Breakthroughs at Baku COP29 Summit, Carbon Market Standards Approved

3 Min. Read Time

As the annual UN climate summit nears the halfway mark, carbon market advocates are celebrating a key decision that will enable emissions-cutting projects to start generating carbon credits under the Paris Agreement’s new Article 6 mechanism.

In the opening session of the COP29 summit in Baku on Monday, delegates from more than 190 countries approved threshold standards for methodologies to calculate carbon reductions from projects ranging from biogas capture to forest restoration. The last two COP summits failed to agree on guidance and standard methodologies for carbon credits. This year, the Supervisory Body took a different approach by rubber stamping “standards” ahead of COP29 rather than just sending a list of recommendations that would have to later be discussed while in Baku. At COP29, countries were left with the straightforward decision to approve or deny the standards, which they chose to approve on day one.

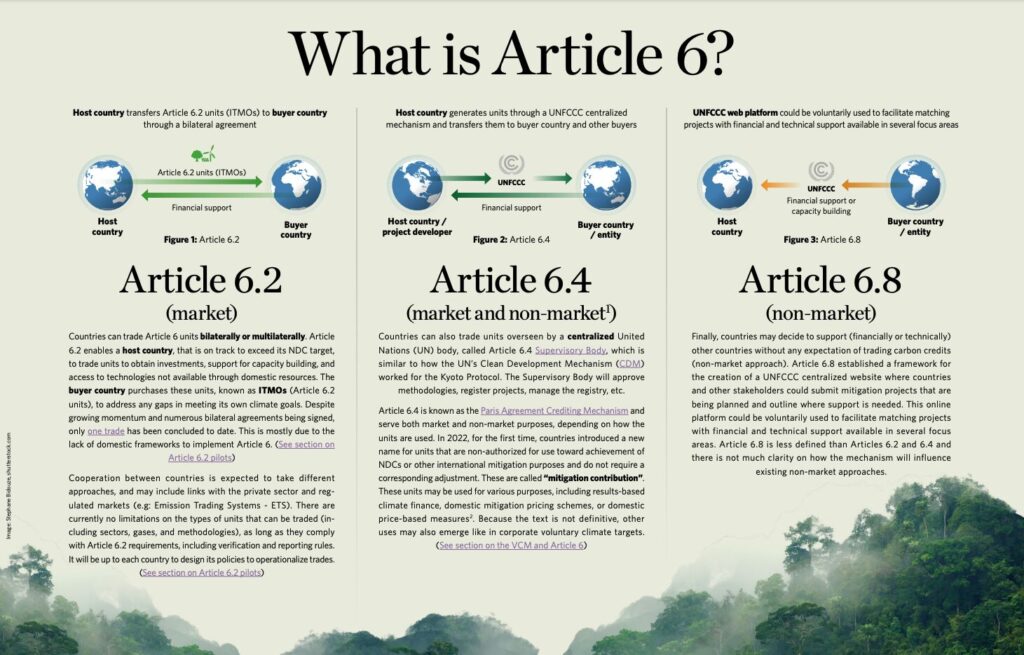

Negotiations are proceeding along two tracks: the Article 6.4 workstream regulates the UN-administered carbon credit market, while the Article 6.2 stream deals with a bilateral country-to-country trading system.

These two markets operate in very different ways. The 6.4 project-based system is centralized and highly regulated, while Article 6.2 leaves the parameters of trading to the sovereign counter-parties.

Monday’s decision means that the panel that operates the so-called Article 6.4 mechanism can now approve specific methodologies and register projects that may start to generate carbon credits as soon as next year.

Negotiators can now move on and begin discussing more detailed procedural and technical rules that will guide buyers and sellers of credits to meet voluntary commitments or national targets.

Limited impact on compliance carbon but should raise the bar for the offsets credit market

The Article 6.4 carbon market is likely to have very little impact on the main compliance cap-and-trade markets in the short to medium term. This is because the largest market – the EU ETS – does not allow the use of carbon credits, while California’s cap-and-trade program allows a very limited use of credits from specific project types.

However, the Article 6 markets are expected to raise the bar for carbon credits worldwide. As the highest-level market, that will be used by sovereign governments to meet their climate targets, the UN mechanism is expected to adopt the strictest parameters for environmental integrity.

This will mean that those entities that create project methodologies may need to revamp and upgrade existing methodologies to meet the UN quality threshold, and any projects that do not adhere to new and higher quality standards are likely to be priced at a growing discount to the benchmark UN market.

The negotiating track dealing with Article 6.2 has become far more contentious. Countries are sharply divided over how much oversight a bilateral system of trading needs, especially when the counterparties are sovereign governments.

Some groups like the EU want more transparency and oversight of state-to-state transactions to ensure that the system is actually leading to emissions reductions. But others insist that Article 6.2 is deliberately a “light-touch” system that offers flexibility, and it should not be subject to the same oversight as Article 6.4.

The 6.2 negotiations are centered on issues relating to the role of a centralized registry, whether credit authorization can be revoked after they are issued and sold, and how to deal with persistent inaccuracies in reporting.

These highly technical and legal flashpoints have held up progress for several years and appear no closer to being resolved. However, the success in completing the final building blocks of Article 6.4 may provide the incentive countries need to advance their talks in the second week of this year’s COP.

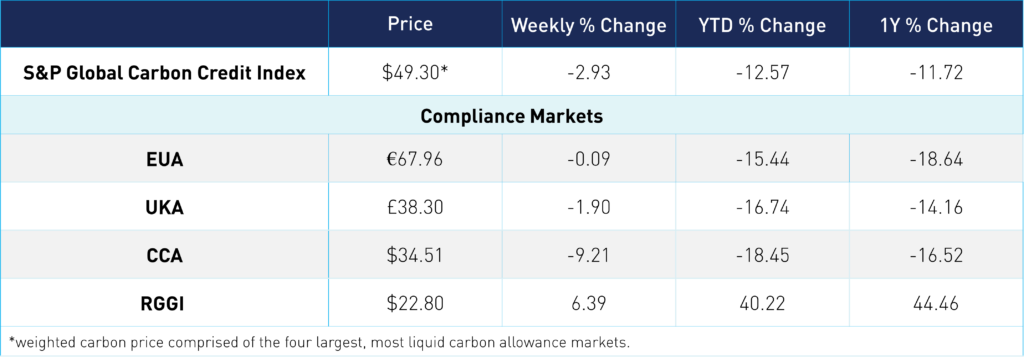

Carbon Market Roundup

The weighted global price of carbon is $49.30, down 2.9% from the week prior. EUAs are down 0.1% for the week at €67.97, while UKAs trended down 1.9% at £38.30. CCAs fell 9.2% to $34.51. There hasn't been anything notable from a fundamental perspective for CCA's recent price action, but a few things could be at play, including typical volatility ahead of options expiry, delays in the market reform process, positioning ahead of next week’s auction, and potential profit-taking following the post-election rally. RGGI prices are up 6.4% at $22.80.