EUAs Break Out of Range-bound Summer, California Closes in on Key Deadline

3 Min. Read Time

European carbon prices are breaking out of their summer range-bound mood and beginning to show signs of dynamism. EU allowances (EUAs) settled at just over €76, their highest closing price in three months, as traders began accumulating length ahead of the winter heating season, which is expected to be characterized by a strong La Niña weather cycle, typically generating colder winter temperatures.

For the previous two months EUAs had traded in a narrow band between €69.00-€73.50, which represented a mid-point between the year-to-date low and high of €60.00 and €84.50, and was driven by shifts in natural gas but held in check by a lack of fundamental demand and speculative traders’ positioning.

The annual compliance cycle comes to an end in September, with the deadline for entities to surrender EUAs matching their 2024 verified emissions.

While the market traded sideways over the summer, analysts continued to highlight the upside catalysts to the market starting from 2026, when the annual cap will see a one-off adjustment lower, benchmarks for free allocation will be tightened, and the REPowerEU allowance sale program will come to an end.

Furthermore, the EU’s Carbon Border Adjustment Mechanism comes into effect in 2026, under which imports of certain products and materials will be charged a levy equivalent to their carbon content. At the same time, free allocation to companies that operate in sectors covered by CBAM will see their free allocation start to diminish, and this will add to pressure in the auctions and secondary market.

Across the Channel, UK Allowance (UKA) prices hit their highest intraday level in over two years on Friday. Unlike EUAs, the UK market has seen less of a sideways channel, where prices slumped at the start of the holiday period to a low of £45.30, but have been slowly and gradually recovering ever since. After finding some resistance at around £52.00 in August, the market has broken higher at the start of September, closing at £56.12 at the end of last week.

The UK market went through its annual compliance cycle at the end of April, and so there is little prospect of a sharp up-turn in compliance demand in the near term, but this market has been dominated by political speculation.

With negotiations over linking the EU and UK markets set to start before the end of this year, traders have been slowly accumulating UKA length, especially at discounts of more than €15 to the EUA price, in the expectation that prices will converge as the process of hashing out the practical details of linking gets underway.

This has meant that over the course of the summer, the two markets have moved into sync and the five- and 10-day correlation in daily prices has increased to more than +0.95 from as low as +0.5 at the start of June.

California Nears Key Deadline

California lawmakers and Gov. Gavin Newsom are in tense, last-minute negotiations over energy and climate priorities, especially reauthorizing the state’s cap-and-trade program. With the session ending September 12th, the Senate and Assembly remain deadlocked.

- Assembly Proposal (Irwin): Would extend cap-and-trade largely as is, adding features to appease moderates, like more carbon offsets and a reserve of permits.

- Senate Proposal: Considers tougher reforms - limiting offsets and free allowances, lowering the price ceiling (similar to a past “carbon tax-like” proposal, SB 775). Businesses and some environmental groups oppose this version.

- Challenges: Both proposals face pushback from business and environmental groups, and neither has cleared the necessary political hurdles.

Negotiations are ongoing today, with tomorrow shaping up to be critical - chances of September extension decrease if final text is not circulated tomorrow. If an agreement isn’t reached this week, we will likely see special sessions this fall to finalize it. Newsom has privately suggested he might call a special session to push through cap-and-trade and other energy measures (grid regionalization, wildfire fund, crude supply).

US Auction Update:

- RGGI Auction 69 ran last Wednesday:

- Settlement price of $22.25 as in line with expectations, all 15.2 million allowances sold

- 40-cent discount to front-month futures settlement price the day prior

- 13.3% above Q2 auction ($19.63) and highest price in a year, since Q3 2024 auction

- WCA Auction 11 ran last Wednesday

- 6.8 million allowances for sale

- Some expect Q3 to clear above the Tier 1 price of $60.43 as front month futures traded at $62.25 the day prior to auction

- If triggered, an APCR sale would take place Oct 1

- Typically dominated by compliance entities, so given this year's compliance deadline only requires 20% of obligation to be surrendered, we may not see aggressive bidding

- Q2 auction settled at $58.81

- Results scheduled for Wednesday, Sep 10 at 12pm PT

Carbon Market Roundup

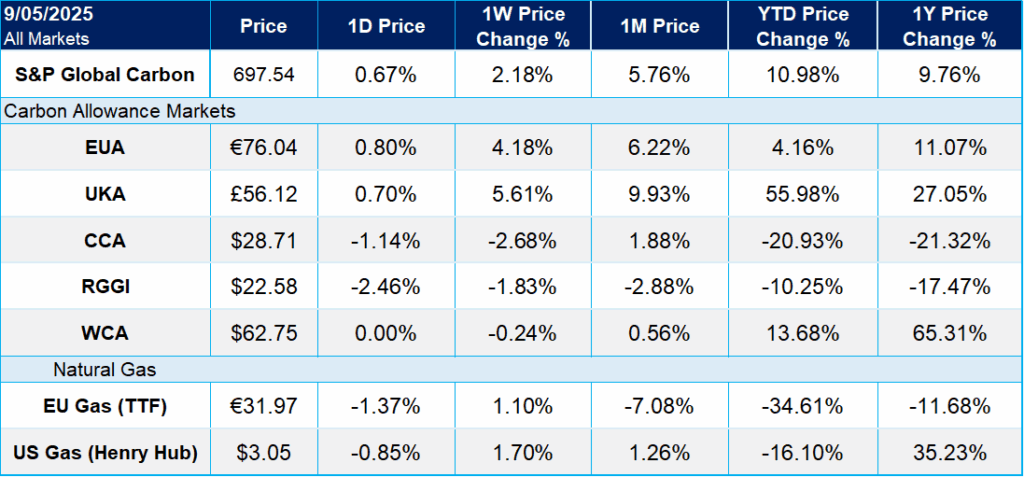

The weighted global price of carbon was $53.06, up 2.2% week over week. EUAs were up 4.2% on the week to close at €76.04. UKAs were up 5.6% at £56.12. CCAs ended the week down 2.7% at $28.71. RGGI was down 1.8% at $22.58. WCAs were down 0.2% at $62.75.