California Carbon November Auction Clears at $31.91, CCA Futures Rebound

2 Min. Read Time

The results for the California carbon allowance auction held last week (Nov 20) were posted on Wednesday. The auction cleared at $31.91, which is a 5.5% increase from the previous auction in August at $30.24 (the lowest settlement of the year). The auction cleared at a $2 discount to the front-month CCA futures close of $33.89, which is not unexpected considering the delays to the CCA market rulemaking,

Collectively, the roughly 53 million allowances offered for sale were all sold at the auction. The Bid Ratio (total qualified bids divided by total allowances available for sale) of 1.50 was just below previous levels of 1.57, signaling slightly less demand.

Investor buying increased to 17.97%, up from 14.39% in August. The lower compliance participation was not surprising, considering this was the first auction after the full 3-year compliance period ended on November 1. Historically, compliance participation dips at the November auction following the program’s compliance deadlines, with the previous two November auctions showing just 80% of the share won by compliance entities. Note that this November was actually higher, with a compliance share of 82%. Every year, entities must provide allowances equal to 30% of their previous year’s emissions by the November deadline, and at the end of every full (3-year) compliance period, entities must provide allowances that cover their emissions for the entire cycle.

Following the presidential election, CCAs started slipping lower from their $38 level, hitting a low of $33.19 the day after the CCA auction occurred as there was a lack of direction ahead of the auction as participants waited for the next reform update following CARB’s announcement mid-October.

Since the auction, prices have been steadily trending higher. When CARB released the results Wednesday, CCAs immediately slipped to a low of $32.19 but then quickly rebounded to settle at $33.89. CCAs moved higher toward the end of the week, with the Dec24 futures closing Friday at $34.23 and Dec25 at $36.30.

The market will be waiting for more certainty around the next step in the rulemaking process, the release of the Initial Statement of Reasons (ISOR) report. The ISOR was initially expected to be released a few weeks after the regulator's last announcement in October but appears to be delayed to potentially after the new year.

As is in line with our expectations, the August auction proved to be a bottom for the market, with prices steadily coming back. Currently, the reform is the main driver for CCAs and we should see some market positioning ahead of the final rulemaking release, which CARB plans to have published by early next year.

Carbon Market Roundup

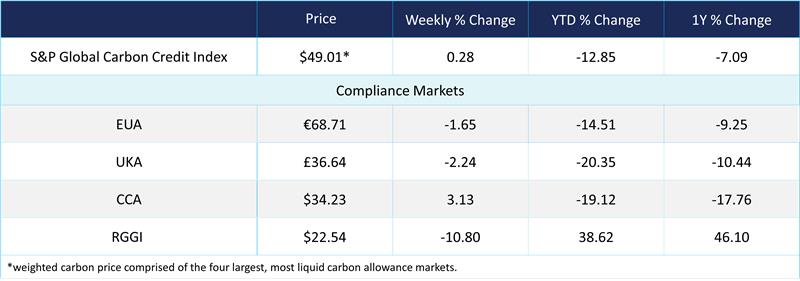

The global weighted price of carbon is $49.01, up 0.28% from the previous week. EUAs are down 1.65% for the week at €68.71, while UKAs are down 2.24% to £36.64. CCAs trended up 3.13% at $34.23. RGGI was down 10.80% at $22.54.