EUAs Reach Seventh Month High Nearing €80, China Makes Major Commitment to Carbon Markets

2 Min. Read Time

Towards the end of last week, EUAs saw a strong rebound, reaching a seven-month high near the €80 level as the market appears to be pricing in next year's significant supply tightening. UKAs also got a boost from news that the UK is reportedly working out a temporary deal to shield its domestic exporters from the EU ETS Carbon Border Adjustment Mechanism (CBAM), according to The Guardian.

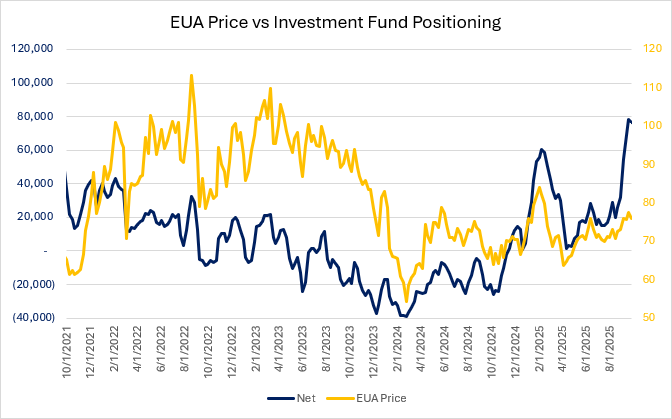

Investment Fund Long Positioning Near Multi-year Highs

- The latest Commitment of Traders (COT) report (Sept 26) shows that investment funds have a net long position of 76.2 million EUAs, down slightly from the record 78 million EUAs seen in the previous week, marking the first decline in six weeks

- Funds have been positioning towards higher prices, with EUA breaking out of the several months long range of €70-€75 , hitting €78 on Sep 17 and has since pushed higher to just under €80.

- We haven't seen a consecutive weekly build up in long positioning since back in the summer of 2021. Policymakers then were working on the Fit-for-55 package, with EUAs trading around €55, a few months before their first attempt at reaching €100 level.

China Makes Major Commitment to Carbon Markets

China last month confirmed its intention to expand coverage and transition the country’s emissions trading system to a cap-and-trade program starting in 2027. The changes will eventually bring total annual coverage of 3.2 billion tonnes a year of CO2 equivalent under the same type of market system as the EU, California and six other cap-and-trade systems worldwide. Needless to say, China’s will be the largest market to date, and will cover around 75% of industrial emissions. (The EU ETS cap in 2024 was just over 1.3 billion tonnes.)

China’s market has historically been based on emissions intensity – CO2 emissions per unit of output – which meant that overall emissions could still increase as long as production grew. But the proposed reforms would transition the market into a capped system. To be clear, Chinese government documents suggest that the absolute cap will only apply to sectors with so-called ‘stable’ emissions in 2027, with a full transition to cap-and-trade envisioned for 2030.

At present the China ETS covers power, cement, steel and aluminum, and the 2027 expansion is expected to bring chemicals, petrochemicals, pulp and paper and aviation within the scope of the market. Experts suggest that as a transitional measure, there will be a generous free allocation to these new sectors at the start of the capped phase, but it’s worth bearing in mind that Europe’s market also began in 2005 with full free allocation, and auctioning only became the default from 2013.

The plans call for a gradual introduction of auctioning as the main method of allowance distribution, which experts suggest is one way in which Chinese exporters can mitigate the impact of Europe’s CBAM.

In its annual report for 2024, China’s ministry of ecology and the environment (MEE) reported that daily trading volume in China Emission Allowances (CEAs) rose by 44% from a year earlier, with the annual total reaching 189 million tonnes. This compares with a daily average trading volume in the European market of more than 20 million tonnes.

Prices for CEAs ranged from 69 yuan to 106 yuan ($9.69 to $14.89) in 2024, more than double the prevailing price when the market as launched in 2021, MEE reported. The ministry also noted that trading activity has risen significantly, with a doubling in buy and sell orders this year as new sectors have been brought into the market, though trading is currently restricted to spot exchange.

A total of 5.22 billion CEAs were issued in 2023, while the verified emissions were reported as 5.24 billion tonnes. The deficit was made up from some CEAs of earlier vintages as well as 6.47 million China Certified Emission Reduction offsets.

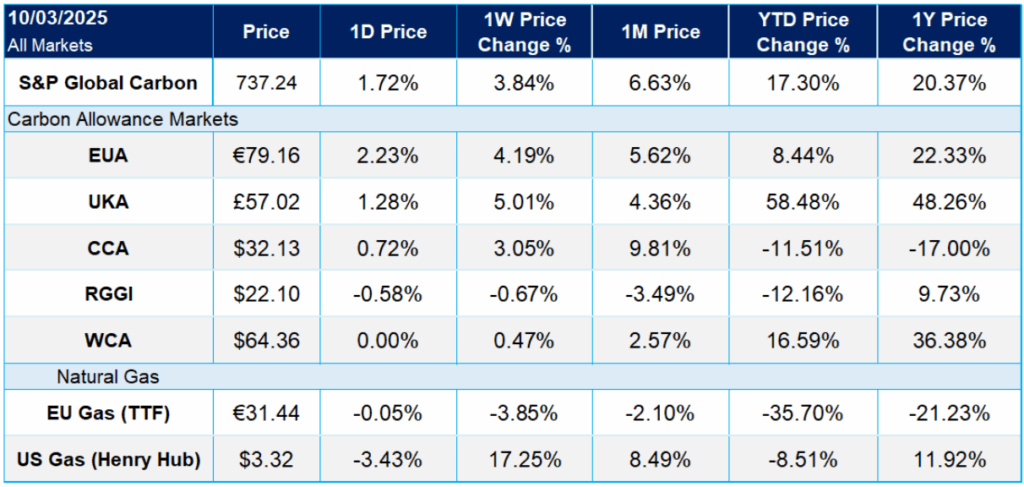

Carbon Market Roundup

The weighted global price of carbon was $55.95, up 3.8% for the week. EUAs were up 4.2%, rallying toward the end of the week to €79.16. UKAs posted a 5.0% weekly gain, ending at £57.02. CCAs were up 3.1% at $32.13, with the 50-day moving average crossing over 200-day on Friday. RGGI was down 0.7% at $22.10. WCA prices were up 0.5% at $64.36.