Carbon Briefing: Update on Recent Price Moves

3 Min. Read Time

European Union

European carbon prices are nearing a key psychological low and could be set for a rally as speculative investors look to take profit from bearish bets dating back to last August. December 2024 EUA futures settled on Wednesday at €56.63 on ICE Futures Europe, the lowest settlement price since October 2021, and are approaching €55.00, a local low last seen in the immediate aftermath of Russia’s invasion of Ukraine.

Analysts remain optimistic that EUA prices are likely to rally in the second half of the year as the macroeconomic outlook improves and interest rates start to drop. Recent forecasts have ranged between €65-€70 for the rest of the year, with experts pointing out that while near-term auction supply has increased to help fund the REPowerEU initiative, this means that after 2026, the market will have at least 250 million fewer permits available.

The carbon market is also being depressed by steady falls in natural gas prices, as warmer than normal temperatures and increased renewable generation have damped demand. Both natural gas and carbon futures markets are showing signs of being oversold, and technical analysts have started to flag the potential for a correction, though they have not yet called the bottom of the markets.

But the landscape will begin to change over the coming year, as the wider economic outlook is generally expected to improve but also as policy goals are starting to shift. The European Union this month proposed a 2040 emissions target of a 90% reduction, and while negotiations are expected to begin after the next set of elections to the European Parliament and the formation of a new Commission, this target implies a significantly tighter EU ETS. Indeed, the impact assessment that accompanied the proposal suggested that based on current policies alone, the carbon price would need to reach nearly €300/tonne by 2040 to achieve the target.

California

California’s cap-and-trade program held its first sale of the year on Wednesday – results will be available next week. The sale sees more than 58 million permits offered with a reserve price of $24.04/tonne. The market has recently been testing higher levels near $44/tonne, though participants did not expect this sale to trigger any additional volumes from the Allowance Price Containment Reserve.

United Kingdom

Across the channel, the UK ETS has been stabilizing between its recent record low of £31.30 and £37.00, as persistent concerns over regulatory clarity and mild weather have undercut demand. Traders and analysts have pointed out that prices as low as £31.00 represent a “bargain” for compliance buyers seeking to build portfolios for future years, as the market is scheduled to see a “re-set” in which the overall cap is reduced from 2026.

RGGI

Elsewhere, prices in the RGGI market have stabilized at just below their recent record high of $17.32/short ton as the market prepares for the first quarterly auction of the year. The sale, to be held on March 13, will offer 15.85 million current-vintage RGAs, and could add a further 8.4 million RGAs if the market clears above $15.92/ton.

The general view sees the market tightly supplied, going into a year when the participating states will agree on reforms to the market that could also see an adjustment to supply to account for unused permits already circulating.

Voluntary Offsets

The voluntary market has had a marked time so far this year, with credit prices moving little as participants are waiting for signals from the CORSIA market – the only compliance market that uses carbon credits in considerable volume – on which credit types will be eligible for use in its first phase, which began on January 1. Regulators at CORSIA, which the International Civil Aviation Organization runs, have approved just two credit standards to date but are expected to add more in the near future.

Despite the flat price outlook, demand has held up comparatively well. Ratings company BeZero reported that retirement of credits rose to a record of more than 30 million in December, while January saw the sixth highest retirement on record. These recent levels led the company to speculate that 2024 could see the highest total volume of retirements to date, pushing the voluntary carbon market to a value of around $3 billion. The health of the market will be heavily influenced by the decisions on CORSIA eligibility as well as the widespread implementation of the IC-VCM’s Core Carbon Principles quality standard.

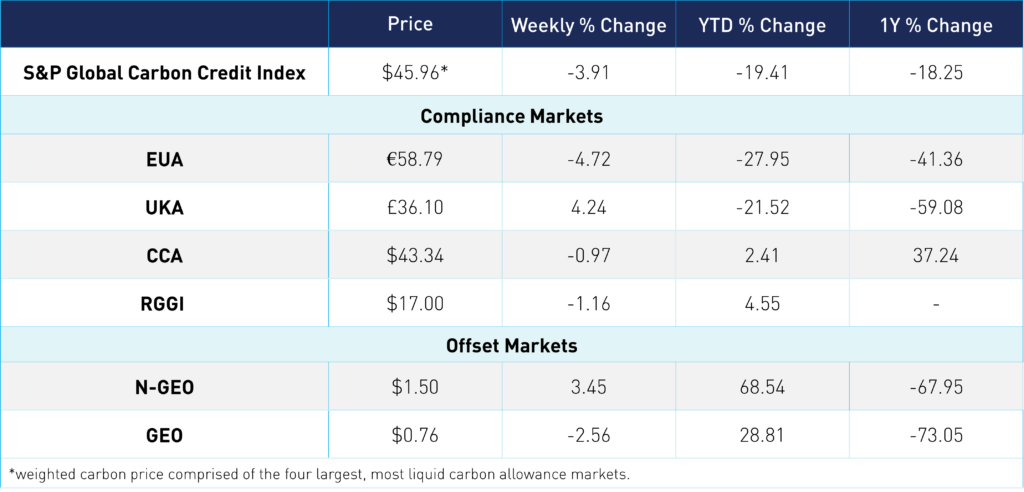

Carbon Market Roundup

The S&P Global Carbon Credit Index was down 3.9% at $45.96. EUAs were down 4.7% at €58.79. UKAs were up 4.2% at £36.10. CCAs were down a slight 0.9% at $43.34. RGGI was down 1.2% at $17.00. N-GEOs were up 3.5% at $1.50, while GEOs were down 2.6% at $0.76.