EU Carbon Prices Adjust Course Amid Macroeconomic Headwinds

2 Min. Read Time

EU carbon prices have begun the year on a weak note, with the benchmark December 2024 futures contract falling from a January 2nd high of €81.25 to a low of €68.62 this week.

EUAs had rallied strongly in the second half of December, climbing from €65.99 to nearly €81 as speculative investors closed out short positions to generate profit ahead of year-end, but traders now say that these short positions are being put back on as the macroeconomic outlook remains glum for 2024.

Fossil power generation slumped, while renewables output grew across the EU, damping demand for EUAs, while industrial production also slowed. In contrast, renewables generation rose by 10% in 2023, the largest annual increase since at least 2018. Solar, wind, and other zero-CO2 sources produced nearly 44% of all electricity in the EU last year, up from 37.5% in 2022.

Industrial output is also declining amid a wider macroeconomic depression that threatens to become a recession in some parts of the world. However, the Eurozone Purchasing Managers’ Index has begun to improve in recent months after hitting multi-year lows in the second half of 2023. The index has been in negative territory since mid-2022 but has begun to recover.

The region’s manufacturers are still dealing with elevated energy costs, with the benchmark natural gas price at the start of 2024 still around double the average from 2018-2020 (before the energy crisis triggered by Russia’s invasion of Ukraine).

Nevertheless, the political and regulatory outlook still underlines the long-term ambition that the EU has for its emissions trading system.

The market has expanded this year to include emissions from maritime transport. Vessels moving within the EU will be assessed 100% of the emissions calculated for their voyages, while ships entering and leaving EU waters will have 50% of their CO2 pollution covered by the market.

Shippers will be required to buy and surrender EUAs covering 40% of their emissions in 2024, 70% in 2025, and 100% from 2026 onwards.

The EU estimates that maritime emissions currently total about 130 million tonnes a year, or twice the tonnage of EU aviation before the onset of the COVID-19 pandemic.

The aviation sector is also bracing itself for the gradual elimination of free allocation of EUAs to airline operators. This will bring new and additional demand for EUAs into the market.

EU aviation will receive over 18 million free EUAs in 2024, compared to verified emissions of 47 million tonnes in 2022, though the free handout will drop by a quarter in 2025. By 2026, there will be no free allocation to aviation.

The EU ETS cap is also being reduced by 90 million tonnes this year and will drop by a further 27 million in 2026, above the annual 4.3% cut in the cap. These “rebasings” of the cap form part of the “Fit for 55” reforms approved last year.

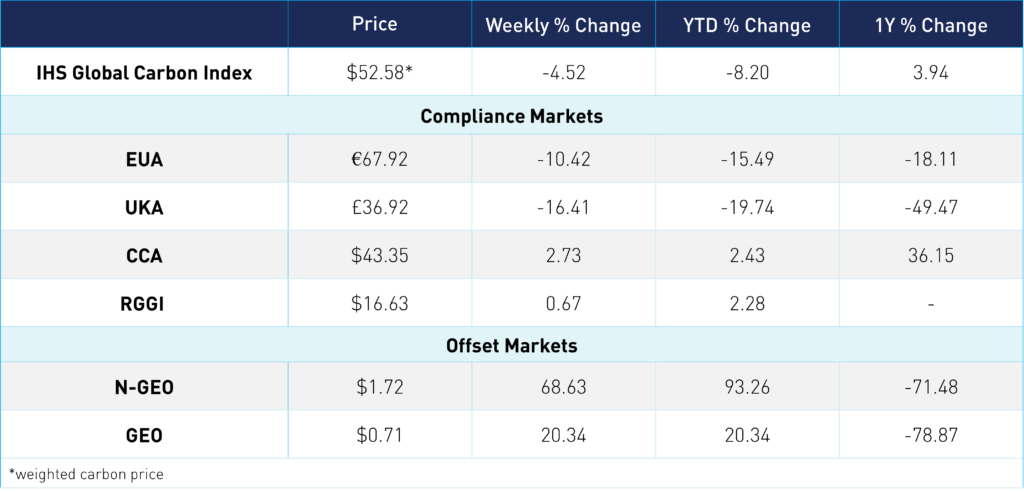

Carbon Market Roundup

The global price of carbon is $52.58, down 4.6% from the week prior. EUAs prices slipped lower throughout the week. After falling 4.8% last week, prices declined further, finishing the week down 10.42%. UKAs fell 16.41% at £36.92 after ending last week at £43.68. CCAs continued to trade higher this week, building on last week's strong finish on low volume, ending the week up 2.73% at $43.35. RGGI continues to push higher, up 0.67% at $16.63. N-GEOs rallied heavily this week, gaining 68.63% to finish at $1.72, while GEOs gained an impressive 20.34% at $0.71.