Macquarie Releases First Carbon Compendium

3 Min. Read Time

Macquarie released a comprehensive report, the Carbon Compendium, analyzing global carbon pricing systems and price forecasts (excluding RGGI). Similar to our high conviction view on carbon allowances, their analysis shows strong upside for the six carbon markets covered in the report. Overall, their price forecasts for the markets show a 60-140% increase over the next five years. Below is a summary of their take on the European and California carbon markets.

European carbon prices will likely remain under pressure for the first half of 2024. The analysts believe there is some potential for a revival late in the year as expected cuts in interest rates trigger an increase in investment and production across the region. They caution that the speed at which the EU power sector is decarbonizing has taken the market by surprise but we have yet to see the massive increase in power demand needed to drive the energy transition. Industrial decarbonization remains the most challenging goal, requiring significantly higher EUA prices. "Emission reductions in industry and transport remain ahead of us and will require triple digits carbon prices," according to the report.

This year, the main downside risk for EUA prices remains the additional supply of auctioned allowances to help pay for the EU's Recovery and Resilience Fund. The so-called REPowerEU plan will raise €20 billion from the sale of frontloaded EUAs through to 2026. While revenue since August 2023 has exceeded expectations, the drop in EUA prices means that the funding will slow down, leading to potentially more allowances injected into the auction program from September. Other headwinds include the rapid replacement of fossil-fired power generation and the closure of some industrial capacity. The resulting drop in demand for EUAs can be absorbed to some extent by the Market Stability Reserve (MSR). However, Macquarie warns "that the EU ETS could still end up with a bigger surplus than required by hedges later in the decade, undermining the case for €100 prices at least until CBAM is fully phased-in."

On the bullish side, EUA prices could be driven higher by any shock to the natural gas supply in the region. As natural gas costs rise, coal generation becomes more economical and brings with it additional demand for EUAs. While many EU states are shutting coal units down, some are keeping these plants on reserve in the event of any interruptions in gas supplies. The bank predicts EUA prices to average €69 this year, €93 in 2025, and €120 in 2026 as the impact of the REPowerEU sales tails off and the market faces a growing annual shortfall in supply.

Turning to the California carbon cap-and-trade program, Macquarie remains "structurally bullish" on prices even though the market is already up ~20% in recent months. "The risk of a change in administration in California is low: the upgraded climate target is now set in the state's law, and tougher cap-and-trade settings are pretty certain in our view," the analysts wrote. However, they noted there is potentially a risk of a price correction at some point given investment funds’ net length has grown to a record high, leaving the market exposed if we were to see events such as a sell-off in US equities or regulators disappoint with the final reform policies.

The bank expects progress on the rule-making for the next phase of the market reform to continue relatively smoothly in time for implementation at the start of 2025. Macquarie forecasts that CCA prices will average $44/tonne in 2024, $51 in 2025, and $65 in 2026.

Macquarie analysts see UK carbon prices as a "bargain" at current levels in the low £30s/tonne range. UKA prices have plunged from as high as £99 in the summer of 2022 when demand from utilities seeking to swap EUA-denominated hedges for new UKA hedges was at its peak. Since then, regulatory uncertainty has grown, and the UK market's lack of a supply management mechanism like the EU ETS' MSR has weighed on prices. Stakeholders also cite the government's decision to inject more than 50 million UKAs into the market this year as a major bearish influence. Although these allowances were intended to "soften the blow" of a steeper reduction target from 2026, the market is already estimated to be between 46-60 million tonnes oversupplied.

That said, regulators are still in the process of reforming the market, with new additions like a potential supply adjustment mechanism, adding new sectors to the program, relinking to the EU ETS, and the recently announced carbon border levy expected to help boost supply/demand dynamics. Macquarie analysts calculate that the market will remain net long until at least 2030, with the surplus shrinking to just 8 million tonnes in 2030. Macquarie sees UKA prices averaging £45 this year, £70 in 2025 and 2026, before rising to £90 in 2027.

Carbon Market Roundup

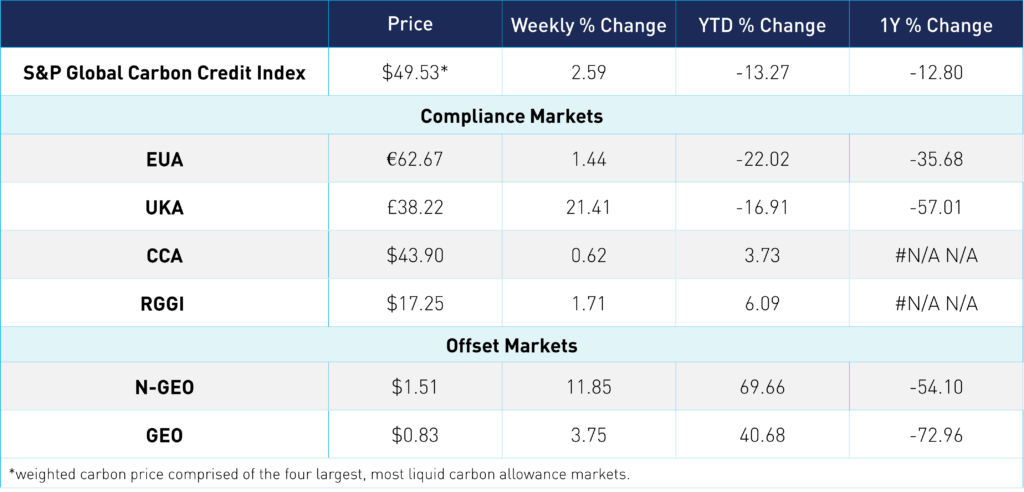

The S&P Global Carbon Credit Index is up 2.6% from the week prior at $49.53. EUAs are up 1.4% for the week at €62.67. UKAs are up 21.4% at £38.22 after coming off their record low seen last week. CCAs are up 0.6% at $43.90. California's auction will be held next week, and so far, analysts are uncertain which direction it will take. RGGI continues to move higher, setting new records each day. RGAs are 1.7% higher, at $17.25. N-GEOs are up 11.9% at $1.51, while GEOs were up 3.8%

To learn more about our carbon credit ETFs, click here.