EUAs Hold Their Ground Amid Weakening Energy Markets, West Coast Remains Steady

2 Min. Read Time

EU Allowances continue to trade above the recent floor at around €70, and have held their ground amid intense pressure from weakening energy markets.

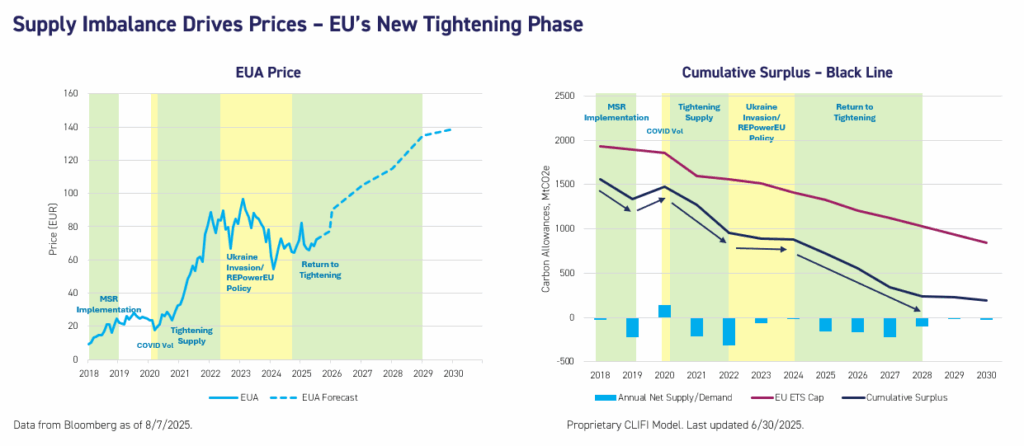

With European natural gas prices at 13-month lows, gas-fired power has become the most cost-competitive fossil fuel, moving ahead of coal and lignite in the merit order. This shift reduces coal and lignite generation, lowering overall emissions intensity and potentially easing demand for carbon allowances. And while this has bearish implications for EUA demand, the market is ignoring the presently weak TTF market and looking ahead to Q4 and 2026, when EUA supply is expected to get tighter and prices to rise.

TTF has weakened primarily on a lack of liquified natural gas (LNG) demand from China, which has backed cargoes out into the Atlantic basin and kept a lid on prices. That was further accentuated last week by feverish speculation ahead of Friday’s Trump-Putin summit.

The talk of a ceasefire agreement fanned a wave of selling, driving front-month TTF below €31.000/MWh, their lowest in more than a year, as traders speculated that a ceasefire could pave the way for sanctions on Russian energy to be at least partially lifted, though whether Europe would play along is doubtful. Since no definitive deal emerged from Friday' summit, the market is still looking for direction and may see more clarity amid talks between the US and Ukraine today.

Failure to reach a peace deal could trigger a bullish response in gas, and this could take carbon along with it. Add to this the looming annual maintenance season for Norway’s North Sea gas plants, and gas may enjoy a strong September. Some participants also highlight that cheaper gas could usher in an industrial revival, as manufacturers exploit lower energy costs to boost production and raise demand for EUAs.

As a result, the short-term outlook for EUAs remains, at worst, relatively flat, and €70.00-€71.00 area has gained strength as a floor price, while attempts by speculative traders to push prices below have run into stiff resistance.

Amid this resilience, EU ETS participants are starting to eye the fourth quarter and the start of 2026. Gas prices are expected to make a recovery as the deadline period for refilling gas storage approaches, and Asian buyers start to build their stockpiles ahead of winter.

Analysts still see potential for prices to move up into the €80s by the fourth quarter, ahead of further strength in 2026 as the supply of allowances shrinks markedly amid the end of the REPowerEU program and an adjustment in free allocations as CBAM takes effect.

West Coast Remains Steady

Across the Atlantic, California CCA prices continue to recover, with the ICE Futures front-December contract hovering just under $30/tonne for the last week.

The market is experiencing growing optimism around formal legislation that would extend the state cap-and-trade system past 2030, though no regulatory decisions are expected until at least September.

The 50-day moving average crossed over the 100-day last Thursday, highlighting the recent strength in the market, but traders are not expected to make bold moves until the summer holiday period has ended and there are more political signals.

Meanwhile, in Washington state’s carbon market, prices for the benchmark December 2025 contract are steady at around $62.75/tonne, with traders watching for signs of progress on the state’s efforts to link its market to California’s.

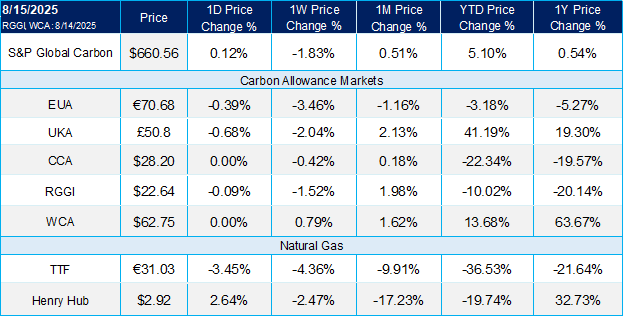

Carbon Market Roundup

The weighted global price of carbon is $50.33, down 1.8% week over week. EUAs were down 3.5% for the week to close at €70.68. UKAs declined 2.0% to £50.80. CCAs closed at $28.20, down 0.4%. RGGI was down 1.5% at $22.64, while WCAs were up 0.8% at $62.75.