RGGI Finalizes Model Rule Provisions

2 Min. Read Time

RGGI administrators and member states have agreed on the Third Model Rule Review of the cap-and-trade market, setting forth the market’s parameters from 2027 to 2037.

The updated Rule will cut the RGGI emissions cap in 2027 to 69.8 million short tons of CO2e from the planned 75.7 million tons under the previous Rule. This adjustment is made to account for the one-year delay in implementation of the Review.

Allowance supply will decline by an average of 8.5 million tons/year, or around 10.5% of the 2025 cap, from 2028 through to 2033.

For the years 2034 through 2037, the cap will decline by 2.3 million tons/year, or approximately 3% of the 2025 budget. The cap for the years after 2037 will be addressed in the next Program Review that will take place no later than 2028.

Crucially, there will be no so-called “bank adjustment” made to compensate for the approximately 67 million surplus RGAs that are held in registry accounts above the compliance requirements. Instead, the participating states have agreed to remove from circulation all standard RGGI allowances that are offered for sale but remain unsold at the end of each auction.

There have also been some changes to the market’s auction rules. The Emissions Containment Reserve (ECR), which was established to withhold allowances when auction prices fell below a threshold level, will no longer operate. Instead, the auction reserve price will be adjusted upward.

The RGGI auction reserve price began at $1.86/ton in 2008 and in 2025 is set at $2.62. Comparatively, clearing prices have reached as high as $25.75/ton in recent years.

The Cost Containment Reserve, which injects additional allowances into quarterly auctions if bids breach set trigger levels, will offer a total of 11.75 million tons each year. The first sale in 2025, for example, saw the full 2025 CCR quota of 8.1 million tons sold at $17.03. The CCR will offer two reserves of allowances at different trigger levels, starting with $19.50/ton and $29.25/ton in 2027. The trigger prices will increase by 7% each year.

The Third Model Rule Review has also declared that carbon offset credits will no longer be eligible for use toward compliance obligations. To date, the regulator notes, only one entity has developed a carbon offset project that issued 53,506 credits eligible for use.

The main element of interest to the RGGI market appeared to be the scrapping of the bank adjustment, which leaves 67 million RGAs available to the market. Prices slipped to just above $20.00/ton after having traded at more than $23/ton before the announcement.

Since then, prices have recovered slightly, and the December 2025 futures contract settled on Wednesday at $22.66/ton.

Attention will now switch to state capitols, where the updated RGGI Model Rule will need to be enacted in state law before the reforms can come into effect.

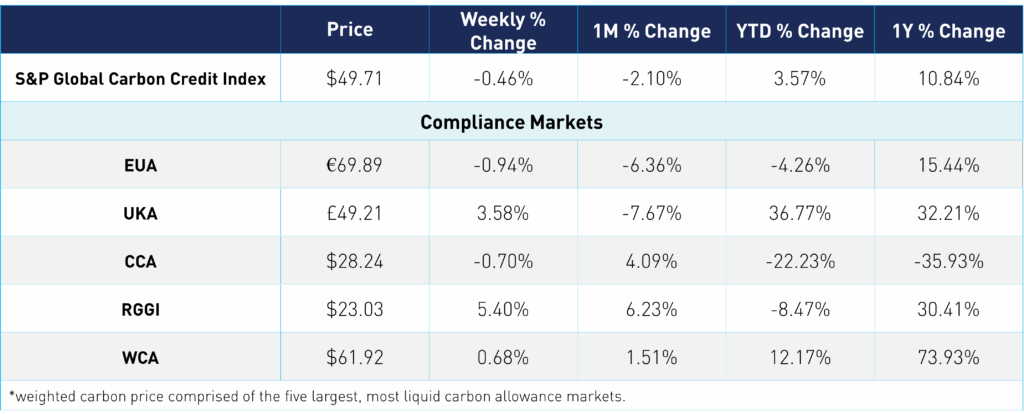

Carbon Market Roundup

The weighted global price of carbon was $49.71, down 0.5% week over week. EUAs saw a modest dip in prices, down 0.9% at €69.89. UKAs were up 3.6% at £49.21. CCAs were down 0.7% at $28.24. RGGI was up 5.4% at $23.03. WCAs were up 0.7% to close at $61.92.