A Confluence of Short-term and Long-term Dynamics Creating Opportunities in EUAs and CCAs

3 Min. Read Time

Prices for European allowances have dropped by as much as 30% this year, driven lower by a steep fall in emissions from fossil fuels by power generators. Coal-fired electricity output was down by 25% last year, while even gas use fell by 17%. A decline in the burning of coal and gas cuts demand for EUAs, and the power industry is the single largest buyer of carbon allowances.

At the same time, industrial output has declined as the high price of natural gas has forced energy-intensive users like steel and aluminum companies to reduce operations. Fertilizers and chemicals manufacturers have also cut output. But the peak in energy prices – specifically natural gas – is behind us now, and prices for fuel are at their lowest level in two years, dating back to before Russia’s invasion of Ukraine.

Similarly, the macroeconomic outlook is widely believed to be brightening, with the prospect of reductions in interest rates later this year. This could lead to an upsurge in investment in Europe and a resumption of industrial growth. The outlook for EUA prices mirrors the macro outlook. Analysts are almost unanimous in their calls for EUA prices to bottom out this spring and begin to rally later in the year and into 2025.

Carbon has endured some specific headwinds as well, which are now beginning to ease.

The energy price crisis in Europe forced the European Commission to develop its REPowerEU plan, which seeks to speed up investment in the energy transition away from Russian energy supplies. Part of the €300 billion plan is being funded by the sale of additional EUAs, brought forward from the 2027-2030 period. This front-loading of EUA auctions is expected to add around 250-300 million allowances to short term supply between 2023 and 2026 but, critically, supply from 2027 onward will be reduced by an equivalent amount.

This additional tightening of the market, just at the time when the EU might be expected to be emerging from the energy crisis and macro slowdown, could boost EUA prices back to the €100 level and even higher, analysts suggest.

The tightening in supply will come on top of the reforms already enacted under the “Fit for 55” reforms, in which the EU ETS cap is cut by nearly 100 million tonnes, the annual reduction in the cap jumps to 4.7%, and new demand sectors come into the market. Maritime emissions are covered by the carbon market starting this year, while airlines will gradually lose their free allocation of permits.

The introduction of the Carbon Border Adjustment Mechanism has also prompted some observers to suggest that the largest importers of energy-intensive materials into the EU may seek to hedge their exposure to the new carbon tariff by buying EUAs.

In California’s market, the regulatory reform process is also underway. The market is absorbing the expectation that the state’s cap-and-trade market will be adjusted to account for a 48% reduction in emissions by 2030, an uprated target from the previous 40%.

State regulators are currently working on reforms to the market that will shrink the cap, which will lead to higher CCA prices. With this comes a faster absorption of the market’s existing surplus, turning the market net short of allowances after 10 years of annual excess supply.

And as with Europe, it’s the industrial sectors of the market that have yet to make significant inroads into their carbon footprint. So far, allowance prices have been largely determined by the ability to switch power fuels from coal to gas, but as more coal plants go offline, the onus will shift to industrial plants as the next source of reductions.

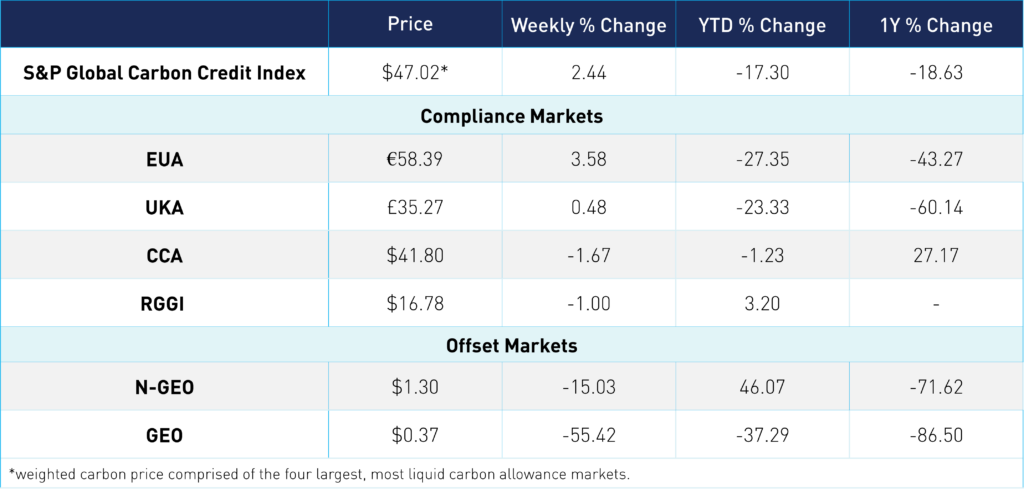

Carbon Market Roundup

The S&P Global Carbon Credit Index is priced at $47.02, up 2.4% for the week. EUAs are up 3.6% for the week at €58.39. UKAs are up 0.5% at £35.27. UK ETS regulatory consultations on free allocation and supply adjustment mechanisms are scheduled to close on March 11. They'll likely confirm the the supply adjustment mechanism (SAM) will launch in 2026 and could also see an update on the strengthening of the other two market stability mechanisms, the cost containment mechanism (CCM) and the auction reserve price (ARP). CCAs are down 1.7% at $41.80, while RGGI is down 1.0% at $16.78. N-GEOs are down 15.0% at $1.30, and GEOs are down 55.4% at $0.37.