California August Auction Results and What’s Next for CCAs

2 Min. Read Time

The California carbon auction result came in low, as anticipated, at $30.24. The compression of California’s increased tightening schedule into 2026-2030, pushed out shorter term traders, and creates a great rebalance or entry point today. This auction was the last "bad news" item on the docket. We believe developments will be positive from here out. The position asymmetry of return potential is attracting attention with prices in the low $30s, the floor price rising to $37 in the coming years, with the ceiling rising to around $134.

At the auction, most factors remained similar to the previous auction (bid ratio and share of investors); however, the one difference is less participation from smaller entities (only 82 qualified bidders compared to 100 in the previous auction), meaning less demand at auction. Many compliance firms have been able to position for their compliance obligations using the lower futures prices, and as we enter the new 3 year cycle we may see less urgency, so the auction result was not too surprising.

We’ll be watching closely and expect the next 6 months of CCAs to stabilize and quietly move higher, much like the European market, which is up over 30% since the February lows as bad news from Ukraine gas supply and policy changes dissipated and the program fundamentals return to the driving seat.

CCA August Auction Details

Despite fewer bidders participating in the auction than in recent editions, demand was relatively steady, with the bid-to-cover ratio for the current vintage at 1.57, slightly ahead of the historical average. The forward vintage portion of the auction saw a cover ratio of 1.87. Compliance entities took up more than 85% of the available current vintage permits, in line with recent sales.

Futures prices in the secondary market reacted fairly sharply to the news, with the December 2024 CCA contract dropping to $31.21/tonne from $32.62 a day earlier. Analysts said the relatively weak performance of the auction reflected the fact that the market has now begun a new compliance period, and that emitters will not need to surrender their full quota of CCAs for another three years.

In addition, ongoing uncertainty about the changes to the market parameters helped to dampen demand, some said. With CARB still discussing the scale of adjustments to the cap as well as possible changes to the Allowance Price Containment Reserve’s (APCR) trigger price, the market’s estimated supply-demand balance going forward is still not clear. CARB has still not decided on whether to delay the start of the updated regulations from 2025 to 2026, and this is also causing some uncertainty among players.

Despite the weakness in the latest auction and the knock-on impact on future prices, the outlook remains bullish longer term for CCAs, as reforms to the market will only reduce the supply of permits: the only question is how quickly.

EUA Comeback

In Europe, EUA prices appear to be stabilising after a period of volatility triggered by natural gas. The market appears to have found short-term support at around €72.00 – compared to a year-to-date average settlement price of €66.59 – as rising gas prices have brought coal-fired power back into play.

Estimates show that the most efficient hard coal-fired plants are now in the money on a front-quarter and front-year basis, while German 2025 power prices of around €100/MWh are said to be supportive for lignite-fired generation as well.

This means more demand for EUAs from the power sector, and with gas supply still in doubt over the coming winter, once Ukraine’s final transshipment contract for Russian gas expires, Europe will need to maintain a steady flow of LNG cargoes to meet demand.

At the same time, industrial demand for carbon remains stubbornly weak as the region struggles to come out of the macroeconomic slump, so all eyes are on the power sector and natural gas as the main drivers of any pickup in EUA demand.

Carbon Market Roundup

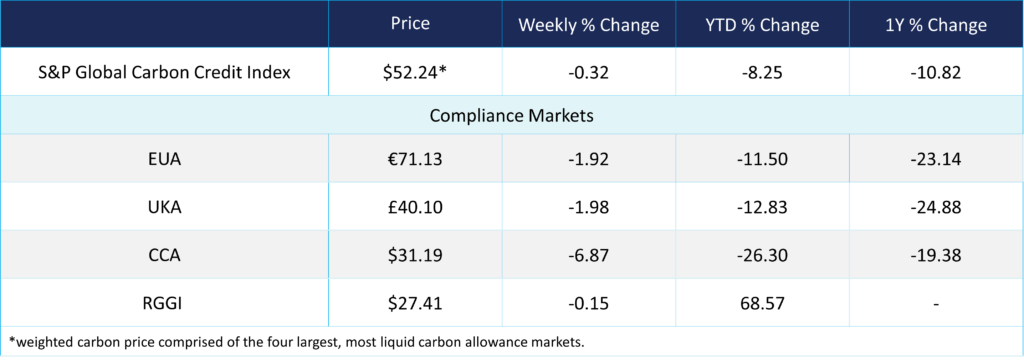

The global weighted price of carbon is $52.24, down 0.32% from the previous week. EUAs are down 1.92% for the week at €71.13, while UKAs are down 1.98% to £40.10. CCAs trended down by 6.87% at $31.19. RGGI was down 0.15% at $27.41.