UK Latest Policy Update, Syncing Allocation Period with CBAM Start

2 Min. Read Time

The UK ETS regulator is considering postponing the market’s second allocation period by one year in order to bring the change into sync with the introduction of the country’s Carbon Border Adjustment Mechanism (CBAM). This shift means the current 2021-2025 allocation period would be extended until 2026, with the additional year adding the same level of allocation as the preceding periods.

Since 2021, the government has handed out between 32-37 million free UKAs to energy-intensive industrial installations at risk of international competition, similar to the free issuance of EUAs in the EU ETS. The original regulations for the UK ETS required the allocation to be adjusted downwards from 2026 to 2030, in line with the country’s progress towards net zero emissions by 2050. However, the launch of CBAM the following year would mean a re-drawing of the 2026-2030 allocation plan just 12 months after it went into effect.

The government has indicated that it will establish a CBAM by 2027, which will charge importers for the carbon content of selected materials in the aluminum, cement, ceramics, fertilizer, glass, hydrogen, iron, and steel sectors. As the CBAM takes effect and the tariff burden on imports starts to ramp up, the proportion of free allowances to UK-based producers will need to decline at the same pace in order to maintain a level playing ground.

The government has already begun to adjust the auction supply to the market as part of its overall net zero trajectory policy. Last year, it confirmed that “ETS allowances available for purchase from the government would reduce by 45% between 2023 and 2027.” In 2024, we saw the auction supply drop by 11 million tonnes, or 14%, to a total of 68 million tonnes. This sets the market’s cap for the year at just below 100 million tonnes.

We expect additional policy announcements in the coming weeks and months. Other areas of focus are the future of the auction reserve price floor and developments around the next UK Government budget (October 30). The UK ETS could see the expansion in the scope of sectors covered (maritime and waste) and the implementation of a Supply Adjustment Mechanism (SAM) to address excess supply and boost prices. Unlike in the EU, there is also talk about incorporating [engineered or nature-based] greenhouse gas removals (GGRs) while possibly maintaining the gross emissions cap. GGR inclusion could encourage needed investment in clean technologies and provide structured demand from polluting sectors.

The impact of the proposed delay is seen as modestly bearish in the short term since it adds one more year of the current 32 million tonne allocation before any reduction. UKA prices subsequently sold off nearly 7% on the announcement last Friday. However, market sources point out that this is merely a type of “front-loading” of supply, where the additional supply in 2027 will be compensated for by a steeper reduction starting in 2028.

Carbon Market Roundup

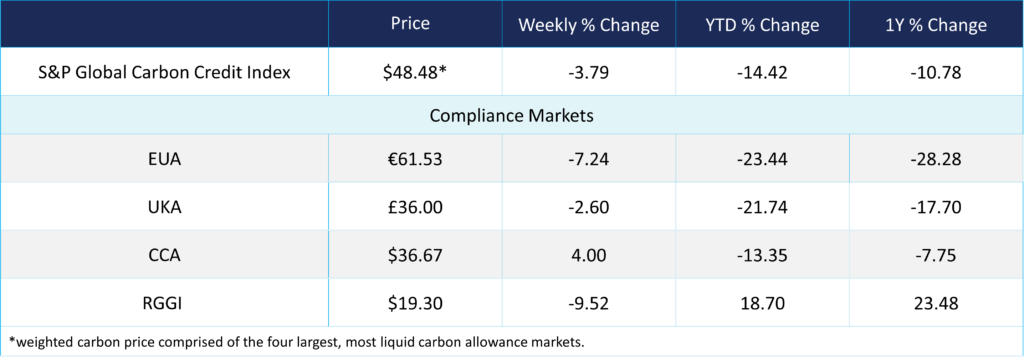

The global weighted price of carbon is $48.48, down 3.79% from the previous week. EUAs are up 7.24% for the week at €61.53, while UKAs are down 2.6% to £36.00. CCAs trended up 4% at $36.67. RGGI was down 9.52% at $19.30.