UK Carbon Retreats After Breaching £50

2 Min. Read Time

On Tuesday, UK Allowance prices completed a 60% rally from their all-time low in January, breaching the £50/tonne level for the first time since mid-October 2023. However, Thursday broke this upward trajectory, with UKAs falling to £45.55 at market close. The market was likely correcting itself as the rally was not a reflection of fundamentals but rather a substantial shift in sentiment over the market’s future direction ahead of the upcoming General election.

The country is set to vote for a new Government on July 4, and all the signals point towards a new center-left Labour administration, which is likely to favor a closer working relationship with the European Union after the country voted to leave the EU in 2016.

Brexit entailed the United Kingdom’s withdrawal from the EU ETS and the creation of a new stand-alone carbon market. The UK ETS is just 10% of the size of its continental neighbor, with a power sector that has almost entirely ended the use of coal to generate electricity. Hence, the opportunities for additional abatement should come from industry and at a relatively higher cost than the EU.

However, the UK ETS has been plagued by difficulties since its launch. The British market does not (yet) have a supply control mechanism like the EU’s market stability reserve. As a result, the UK market is already building up a sizeable surplus. Based on the total allocation and auctioning of UKAs since the market began relative to reported emissions each year, the UK ETS has accumulated an oversupply of nearly 55 million UKAs since 2021, a little more than half of one year’s total emissions.

Over the first two years of the market, UKAs traded at a premium to EUAs as British installations bought new UK allowances to replace EUA holdings as hedges against future emissions. However, once the swap had been completed, fundamentals came to the core, and the UK price reflected the growing surplus as well as swelling uncertainty over the market’s future direction. Government consultations on the free allocation of permits and the implementation of a supply adjustment mechanism (the UK version of the EU’s MSR) have dragged on and are now left in limbo by the looming election.

Recent reporting has hinted that a new Labour government will look to address challenges raised by the EU’s carbon border adjustment mechanism (CBAM) by proposing a linkage between the UK and EU carbon markets. CBAM will force importers of steel, cement, aluminum, fertilizers, and electricity to pay for the carbon content of those products based on the prevailing EUA price. As well as hitting imports of UK industrial materials, CBAM will require UK renewable electricity generators to pay the carbon levy despite the fact that their output is zero-carbon, and there are concerns it may discourage renewables from despatching to the grid at certain times. Linking the two markets would remove the disruption threatened by the border levy and would also address challenges to power generation and sales across the border to Ireland.

In the last month, speculative traders have slashed their total short positioning in UKAs from 6.9 million tonnes in the week ending April 12 to just 1.3 million tonnes on June 7. At the same time, they have maintained their total long positions at between 8 and 9 million tonnes. This short covering helped drive UKA prices from around £35.00 to £50.00 in the last eight weeks, though some traders caution that the £50 level might represent an attractive enough price to take some profit.

Carbon Market Roundup

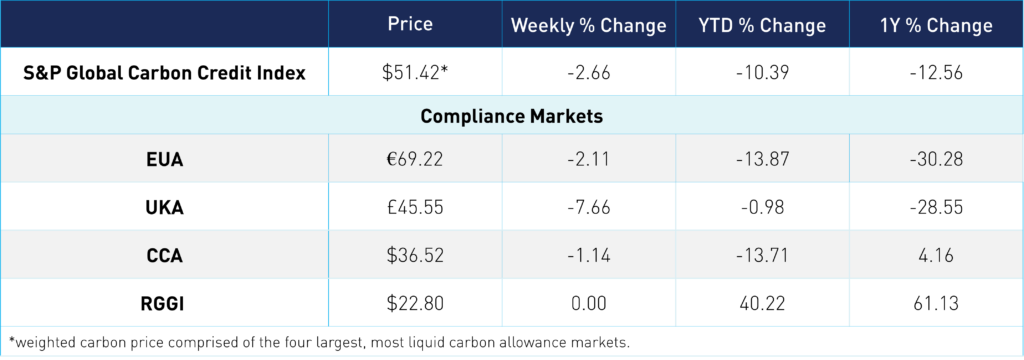

The weighted global price of carbon is $51.42, down 2.66% from the week prior. EUAs are down 2.11% for the week at €69.22. UKAs are down 7.66% at £45.55. CCAs fell 1.14% to close at $36.52. RGGI ended at $22.80, unchanged for the week.