely be met with legal pushback, and previous attempts at attacking state-run cap and trade have been unsuccessful.

While the legal battles begin on the implications of the EPA’s decision, US markets continued to trade as normal, albeit with a softer tone. CCAs were down 16 cents on the week at $29.63/t as the market prepares for the Q1 auction (February 18). The February 2026 auction will offer 55 million V26 allowances, alongside an additional 7.2m V25 allowances from the under-subscribed May 2025 auction. With current spot prices barely above the 2026 floor of $27.94/t, there is some speculation that this auction too might be under-subscribed, but we expect compliance players to support the auction given the current low prices near the floor and the expectations of a tighter market going forward in line with the recently published ISOR.

Carbon Market Roundup

The weighted global price of carbon was $51.03, down 7.38% over the week. EUAs dropped to €70.68, a 10.22% weekly decline, while UKAs closed at £45.50, down 19.74% week-on-week. In North America, CCA prices eased to $29.63, off 0.54%. RGGI allowances closed at $22.90, down 4.58% on the week. WCA held up relatively better but was still down 1.64%, ending at $72.75.