Muted Reaction to Weaker Q4 CCA Auction, EUAs Hold Strong above €80

3 Min. Read Time

CCA Nov 19 Auction Highlights

- The CCA auction completely sold out (51.3mm units) at $28.32

- 1.5% under the Q3 auction ($28.76) and $1.50 lower than futures

- 86 qualified bidders vs 96 last auction

- Bid to cover ratio was 1.10, from 1.45 in Q3, so on lower end

- Non-compliance entities took almost one fifth of the auctioned allowances, their largest share of 2025

- Considered a weaker auction, led by year end and uncertainty around CARB's reform timing.

- Price action has been muted, Dec CCAs traded $29.50 Friday, down from $29.95 on Wednesday.

The Q4 CCA auction for current allowances cleared at $28.32, which was 5.3% below where the secondary price for Nov-25 V25 allowances settled on November 18 , the day before the auction took place. The Q4 clearing price of $28.32 was also 1.5% lower than the equivalent Q3 auction clearing price of $28.76, and only 38 cents above the expected 2026 floor price of $27.94. Indeed, apart from the undersubscribed Q2 auction of May this year when regulatory uncertainty was at its peak, this was the lowest settlement since the Q2 2023 auction. And while all 51.2 million allowances offered in the current auction were sold, the cover ratio was only 1.1x compared with the 1.45x ratio attracted in the Q3 auction, with 86 entities bidding compared with 96 in Q3.

That being said, the mean and median bid prices of $35.15 and $31.95 respectively were well above the equivalent Q3 levels of $31.96 and $28.94 respectively, signalling a wider fair-value range for CCAs than three months ago, with some participants clearly seeing much greater value than that implied by the clearing price.

Moreover, the results in the advance auction for V28 allowances were more encouraging, with the clearing price of $29.61 coming in 4% higher than the Q3 auction clearing price of $28.50, and with a healthier cover ratio for the 6.8 million CCAs on offer of 1.65, which was stable versus the 1.67 recorded in Q3.

Overall, though, the headline result was below expectations and the secondary market price for the benchmark Dec-25 V25 contract dropped 2.5% – from $29.95 to $29.20 – in the hour following the publication of the results.

We think the weak Q4 auction result mainly reflects ongoing scepticism on the part of market participants regarding the publication of CARB’s Initial Statement of Reasons (ISOR) report, which is key to finalizing the legislative framework and thereby putting in place the tighter cap to 2030. Although CARB has signaled that it plans to publish the ISOR by the end of the year, it has already disappointed on the publication date a number of times over the last 18 months – the ISOR was originally planned to come out in early 2024 – so market reservations on this point are understandable.

A final point worth noting is that following the two consecutive fully covered auctions in Q3 and Q4, the 7.2 million unsold CCAs from the failed Q2 auction will now be eligible for re-offering to the market from the Q1 2026 auction onwards.

EUAs at highest level since January as future deficits drive constructive market narrative

In contrast to CCAs, EUAs have been consolidating recent gains this last week, with the benchmark Dec-25 contract hitting €83 on November 28, its highest level since the year-to-date (YTD) high of €84.17 on February 11.

This is despite the fact that European natural-gas prices have continued their recent downward trend – the benchmark front-month TTF contract has fallen 9% since November 18 – while the equivalent hard-coal price has remained flat over the same period, meaning that gas-fired power plants are now running ahead of all but the most efficient coal plants everywhere across the EU. Indeed, on current natural gas and carbon prices, gas-fired plants are even running ahead of all but the most efficient lignite plants.

We attribute this disconnect between EUA and TTF prices to a growing appreciation amongst speculative investors that the so-called fuel-switching price between coal and gas – which has been a reliable proxy for the fair value of EUAs since the inception of the EU-ETS 20 years ago – is increasingly irrelevant for EUA pricing. Rather, what the market is focused on now is the looming consecutive annual deficits over 2026-30, which will see a big drawdown in the inventory of EUAs over 2026 and 2027 in particular, and hence a constructive backdrop to prices into year-end and beyond.

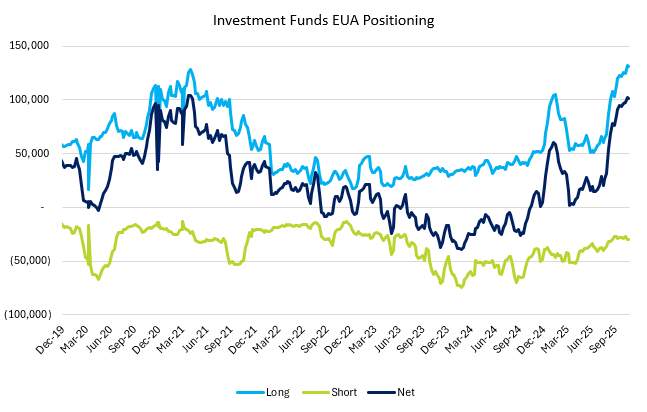

This upcoming supply crunch is also driving the speculative positioning that has built up strongly since September, with the latest published commitment-of-traders data showing net investment fund length of 101 million tonnes (Mt), within striking distance of the all-time high of 104Mt recorded in May 2021. With the end-of-year three-week auctioning drought from mid-December fast approaching, we would expect prices to test the YTD high of €84.17 in the coming week’s trading sessions.

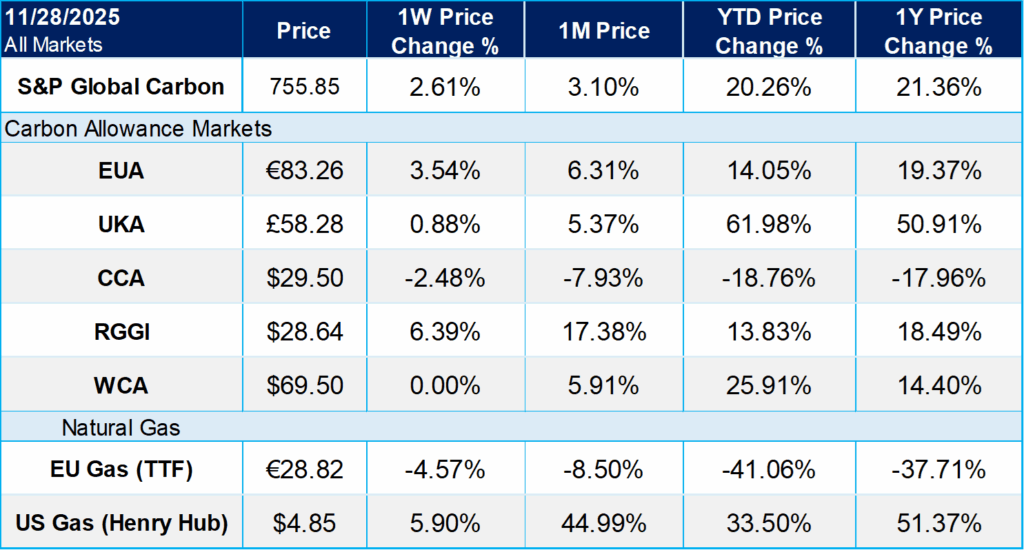

Carbon Market Roundup

The weighted price of carbon was $57.12, up 2.6% week over week. EUAs posted a 3.5% weekly gain, closing Friday at €83.26. UKAs were up 0.9% at £58.28. CCAs were down 2.5% over the week at $29.50. RGGI jumped 6.4% at $28.64. WCAs were flat at $69.50.