EUA Prices Rallying From Five-Month Low, Nat Gas Correlation Strong as Ever

<1 Min. Read Time

EU Allowance prices are rallying from a five-month low as natural gas and power prices also recover from a sharp sell-off that has lasted three weeks. The front-December futures contract last traded just shy of €65.00 on ICE Endex, after falling earlier this week to a low of €62.45.

Since the end of August, the Dec 2024 EUAs have declined by 10%, while front-month TTF (Europe's nat gas benchmark) prices have fallen as much as 14%. The correlation between the EUA market and natural gas is as strong as ever, and the two often move in lock-step on an intraday basis.

Some of the downward pressure stems from some liquidation of long positions in TTF natural gas. By the end of August, investment funds had accumulated as much as 260 MWh of net long positions in the benchmark gas contract, and some selling has now begun to trim this length.

Meanwhile, funds’ net short positions in EUAs have begun to increase again after shrinking to as little as 4.8 million euros, the smallest bearish position in a year. Just three weeks on, investment funds now hold a net short position of more than 21 million EUAs.

The latest boost in bearish bets has been slow to trigger a squeeze, since the market is also being trapped between two key put option levels at €60 and €65, and market sources believe prices will stabilize in this range until the expiry next week.

Across the channel, the UK ETS price is finding support at around £40.00/tonne as investment funds now hold a record net long position of 8.8 million UKAs. Bearing in mind the cap on annual UKA supply is around 100 million UKAs in 2024, this represents a sizeable share of the total market supply.

(In comparison, funds net short positions in the EUA market represents just 1.8% of total market supply this year.)

Speculative investors are still optimistic that the autumn budget in the UK will bring some news on reforms to the UK ETS, either in the form of legislative proposals on a supply adjustment mechanism or a move towards linking the British market with its EU counterpart.

The latter is far more problematic and would take considerably longer to implement, but industrial lobbies are firmly in favor, and many non-compliance stakeholders are also calling for talks to begin.

Carbon Market Roundup

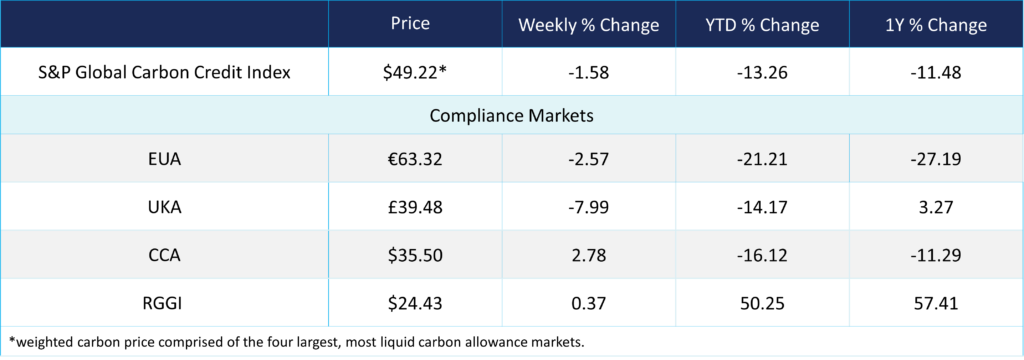

The global weighted price of carbon is $49.22, down 1.58% from the previous week. EUAs are up 2.57% for the week at €63.32, while UKAs are down 7.99% to £39.48. CCAs trended up by 2.78% at $35.50. RGGI was down 0.37% at $24.43.