Gov Newsom Doubles Down on Support for California Carbon With Latest Extension Pledge

<1 Min. Read Time

California lawmakers, led by Governor Gavin Newsom, pledged last week to seek an extension of the state’s cap-and-trade program past 2030, responding robustly to the April 8 Executive Order signed by President Donald Trump seeking to end sub-national carbon markets.

In a joint statement issued on April 15, Governor Newsom, acting Senate President Mike McGuire, and Assembly Speaker Robert Rivas said they will seek to approve the extension by the end of the current legislative year. Market participants welcomed this announcement as it committed the legislature to deliver the extension by September 12, the end of the current legislative session.

“California must continue to lead on reducing pollution and ensuring our climate dollars benefit all residents,” Governor Newson said in the statement. “That’s why we’re doubling down on cap-and-trade: one of our most effective tools to cut emissions and create good-paying jobs.”

The release added that details of the proposed extension will be published “in the coming weeks”. The California statement marks a bullish shift in sentiment among regulators, since previously the legislature had said it was only “considering” extending the market.

The extension of the carbon market has been under discussion since the start of the year, while at the same time, officials at the Air Resources Board have been working on draft amendments to the market’s parameters. The reform process has been dogged by delays, with the most recent update from Sacramento indicating that the package of updates will be ready during the current year instead of the “early 2025” deadline that had been floated earlier.

Earlier in the month, President Trump published an Executive Order titled Protecting American Energy From State Overreach, which requires the Attorney General to identify “all State laws…burdening the…use of domestic energy resources that are or may be unconstitutional, preempted by Federal law, or otherwise unenforceable” and to “take all appropriate action to stop the enforcement of State laws” that are determined to be illegal.

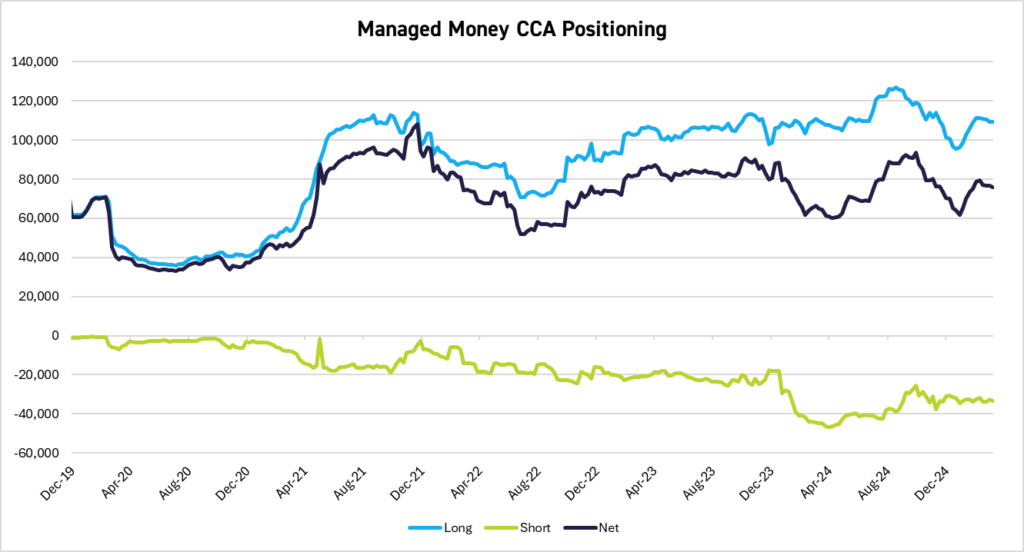

We expect to see more long positioning that supports the CCA thesis. Long positioning came off around the election last year/delays to the ISOR report but came back on at the start of 2025.

Carbon Market Roundup

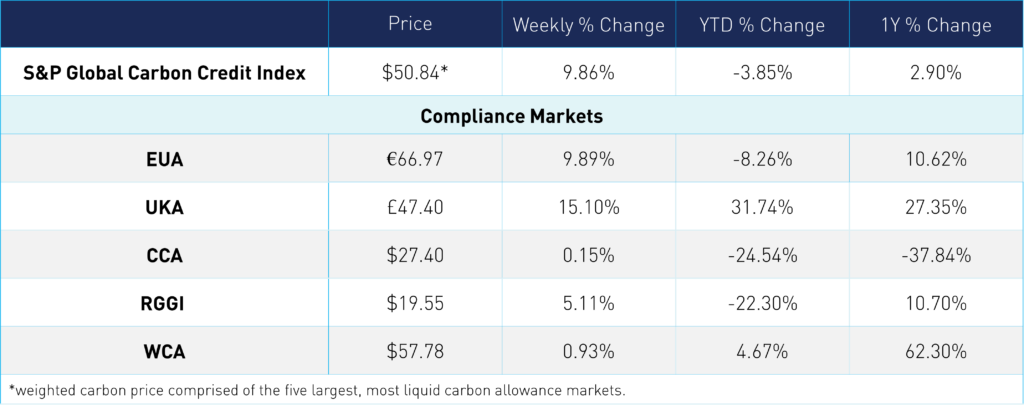

The weighted global price of carbon is $50.84, up 9.9% for the week. EUAs were up 9.9%, at €66.97. UKAs pushed 15.1% higher to close at £47.40. CCAs were flat week over week at $27.40, up 0.2%. RGGI recovered some of last week's losses, up 5.1% at $19.55. WCAs were up 0.9% at $57.78. Note prices are as of Wednesday due to the market holiday last week.