EUAs Rally This Week Coming Off Recent Lows

<1 Min. Read Time

European carbon prices may have set a short-term floor just above €55/tonne after the market rallied this week to post the first week-on-week gain of 2024.

Prices have tumbled by as much as 30% since the start of the year as natural gas has displaced coal in the power sector and rising renewable energy output continues to marginalize all fossil generation. The addition of more than 250 million EUAs to supply between 2023 and 2026 is also dampening price expectations in the short term.

However, traders seem to be looking beyond the short term and are beginning to eye an upturn in demand in the second half of the year, as economists predict interest rates may begin to fall and the macroeconomic outlook is expected to improve.

Carbon prices in the last week have tested new lows for the year at €51.08 but bounced back strongly to trade above €58.88 just three days later as gas prices rallied, encouraging some short-positioned traders to cover EUA positions.

Natural gas has emerged as the key driver for carbon this year. Respective price movements for gas and coal over the last year have put gas firmly at the top of the generation merit order, though some lignite plants are still profitable.

As gas prices fall, coal becomes less profitable on average and forces even the most efficient coal-based generation offline, diminishing the demand for EUAs.

The Commitment of Traders data showed that investment funds have doubled down on their bearish bets, however, with total short positions setting a new record for the category at 74.6 million tonnes.

Earlier in the year, carbon traders were eyeing the €50 level as a key psychological support for the market, but so far, the threshold has not been severely threatened. Numerous participants have reported increased forward demand from industrial entities, who spy a bargain in EUAs at these two-year low levels.

Analysts, too, are suggesting that the bottom of the market may have been reached. With the REPowerEU program bringing forward the sale of €20 billion worth of EUAs to fund the energy transition, EUA supply in the later years of the current phase will be even tighter after 2026, and prices are widely expected to return to record levels at €100 by then.

Carbon Market Roundup

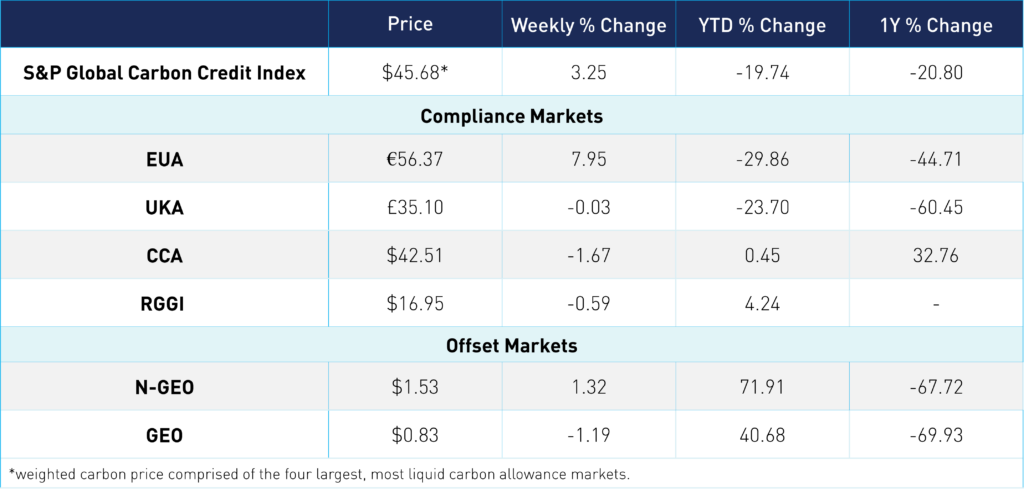

The S&P Global Carbon Credit Index is down 3.3% at $45.68. EUAs are up 8.0% at €56.37. UKAs are flat for the week at £35.10. CCAs are down 1.7% at $42.51, while RGGI is down just 0.6% at $16.95. N-GEOs are up 1.3% at $1.53, and GEOs are down 1.2% at $0.83.