UKA Rally Driven by Talks of Market Linkage with the EU ETS

2 Min. Read Time

UK carbon allowance (UKA) prices have embarked on a ten-day rally that has seen the price for benchmark UKA futures rise by 23%, reaching just over £47.00/tonne on March 19. This latest recovery follows in the tracks of an even bigger climb in January and early February, when the market set a record low of £31.10/tonne on January 20 before soaring by 57% to £48.84/tonne just three weeks later.

The market’s increasing volatility is not chiefly due to geopolitics or to concerns over gas supply, but to swirling speculation over if, and when, the British government will begin talks on linking the UK ETS to the much larger EU carbon market.

The late January rally was driven by news reports that UK officials had asked to include the topic of market linking to the agenda of a summit between the UK and EU leadership to be held in April. The Financial Times quoted Nick Thomas-Symonds, a Cabinet Office minister, as telling a House of Lords committee that “linking our respective systems is absolutely what the ambition is.”

UKA futures prices immediately soared, advancing nearly 30% in just five days up to January 31, and went on to set an eight-month high of £48.84 a week later. But it’s not just speculation over linking that is driving the market. Stakeholders have complained that the government is sitting on a large number of important reform programs that could, if enacted, revive the UK system and bring prices closer in line with the EU ETS.

The government has launched around a dozen consultations on various amendments to the UK ETS, ranging from the introduction of a Supply Adjustment Mechanism – analogous to the EU ETS’ Market Stability Reserve – to expanding the market to include the waste and maritime sectors.

So far, none of the consultations relating to major changes have led to any formal regulatory proposals, and traders have expressed frustration at the slow pace of reform. However, there has already been one key change: the current phase of the market, which was initially set at 2021-2025, will be extended by one year to synchronise with the introduction of the UK’s own carbon Border Adjustment Mechanism in 2027.

Despite the disappointment at the lack of progress on market fixes, traders have been brought back to the issue of linking in recent days. A report by Bloomberg on March 12 quoted Spencer Livermore, financial secretary to the Treasury, saying that the UK and EU were giving "serious consideration" to linking their markets. Prices jumped by as much as 11% in response to the report.

The market again rallied on March 18, when a meeting of UK and EU parliamentarians recommended that the two parties should give “serious consideration” to linking their markets. Despite the lack of substantive news, the market took this as a positive sign, and prices rose more than 5% on the day. With such major issues remaining unresolved, there is little change for UKAs to reflect abatement costs in covered sectors, and it may be some time before traders can refocus on fundamentals.

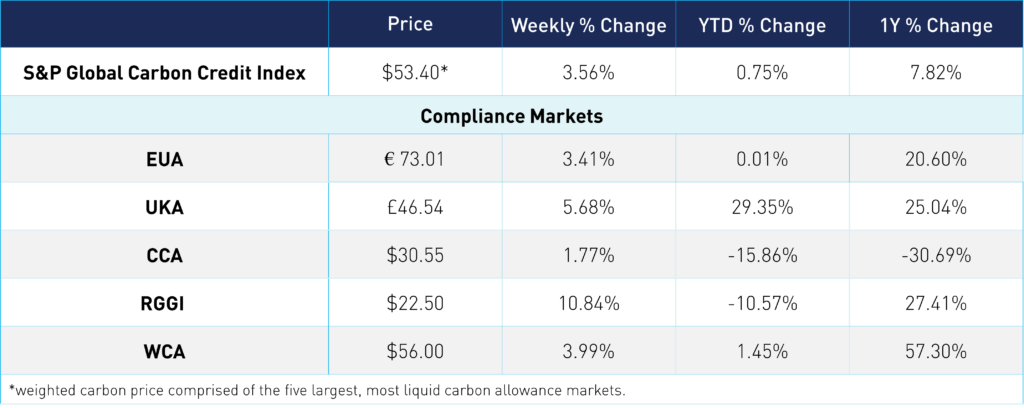

Carbon Market Roundup

The weighted global price of carbon is $53.40, up 3.6% for the week. EUAs are up 3.4% from the week prior at €73.01. UKAs were up 5.7% at £46.54. CCAs are up 1.8% at $30.55. RGGI surged 10.8% to $22.50. WCAs are up 4.0% at $56.00.