EUAs Ditch the Switch, UKAs Sync to Link: 2025 Price Action Offers Clues to 2026

4 Min. Read Time

As 2025 comes to an end, it is instructive to review the price action in both EUAs and UKAs and ponder what clues this offers into the outlook for 2026. And in both cases, there has been a key development over the course of this year which we think gives strong grounds for supposing that 2026 will continue the supportive trends of the last 12 months.

EUAs leave fuel-switching behind to focus on the looming deficits over 2026-30

The benchmark front-year EUA contract – now the Dec-26 vintage following the expiry of the Dec-25 contract on 15 December – settled on Friday at €87.09, up 16% from the €75.09 at which it closed 2024. With the greenback depreciating against the Euro by 14% over the course of 2025, this represents a 31% return on EUAs in USD terms.

What is so interesting about this strong performance in EUAs, though, is that it has happened against the backdrop of a big decline in European natural-gas prices. As of Friday’s closing price, the benchmark front-month TTF contract fell 36% since the start of the year. This is significant because historically, EUA prices have tended to move in line with TTF prices.

This relationship is because the natural-gas price is key to determining the so-called “fuel-switching” price: other things being equal, the higher the natural-gas price, the more expensive it becomes for gas-fired power generators to run relative to coal-fired plants, and hence the higher the carbon price needs to be in order to incentivize the less carbon-intensive fuel (natural gas) to displace the more carbon-intensive fuel (coal). Conversely, the lower the natural-gas price, the lower the carbon price needs to be to push gas-fired plants ahead of coal.

How do you explain, then, the fact that EUAs have rallied 16% this year while TTF has dropped 36%? The answer lies in the market recognizing two things. First, the fuel-switch is declining in importance over time, as the power sector decarbonizes structurally via the increasing share of renewable electricity in the mix and as more coal plants are retired. Second, the EUA market is set for significant supply/demand deficits annually over 2026-30, and especially in the next two years.

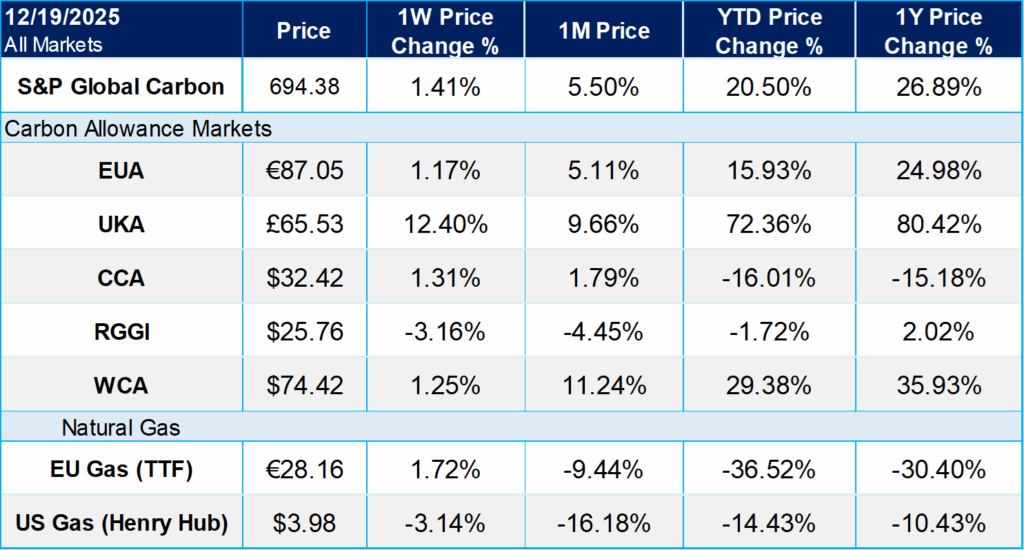

As shown in Figure 1 below, on our estimates, the market will be short 149 million tonnes (Mt) in 2026 and 141Mt in 2027, with further significant deficits over 2028-30. This reflects the reduction in supply as both the overall cap falls over time and as auction volumes in particular are reduced with the ending of the frontloading of EUAs under the RePowerEU programme.

Figure 1: Annual supply/demand balances in the EU-ETS 2008-30 (Mt)

Source: CLIFI

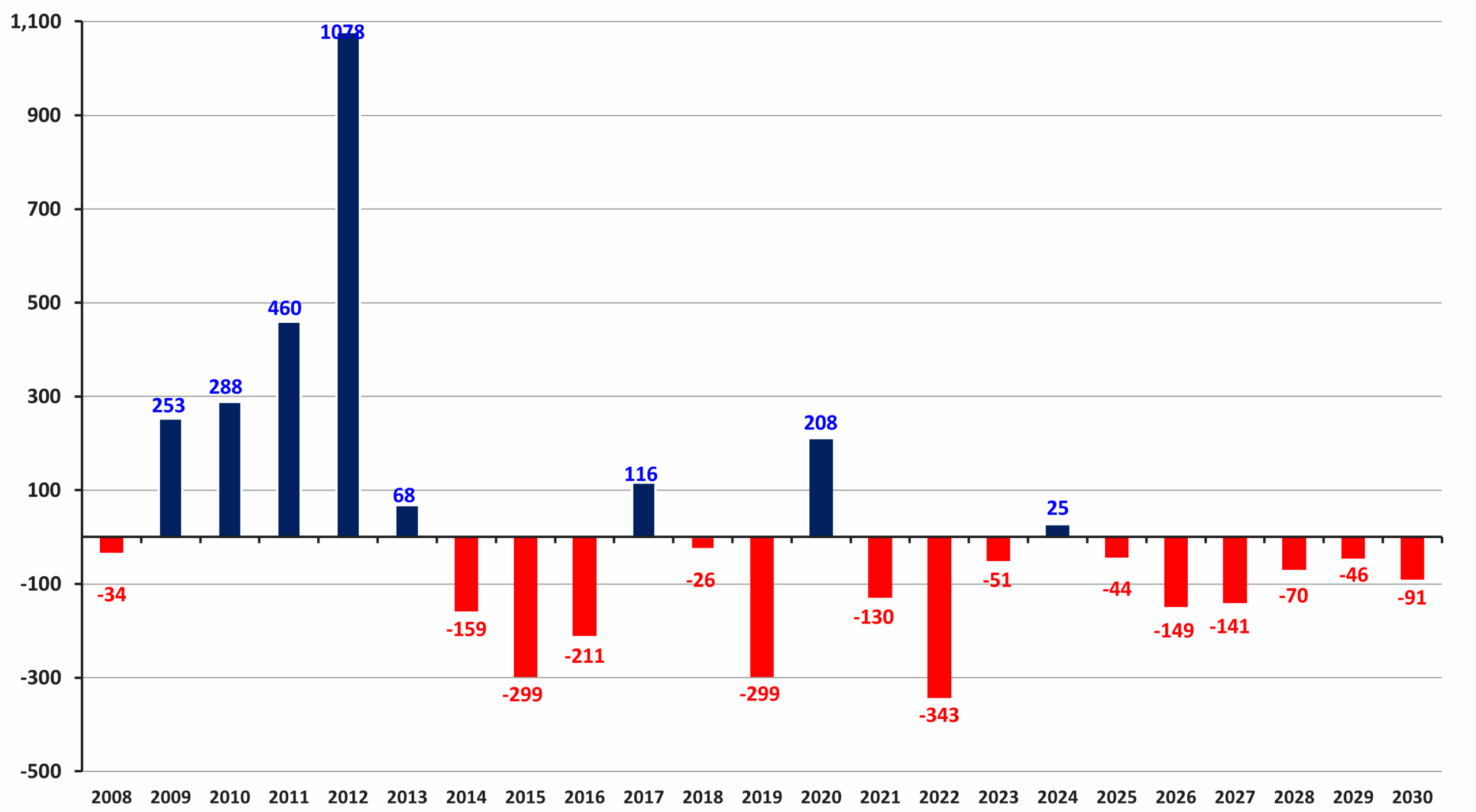

These looming deficits explain why net speculative length in EUAs has built up very aggressively since September, reaching a new all-time high (ATH) last week of 114Mt. Before December this year, the previous ATH was all the way back in April 2021.

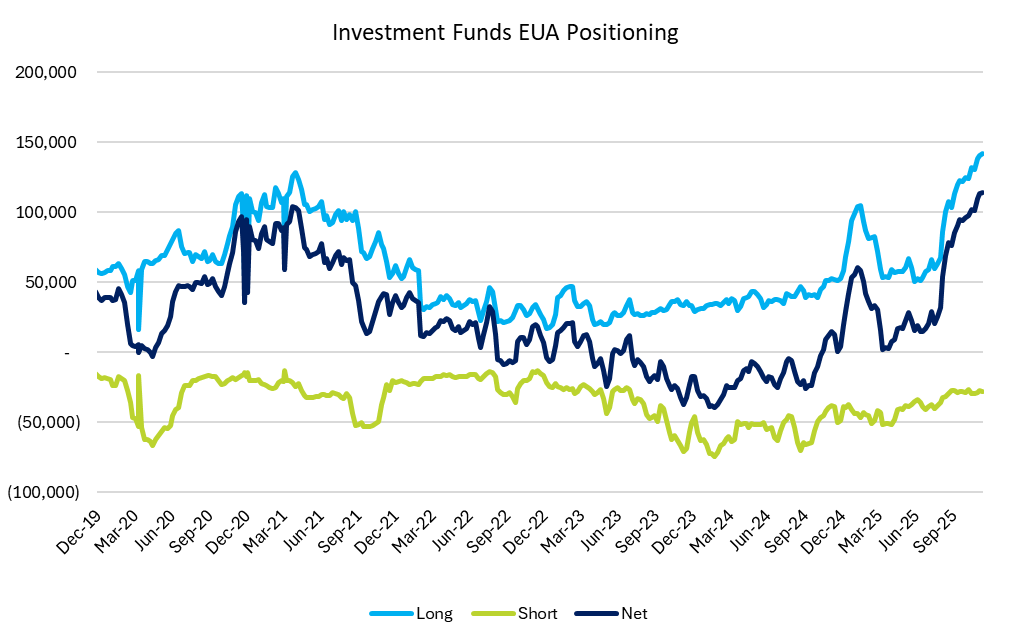

Investors are hoping for a break back above €100 in 2026 as the deficits bite and the total number of allowances in circulation (TNAC) on a system-wide basis – that is, the inventory of outstanding EUAs held in the market, including the cumulative deficits in aviation – draws down as a consequence. In our estimates, the system-wide TNAC falls sharply between now and 2030, from 945Mt at the end of 2024 to 404Mt by the end of 2030 (Figure 2).

Figure 2: System-wide TNAC (including aviation deficit since 2012) in the EU-ETS, 2008-30 (Mt)

Source: CLIFI

In short, we maintain a high conviction outlook for EUAs heading into 2026, and with no fresh auctions until January 8, there is always a chance that prices could gap sharply higher in already thin holiday markets over the next two to three weeks.

Overall, we think in Q1 2026 the market will be targeting the ATH for the benchmark contract of €101.25 set in February 2023 (at that time the Dec-23 contract was the benchmark), the main risk being stronger political headwinds if prices break through the €100 barrier too quickly and EU industrial demand continues to languish.

UKAs surge in 2025 as the market anticipates synchronization with EUAs via linking

UKAs have been the best performing carbon instrument in 2025, with the benchmark front-Dec contract surging 73% over the course of the year. The Dec-26 contract settled on Friday at £65.47, up from £38.02 at the start of the year. Again, after factoring in the greenback’s depreciation over the course of 2025, this represents an 83% return on UKAs in USD terms.

The spectacular performance of UKAs this year is attributable to the positive political momentum between the UK and the EU around linking the UK-ETS with the EU-ETS. Once this eventually happens, UKAs and EUAs will effectively be fungible instruments that can be used for compliance in either system, and, although the operationalization of linking – whereby the UK and EU registries are set up to receive each other’s allowances on a reciprocal basis – is probably at least 18 months away, the market is now betting on this happening.

This is reflected in the narrowing of the spread between UKAs and EUAs over the course of this year. At the start of 2025, UKAs traded at a discount of €29 (39%) to EUAs, whereas at Friday’s close the gap was only €12 (14%). The most recent boost to UKAs occurred last week, with the UK and EU announcing that they intend to finalize talks on linking the two markets at the summit to be held in Spring 2026, reassuring the market that this remains a priority for both parties.

With the UK market itself also set to tighten over 2026-30 and with full operationalization of linking now a realistic prospect in late 2027/early 2028, we think the outlook for UKAs heading into 2026 is similarly bullish to the outlook for EUAs. The main risk would be if political momentum for linking with the EU-ETS were to stall, but that looks unlikely as things stand at the moment.

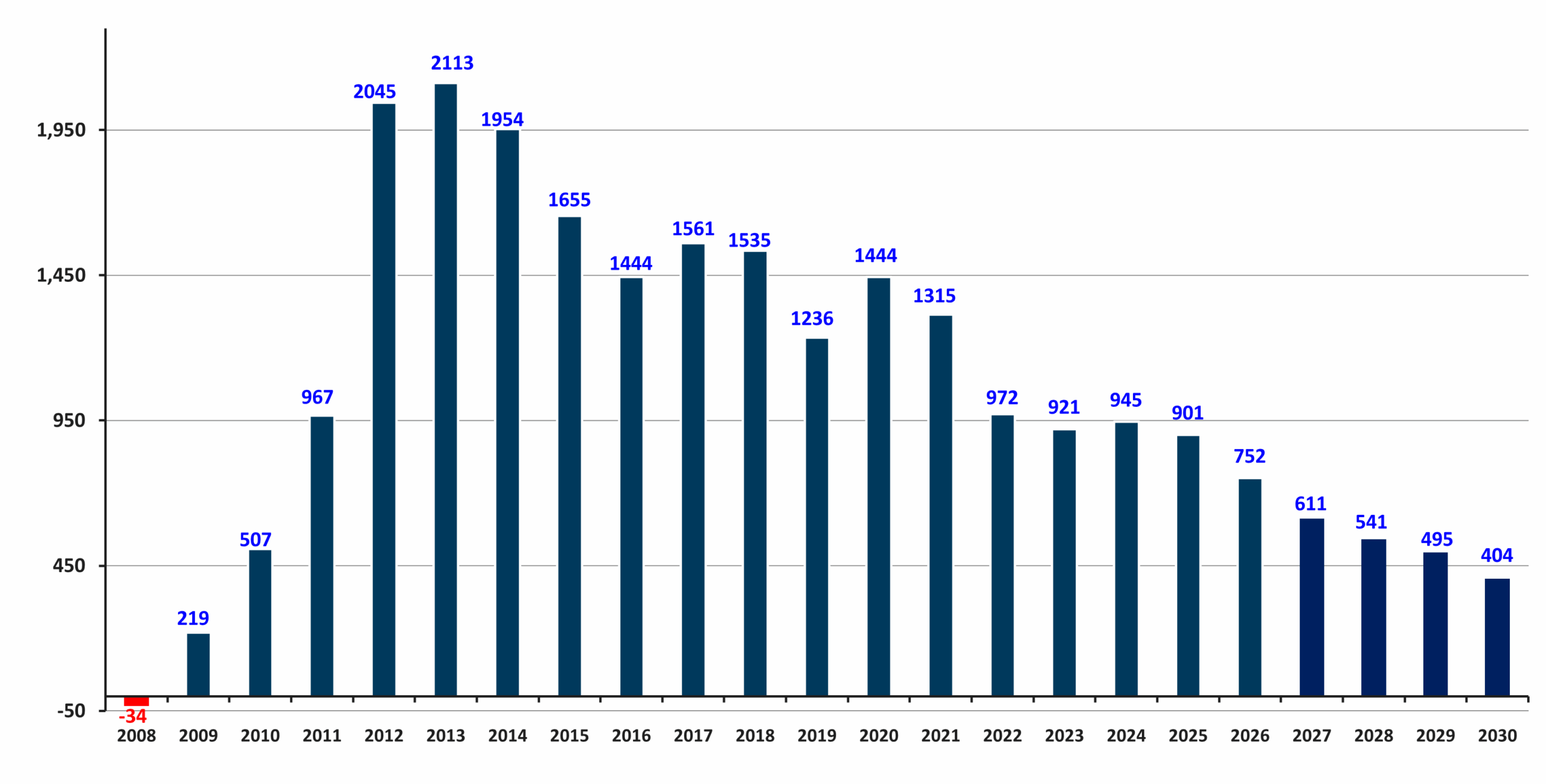

Carbon Market Roundup

The weighted global price of carbon was $60.03, up 1.4% week over week. EUAs were up 1.2% over the week, closing at €87.05. UKAs jumped 12.4% to £65.53. CCAs were up 1.3% at $32.42. RGGI was down 3.6% at $25.76 while WCAs were up 1.3% at $74.42.