California Carbon Clarity: Cap-and-Invest Extended to 2045

3 Min. Read Time

Long-awaited Update for California Carbon

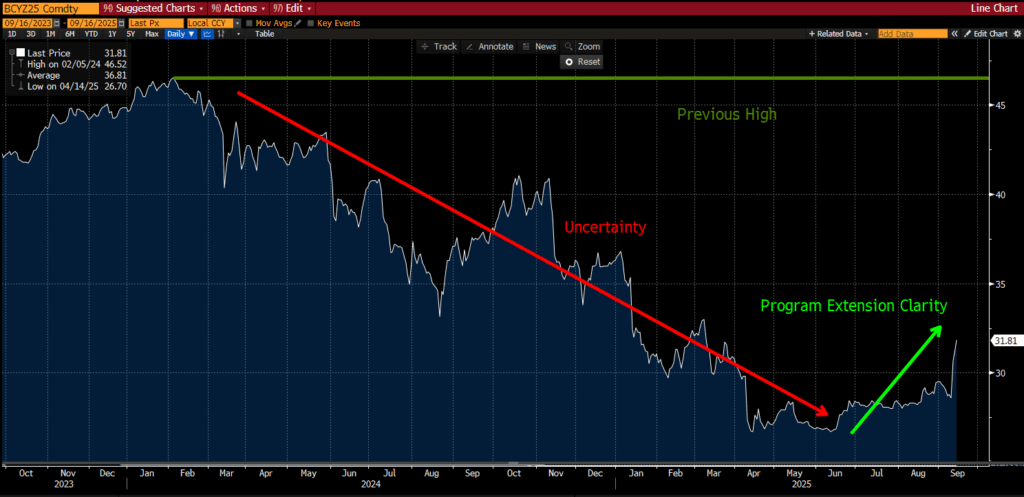

With California carbon now up 24% from the lows, we believe there is significant runway for this momentum to continue in the coming months/years.

So, what’s happening?

California just extended its cap-and-trade program, now called Cap-and-Invest, through 2045, giving the market 20-year pricing clarity and tightening allowance supply. These changes should push prices higher in the $70bn California carbon market and create a significant investment opportunity.

This market is attracting growing institutional interest (see CFA Policy Institute report here), with California Carbon Allowances (CCAs) supported by a reserve price floor that rises 5% plus CPI each year and a steadily rising price trajectory. Prices are $32 today and, with these developments, we expect CCAs to potentially move toward the 2024 high of $43 before advancing through the $65 tier-1 price in the coming years. Ultimately, we believe prices could breach $130 as we move into the 2030s.

Now is the time to understand what this means for your portfolio — let’s schedule a time to discuss with us.

Want more detail? Here’s the policy developments.

Key Policy Takeaways

What Happened? AB 1207 – Cap-and-invest extension

- Extension through 2045 – Provides 20-year price signal for the market and underscores the state government’s commitment to long-term decarbonization

- Maintains offset use with supply adjustment – The offset contribution will now be brought under the cap, as the cap will be reduced for every offset credit surrendered in the prior year

- Same limits: max 6% of obligation (up from 4% in 2021-2025) with existing 50% limit on non-DEB (in-state Direct Environmental Benefit) projects

- Tightening affect on supply as it could mean a considerable reduction of the allowance supply each year

- Offset use could be roughly 203Mt between 2031 and 2045 compliance years, according to ClearBlue Markets

- Considers emissions leakage risk – Starting in 2031, CARB must distribute industrial sector allowances based on minimizing leakage risk (entities relocating or exporting emissions) as previously free allocations were handed out similarly across sectors regardless of leakage risk

- Allocations should also support the transitioning of gas corporations to electrical distribution utilities

- The state board shall include recommendations to the Legislature on necessary statutory changes to the program to reduce leakage, including the potential for a border carbon adjustment (CBAM), by year end

- CARB can adjust the APCR and/or the price ceiling, if it believes the CCA price is rising too quickly and not protecting the interests of CA consumers – helps address the concerns of the Senate, which wanted to reduce the price ceiling

- Addresses affordability concerns – If the reserve is fully depleted, pricing ceiling units can be sold with revenues from the sale deposited into the new California Mitigation Fund, which provides direct rebates and investments to reduce household energy costs

What do Californians get? SB 840 – Greenhouse Gas Reduction Fund (GGRF) Revenue Use

Legislature seeks greater control over GGRF spending; distribution reflects compromise with the Governor’s May proposal. Key allocations:

- $1B - California High-Speed Rail (HSR) annually

- $1B - Direct legislative appropriations via annual budget

- $200mm - Fire protection programs.

- Additional allocations (percent of annual GGRF revenues): fire-fighting operations, low-carbon transit programs, climate research, among others

Offsets provisions: CARB must conduct a study by end of 2026 evaluating and recommending changes to offset use.

It also creates a “Legislative Counsel Climate Bureau” within the Legislative Counsel Bureau to support the Legislature in investigations, advice, policy planning around climate, and environmental quality.

What’s Next?

Following the state legislature's vote to extend the program through 2045, Governor Gavin Newsom has until October 12 to sign off on it. Attention now turns to the market reform package. The extension was one big ticket item to bring greater clarity to the market, though the reform is another key policy piece that is still waiting to be addressed. The reform would result in further tightening allowance supply to align with California’s more ambitious emissions-reduction goals under the 2022 Scoping Plan. CARB announced earlier that it would remove at least a total of 180-265Mt of allowances from the annual budgets the auction and allocation pools to stay on track for its revised decarbonization targets.

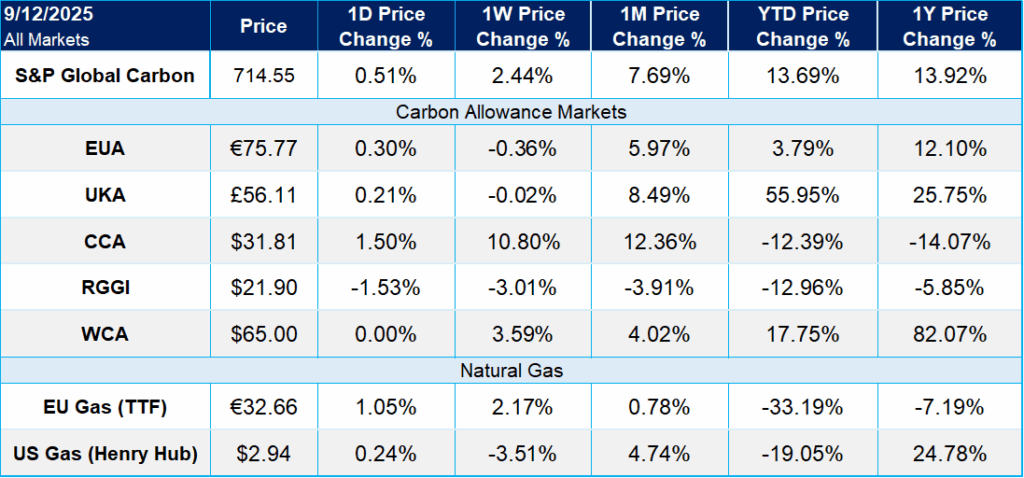

Carbon Market Roundup

The weighted global price of carbon was $55.07, up 2.4% week-over-week. EUAs settled at €75.77, down 0.4% for the week. UKAs were flat at £56.11. CCA closed at $31.81, up 10.8% for the week. RGGI was down 3.0% a $21.90, while WCA was up 3.6% for the week at $65.00.