Energy Aspects Releases CCA and RGGI Price Forecast, What to Watch with Policy

3 Min. Read Time

Emissions covered by the California cap-and-trade program are likely to fall by around 2.2% in 2024 to 263 million tonnes, while prices for the benchmark futures contract will average $45/tonne, according to Energy Aspects, a leading data and analytics provider for global energy commodity markets. The average price forecast for 2024 implies a 13% premium to the last CCA closing market price of $39.57 and a slight premium to the record CCA price earlier this year, which was nearly $44/tonne.

According to Energy Aspects, the market will move from an annual surplus to an annual deficit of allowances in 2025, which will begin to reduce the market inventory from about 350 million tonnes in 2024 to around 75 million tonnes by 2030.

The market has recently retreated as traders reacted to what has been seen as a lack of clarity on proposed market reforms being developed by the state’s Air Resources Board. According to Trevor Sikorski of Energy Aspects, “Recent policy developments, such as the release of the Standardized Regulatory Impact Assessment and a workshop on April 23, failed to provide enough new policy information to tempt investors back.”

Sikorski added that the next important moment for traders may be “the next workshop or when CARB publishes the draft rules. We expect the former could happen in May (probably after the May 15 auction) and the latter in late June or early Q3 24.”

Sikorski listed the risks to his $45/tonne price forecast as “policy ambition undershooting our expectations or new rules not starting by 2025. That said, elements of policy that would be supportive include a large cut to the cap from the allowance price containment reserve or no-to-little uplift in the Allowance Price Containment Reserve triggers, he explained. He added that market reforms should still be enacted before the end of 2024 so that they can take effect next year.

Energy Aspects’ central scenario calls for a new trajectory of a 48% reduction in greenhouse gases compared to 1990 levels by 2030. Measures to reach this goal would include a reduction of 48 million tonnes in the Allowance Price Containment Reserve and a 216 million reduction in the allocation and auction totals. Sikorski pointed out that splitting the reduction evenly between the APCR and market supply “would lead to a swifter run through the Tier 1 and Tier 2 price triggers” in the auctions.

Other proposals discussed by CARB in recent webinars include a cut in the maximum holding limit as the overall cap declines. Energy Aspects estimated that positions totaling around 20 million tonnes might need to be sold to meet the new limits.

Additionally, new rules on corporate association groups may lead to the sale of another 30 million CCA futures positions, Sikorski said. However, he added that CARB may delay the introduction of one of these rules to prevent large-scale selling at once.

Energy Aspects forecast CCA prices to average $44.60/tonne in 2024, rising to $48.20/tonne in 2025 and $57.90/tonne in 2026.

Across the country, the Regional Greenhouse Gas Initiative market also saw record prices in 2024, but according to Sikorski, the outlook is slightly more muted.

Prices for the front-December futures contract are higher than the Cost Containment Reserve trigger price, and this year’s CCR was depleted in the first quarterly sale. Sikorski suggested this additional RGA supply may help keep prices on a lid.

“We believe that the CCR will be annually drained in the coming years, leading the market to price RGGI allowances at the value of the following year’s CCR,” Sikorski said. “We feel market participants are overvaluing RGGI futures, as the release of allowances held in the CCR would limit allowance deficits in the coming years.”

Energy Aspects forecast RGA prices to average $17/short ton in 2024, rising to $18.20/ton in 2025 and $19.50/ton in 2026.

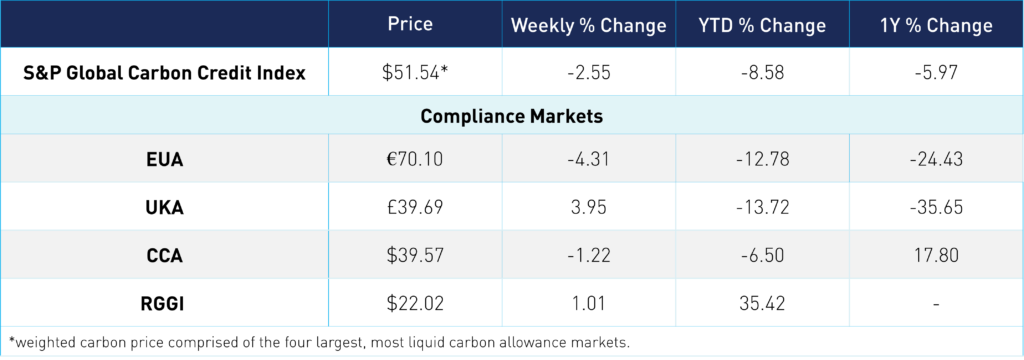

Carbon Market Roundup

The weighted global price of carbon is $51.54, down 2.6% from the week prior. EUA prices fell 4.3% for the week at €70.10. UKAs trended up 4.0% at £39.69. CCAs are down 1.2% at $39.57. CARB was unable to run the WCI auction Wednesday due to technical reasons and will be rescheduled for a later date. RGGI broke back above $22 for the first time since the start of May, up 1.0% for the week at $22.02.