Investment Funds Extend Long Positions in EUAs to Highest Levels in Over a Year

2 Min. Read Time

After touching a high of €71.50 early last week, EUA prices have eased back off again and are trading today at just below €68.00, driven by the ebb and flow of TTF natural gas futures.

EUAs are still in a rising channel that dates back to the start of October, and this latest slip may only be a precursor to prices once again testing €70.00 as the auction program for the year comes to an end on December 16. However, gas may still remain the main driver.

Gas is heavily influenced by the supply outlook over the winter, and the early weeks of the season saw stock draws pick up sharply. The result has been that storage levels across the EU are below the level they were at this time last year, and this has helped bolster prices, not just for December but also for next summer, when storages are typically refilled for the next winter.

Gas is far and away the best-performing energy market so far this year: prices for the rolling front-month contract are up early 54% for the year-to-date, while December EUA futures are down by just over 10% since January 2.

And yet, it could be argued that gas prices have helped carbon avoid an even steeper fall. Natural gas has priced itself out of power generation for the coming year, and coal is now more profitable for most of the near term contracts.

The implicit demand for EUAs from this has widely been credited as keeping EUAs away from the €50 low that they reached early in the year.

Analysts are already looking ahead to 2025, and S&P Global said this week that they believe 2024 prices will represent the bottom of the current cycle; they expect an average of around €75 next year and €100 by 2030.

Fundamental demand from the new maritime sector may play a part as shippers start to hedge their voyages, while the removal of free EUA allocations to airlines will also bolster demand.

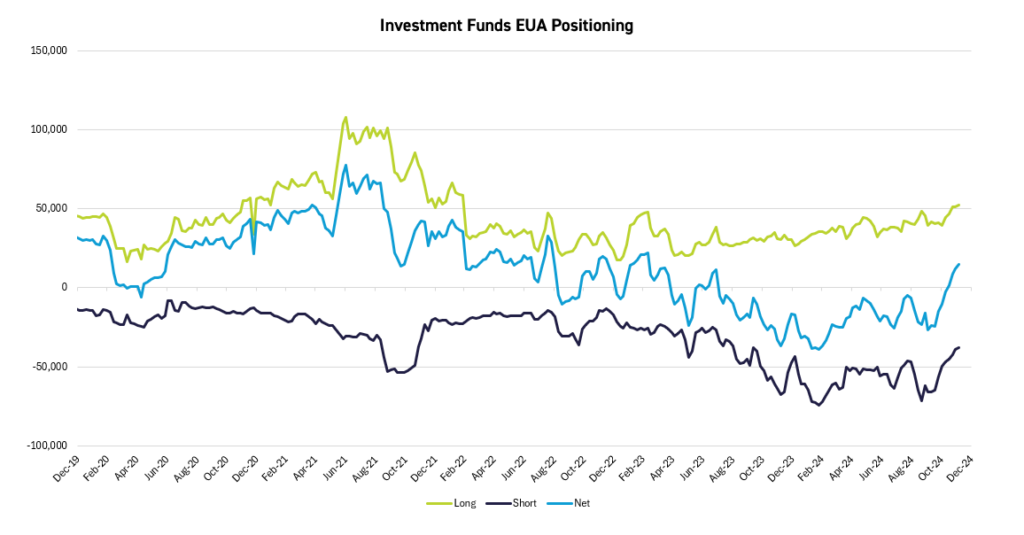

The strongest signal showing that the market may be on the turn comes from the Commitment of Traders data. For the week ending November 15, investment funds reported a net long position of 1.4 million tonnes of carbon allowances. This may not sound like much but it represents the first net long positions that funds had reported since August 2023.

In the two weeks since, funds’ net length has increased to nearly 12 million tonnes, the most since April 2023. And the total number of short positions held by managed funds fell to 39 million EUAs, the lowest in 13 months.

During the 15-month period when funds held a net short position, EUA futures prices fell from €83.65 to a low of €51.08; now, with EUA prices set to get a boost from colder weather driving higher coal burn and a pause in the auction supply, they may be well-placed to ride a rally.

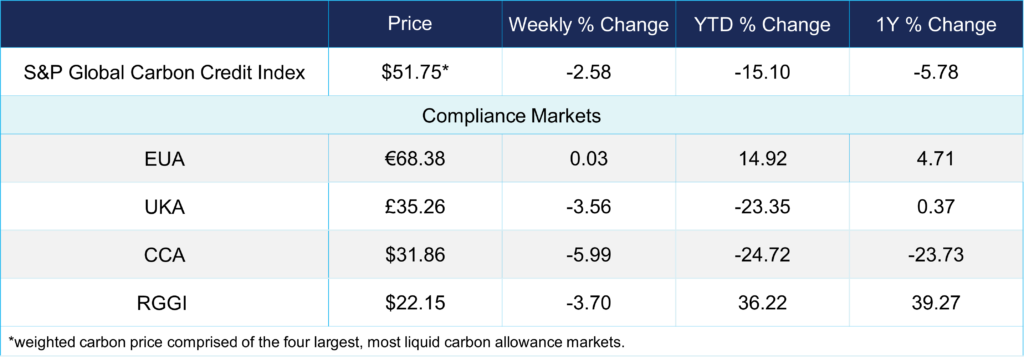

Carbon Market Now

The global weighted price of carbon is $51.75, down 2.58% from the previous week. EUAs are down 0.03% for the week at €68.38, while UKAs are down 3.56% to £35.26. CCAs trended down 5.99% at $31.86. RGGI was down 3.7% at $22.15.