Gas Leak Sabotage Highlights Fugitive Emissions and Global “Net Short” on Emissions Reductions

3 Min. Read Time

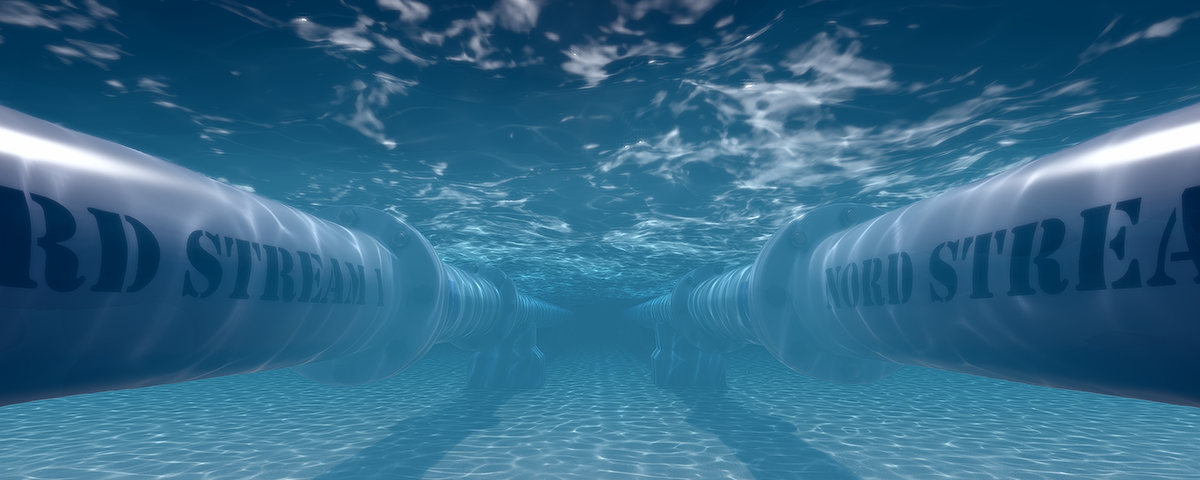

Two major developments have dominated the European Emissions Markets: the ongoing energy crisis triggered by the Russia-Ukraine conflict and now the unexplained Nord Stream pipeline gas leaks.

The Nord Stream incident has brought to the forefront the issue of so-called fugitive gas emissions, with no country having stepped up to claim responsibility or account for the methane leaks.

Beyond the lack of accountability, it has also highlighted the practice of flaring, which is the burning of gas combustion that occurs at oil or gas extraction sites, natural gas processing plants, and chemical plants. It can be a by-product of oil extraction or intentionally done for maintenance and testing or disposal purposes from various fossil fuel-related processes.

Gas flaring persists due to areas without regulation requiring gas to be captured or insufficient financial incentive to capture and monetize the escaped gas. Gas flaring and fugitive gas emissions are one of the main arguments against using natural gas for fuel because escaped gas—whether intentional or accidental—can cause more net damage than the benefits of its relatively cleaner combustion compared to coal.

The practice is problematic in part because of its effect on the environment but also because it represents unnecessary and unaccounted-for carbon emissions. These emissions are not priced under any mechanism, only adding to the global “net short” on emissions reductions. However, this is one area where emissions trading systems and carbon allowances can have a significant positive environmental impact by making it cost-prohibitive for companies to allow excess gas to leak into the atmosphere.

Last week, BBC published an investigation that showed “dozens of oil fields” where operating companies are not declaring ongoing flaring. The extent of this practice is alarming and not something to be ignored. Keep watch for Eron Bloomgarden’s full write-up on gas-flaring and its impact on climate goals and carbon markets to be published in the coming days on www.kraneshares.com.

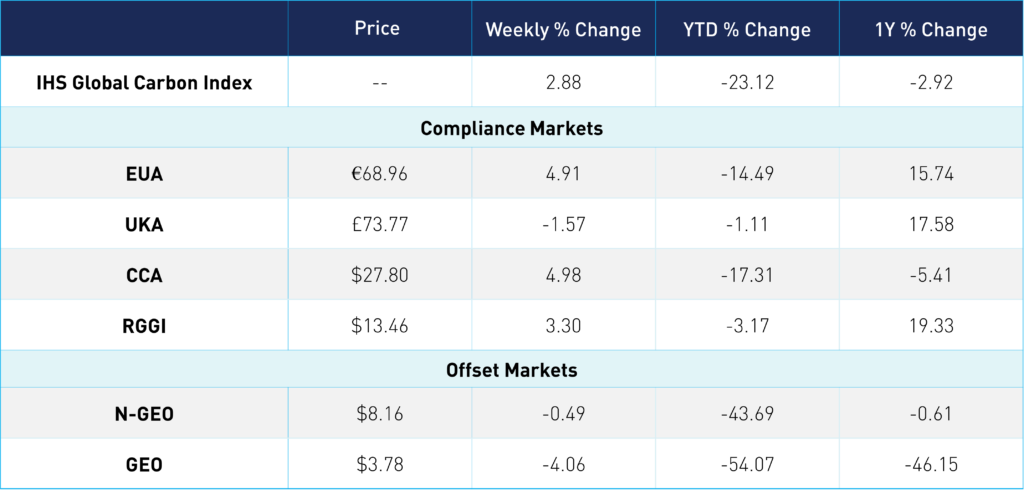

Carbon Market Roundup

Compliance Markets:

EUAs steadily climbed higher over the last few days, closing up nearly +5% from the week prior at €68.96 ($67.53). UKA prices fell slightly, ending at £73.77 ($82.37), down -1.57% week-over-week (WoW). A lot of the sentiment around EUAs seems to be pivoting around the “will they / won’t they” plan to raise an additional €20bn for REPowerEU, a plan to make the bloc less dependent on Russian fossil fuels. Markets are reacting favorably to the decreased likelihood the EU will dip into the market stability reserve to fund its REPowerEU. The market stability reserve, or MSR, was introduced in 2019 to help control the number of allowances in circulation in order to prevent price volatility. While tapping into the market stability reserve was initially floated earlier this year when the REPowerEU plan was initially proposed, it has been met with strong opposition recently from a number of EU countries and political groups in the EU Parliament. Releasing more allowances from the reserve would have depressed prices and potentially shaken confidence in the EU ETS.

US markets saw a reversal this week, with both CCAs and RGAs up WoW, +4.98% and +3.30%, respectively. CCAs ended at $27.80 and RGGI at $13.46. This rebound comes in tandem with US equities rising sharply on Wednesday, with the S&P 500 on Tuesday seeing its largest one-day increase since May 2020. Markets reacted to the positive sentiment around inflation and interest rates possibly peaking following August's declining unemployment numbers and the Central Bank of Australia’s less-than-expected interest rate increase. While the markets aren’t correlated, carbon prices have been impacted by the spillover effect from macro sentiment, so this week’s turnaround presents a positive development across markets. Later in the week, carbon prices maintained their upward trend despite equities declining.

Offsets Market:

Nature-based offsets futures, N-GEOs, remained relatively stable. The contract closed at $8.16 and was down an overall -0.49% WoW. The aviation offsets futures, GEOs, saw strong momentum all last week, but those gains waned slightly starting Tuesday and ended down -4.06% at $3.78.

Carbon Futures Prices