EUAs Stabilize After Post-Tariff Frenzy

2 Min. Read Time

EUAs have halted the slide that began amid the turmoil generated by the announcement of widespread US tariffs. Prices appear to be consolidating on the back of recent compliance buying interest and a general stabilization in energy and equities. The benchmark December 2025 EUA futures contract settled on April 24 at €66.31/tonne, more than 10% up from the €60.06 low point two weeks earlier.

The announcement by the White House that the US would impose universal tariffs of at least 10% on all imports triggered some panic selling across financial and commodity markets as investors sought safe havens. The April 2 announcement triggered a more than €10 plunge in EUAs in just five trading sessions, with European natural gas also falling as much as 18%.

While traders were selling the expectation that tariffs on European goods would likely depress regional industrial output, compliance buyers were preparing to step in, and market participants reported a surge in demand from industrials looking to lock in cheap permits as the price fell close to €60. Since the April 9 low, the market has stabilized as some tariffs have been rolled back, but the overriding impression has been that the market now sees €60.00 as a good entry point.

In other news, a widespread power outage hit Spain and Portugal today. The cause of the blackout is still unconfirmed, but some have pointed to issues with the electricity distribution network in Spain. The disruption also highlights the importance of grid stability and the potential challenges of integrating renewable energy sources, such as solar and wind. We'll keep watch of the implications for energy markets, power generation, and, subsequently, carbon allowance demand.

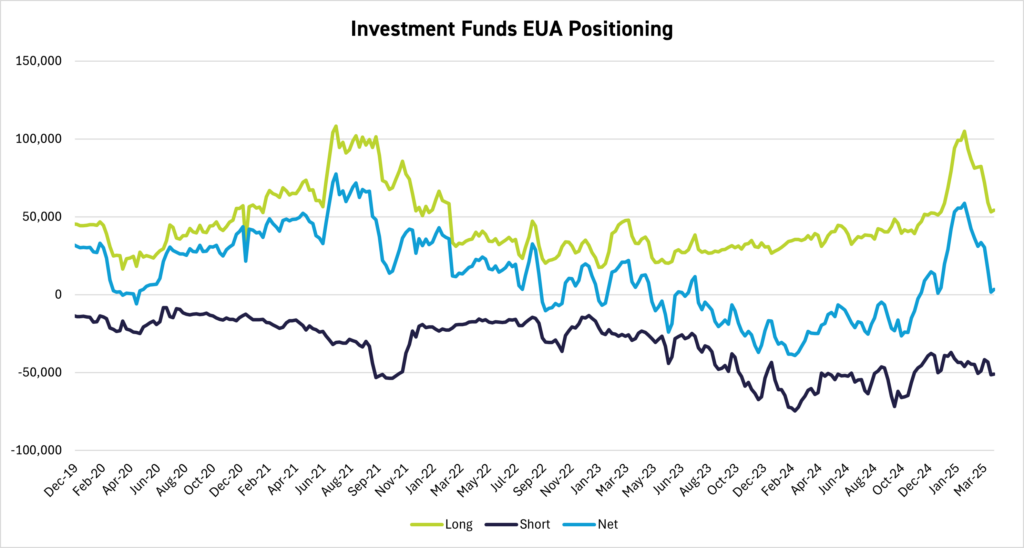

Data from the main future exchanges show that investment funds had cut their net length to just 1.7 million EUAs in the week ending April 9 after holding a net bullish position of as much as 60 million EUAs two months earlier. Since then, speculative participants have resumed buying: the latest Commitment of Traders data shows that funds built their net long position to 3.3 million EUAs in the week ending April 17.

The €60.07 low corresponds to the low from October last year, when the December 2024 futures contract also traded around the €60.00 mark. Prior to that is the February 2023 low point when front-December prices dropped to €51.08.

The recent volatility in energy markets has also caused the correlation between carbon and natural gas to loosen. The five-day EUA-TTF correlation had reached +1.00 on April 4 but has swung sharply since then, dropping to as little as -0.06, and has often shifted completely on a day-to-day basis. This suggests that carbon traders have been looking to gas for their lead less frequently of late, and are considering financial markets as well as fundamentals in their strategy.

Nevertheless, gas will remain an important driver: Europe’s power generation mix has seen a sharp shift away from renewables in recent months, as the weather has depressed output from wind farms and solar parks. The slack has been picked up by fossil fuels. In the first three months of 2025, gas, hard coal, and lignite generation increased by 40%, 15%, and 13%, respectively, on a year-on-year basis, and that came on the heels of three solid years of annual decreases.

Prices need to rise to allow Europe to divert gas from power generation to storage ahead of next winter. With crude oil prices falling at the moment, there is little incentive to buy gas just yet. But as the year progresses, the stress on Europe’s winter balance will increase; any rally will pull carbon with it, and as we near 2026 and the end of the REPowerEU sales, EUA fundamentals may begin to re-exert some influence.

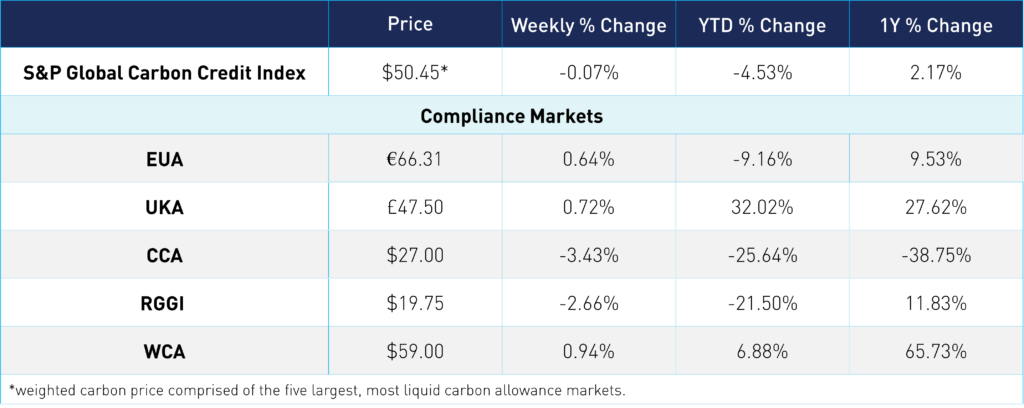

Carbon Market Roundup

The weighted global price of carbon is $50.45, down a slight 0.1% for the week. EUAs were up 0.6% at €66.31. UKAs were up 0.7% at £47.50. CCAs fell 3.4% at $27.00. RGGI was down 2.7% at $19.75. WCA was up 0.9% at $59.00.