UK CBAM Update, What to Expect at COP29

3 Min. Read Time

UK CBAM Update

This week, the UK government published a response to its public consultation on implementing a Carbon Border Adjustment Mechanism (CBAM), in which it affirmed its intention to introduce the border levy in 2027.

CBAM will bring the UK into line with its larger neighbor: the EU has already begun collecting data from importers on the carbon content of their products and, starting next year, will charge a cost linked to the price of EUAs on each tonne of "embedded" carbon in imported aluminum, steel, iron, cement, fertilizers, hydrogen, and electricity.

The UK system is slightly narrower in scope: it covers aluminum, cement, fertilizer, hydrogen, iron, and steel, while it has decided to exempt glass and ceramics for now.

The next step will see the government providing legislation enacting the CBAM, but we already have some insights into how the cost will be applied to importers. The consultation document confirms that UK CBAM "certificates," each representing one tonne of embedded CO2, will be priced at the average price realized in UKA auctions in the preceding quarter.

However, the consolation response added a new twist. The CBAM rate will also take into account the proportion of UKAs issued free of charge to domestic industry—implying that the actual cost to importers will be lower than the actual UKA price—as well as the Carbon Price Support and £18/tonne levy paid by power generators, for which energy-intensive industry receives some relief. The government said it "is continuing to consider options for how to [incorporate the CPS and free allocation] and will set out further detail in due course.

What to Expect at COP29

Meanwhile, most of the discussion in the wider carbon market sphere surrounds the upcoming COP29 summit in Baku, Azerbaijan. The main agenda items are related to climate finance and updated national commitments. National Determined Contributions (NDC) detail countries' plans to cut emissions and align their decarbonization efforts with the Paris Agreement goals. Nations are expected to submit their new NDCs covering the five years from 2030.

The EU is expected to further its current climate plans, which call for a 55% economy-wide cut by 2030 and a recently proposed but not yet confirmed 90% cut by 2040. Other major emitters, such as Brazil, the UK, and the UAE, are expected to announce their targets in the run-up to the summit.

The other main branch of high-level talks will concern climate finance and negotiations over a New Collective Quantified Goal for climate finance from developed countries to developing countries to pay for climate action.

The previous goal of $100 billion a year by 2020 was first set in 2009, and this year's talks represent the next stage. Already, developing nations have called for significant, and in some cases enormous, uplifts in the sums being shifted to poorer countries. Even independent studies set the total in the trillions of dollars per year, and this is likely to be a major sticking point in the talks.

Article 6.4, An International Carbon Offset Market

Beyond these political discussions, carbon market experts will be digesting a bold move by the panel tasked with setting up the new international carbon offset market under Article 6.4. Remember, the carbon offset credits are different from the compliance carbon allowance market and are generated through projects that remove or reduce emissions, such as reforestation, biochar, and seaweed restoration. Under this new provision, countries could trade carbon offset credits under a regulated market overseen by the UN. A regulated international carbon offset market is important as it should provide more structured demand for offset credits that are deemed Article 6 compliant, which is currently lacking in the offset space.

At its final meeting of the year before COP, the Article 6.4 Supervisory Body decided not to submit proposed rules for carbon credit-generating projects to the COP for approval but instead to formally adopt them. The Supervisory Body's move means that the onus is now on the COP to either rubber-stamp or actively reject its adopted rules. This follows two years of delays and disagreements over how to run the global carbon credit system, culminating in the breakdown of talks in Dubai last year.

Observers say the move is high-risk since it could establish a precedent whereby the Supervisory Body can regulate without sanction from the COP, the Body to which it ultimately reports. But, others note that amid the complicated and highly political nature of COP, the Body may simply have run out of patience. The sessions dealing with Article 6.4 matters will be closely watched, with some stakeholders wondering whether approval of the Body's decisions may become subject to agreement in other unconnected areas.

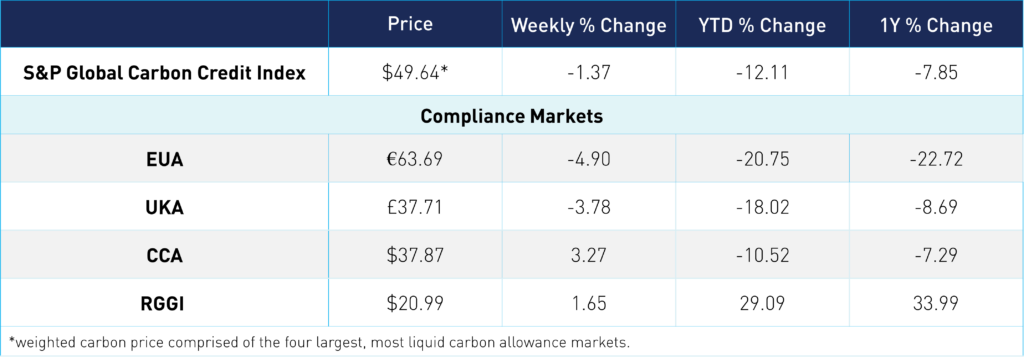

Carbon Market Roundup

The weighted global price of carbon is $49.64, down 1.4% from the week prior. EUAs are down 4.9% for the week at €63.69. UKAs slipped 3.8% lower to £37.71. CCAs trended up 3.3% to $37.87, while RGGI prices are at $20.99, up 1.7%.