Newsom Signs Off on CCA Extension, 2025 Climate Week Wraps

2 Min. Read Time

| Upcoming Live Webinar |

| Join us tomorrow, September 30th, at 12 pm EDT for: California Extends Cap-and-Trade: What Investors Need to Know Please click here to register |

Last week was a flurry of activity as part of New York Climate Week (NYCW), which brings together leaders, investors, and innovators from around the world to explore solutions to decarbonizing our economy. It’s one of the biggest climate events of the year, coinciding with the United Nations Climate Change Conference (COP), where governments negotiate international agreements to address global climate change. Together, these events highlight the policies, technologies, and investment trends shaping the transition to a low-carbon economy.

As part of the week, we hosted an investor roundtable breakfast where we were joined by Bo Qin, Head of Environmental Markets and Weather at Bloomberg, to share insights on recent legislative developments and what they mean for California’s carbon market and the European Union’s largest carbon market.

Just ahead of Climate Week, California governor Gavin Newsom signed off on the extension of the state’s renamed ‘cap-and-invest’ program, setting the carbon market up for the next 20 years and aligning the cap trajectory with the state’s 2045 goal of achieving carbon neutrality. Newsom had until mid-October to sign the bill, so his early approval marked a strong start to NYCW.

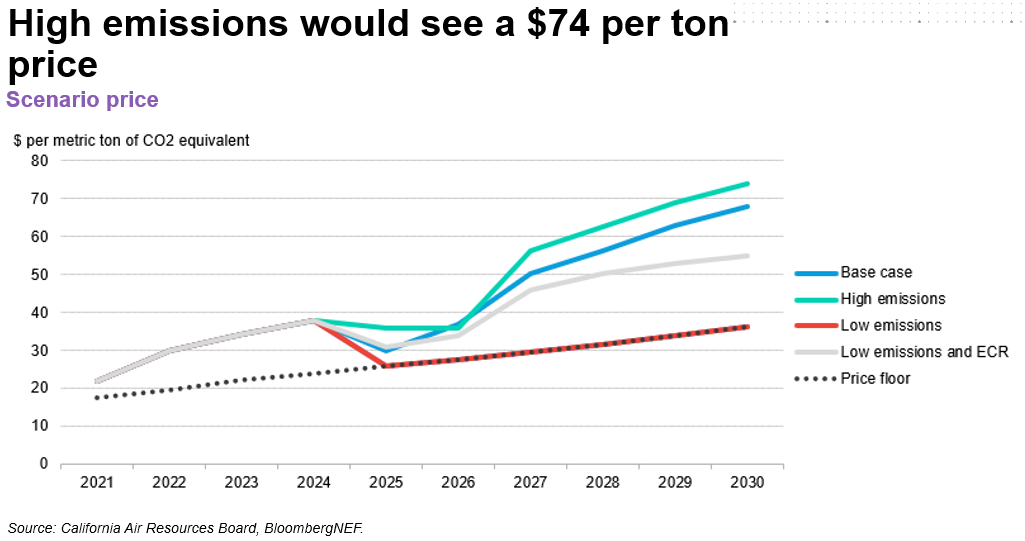

The immediate reaction has been very positive, with analysts from BNEF predicting an average front-year price for CCAs of $30/tonne in 2025, slightly higher than the year-to-date average. BNEF predicts CCA prices will average $37/tonne in 2026, rising to $68/tonne in 2030.

Bo Qin said that the reforms approved for the market are equivalent to taking 80 million tonnes of allowances out of the market between now and 2030, which she compared to an annual cap reduction rate of 10%.

State regulators will begin the process of updating the market parameters in the coming weeks, and at least one stakeholder workshop is foreseen for the autumn. Stakeholders at this week’s New York events noted that California lawmakers have targeted finalizing the reforms before the end of this year.

The market is waiting for further clarity on the approved rule that would bring use of offsets under the overall cap, meaning that retirement of offsets would be matched by the cancellation of an allowance from market supply. But one analyst pointed out that offsets are included in the market as a cost-saving measure, and their use should not lead to higher allowance prices.

The extension also gives a boost to efforts to link Washington state’s cap-and-invest program with its southern neighbor. Environment department officials in Washington are already working on rule making that would align the smaller market with the updated parameters of California’s system.

And Quebec has also indicated that it too will update its regulations to match California’s before an election scheduled for next year.

With Washington allowance prices trading at more than $60/tonne and California’s at half that level. There is some room for prices to converge as the linking process progresses.

Given that California’s market is the significantly larger of the two, most stakeholders expect prices to converge closer to the Californian price, and analysts in New York pointed to the Price Containment Reserve level as a possible end-point.

Our webinar tomorrow will provide more in depth coverage of what these latest developments mean for the market. Register here.

Carbon Market Roundup

The weighted global price of carbon was $53.92, down 2.0% week over week. EUAs were down 2.7% to close at €75.76. UKAs were down 1.4% at £56.08. CCAs were down 0.6% at $31.13. RGGI was up 7.0% at $22.41. WCAs were up 3.7% at $64.06.