Nat Gas Rally and Investment Fund Activity Boosting European Carbon

2 Min. Read Time

| Upcoming Webinars |

| Join us on June 5th, 2024 at 11 am EDT for: Ocean Conservation Engagement in Action with One of Canada's Largest Food and Pharmacy Retailers Please click here to register |

Despite slipping slightly lower yesterday, European carbon is up 11% since the start of the month, bolstered by rising natural gas prices and investment funds' short covering. This week, the benchmark EUA price reached a four-month high of €77.70.

The main driver for carbon's rally has been a steep increase in front-month TTF natural gas, which traders have been positioning ahead of the expiry of June options contracts at the end of this week. The steady recovery in TTF prices has seen front-month prices climb 16% in the last seven days. As analysts at Commerzbank pointed out this week, this increase reflects growing concerns over supply in the short term.

The analysts highlighted the state of gas storage across the bloc, noting that inventories are currently almost at par with where they were at this point in 2023. "Even if these are still at a comfortable level by historical standards, the slower build-up of the last week seems to be fuelling nervousness," they added.

Bullish headlines have, therefore, helped drive the market higher: a sharp reduction in Norwegian output due to scheduled maintenance, a significant rise in Chinese LNG imports, and the bankruptcy of a leading contractor for the construction of the US Golden Pass LNG export terminal have all added to the upward pressure on gas and therefore carbon.

The short-term correlation between front-month TTF and December 2024 EUA prices has remained high at more than 0.8 for the last six weeks.

The other main factor has been the actions of investment funds. The weekly commitment of traders data from the two main European exchanges shows that funds had reduced their net short positions in EUAs from around 25 million tonnes to just over 11 million tonnes in the week ending May 10. The liquidation of those short positions is widely believed to have helped bolster EUAs from their lows in the €50s and €60s earlier this year.

UK Market Climbs Higher

Across the Channel, the UK ETS has also seen a strong price rally driven largely by speculative investors' actions. UKA prices have risen 17% since May 13, and with Wednesday's high of £43.89, they have now reached their highest since the start of the year. Much of this recent strength has come from speculative buying.

Weekly position data from ICE Futures show that investment funds have built their largest-ever long position in UKAs of more than 9 million tonnes. At the same time, funds' short positions have held relatively steady between 5 and 6 million tonnes. The upshot is that funds' net short position of just over 4 million tonnes is the largest bullish bet since September 2022.

Some of the more recent strengths in the UK market may stem from speculation around the likely outcome of the upcoming election. The opposition Labour Party is widely held to be more in favor of ambitious climate action, particularly given the current Conservative government's watering-down of commitments.

And with prices having found what appears to be a floor at use above £30, the market is seen as ripe for a significant recovery if a new government addresses issues, including the potential linking of the UK market with its EU neighbor.

Carbon Market Roundup

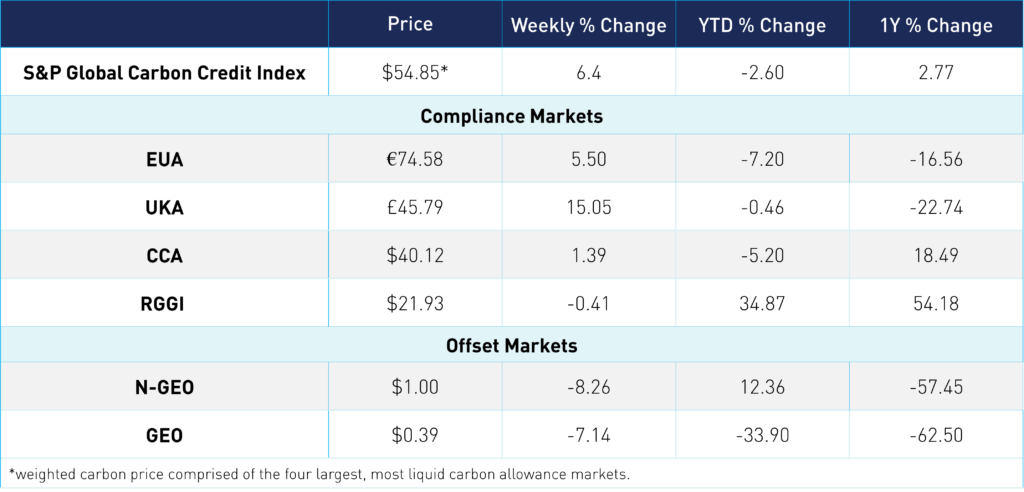

The weighted global price of carbon is $54.85, up 6.4% for the week. EUA prices gained 5.5% for the week at €74.58. UKAs trended up 15.1% at £45.79. CCAs were up 1.4% at $40.12. RGGI fell to $21.93, down 0.4% for the week.