UK Announces the Launch of its Own Carbon Border Levy

2 Min. Read Time

In an exciting new development for global carbon pricing, the United Kingdom announced the launch of a Carbon Border Adjustment Mechanism (CBAM) in 2027, which will put a carbon levy on imports of aluminum, cement, ceramics, fertilizer, glass, hydrogen, iron, and steel, with other products potentially added. The European Union implemented its own CBAM last year, requiring importers of selected materials to report the carbon emissions generated in their production. Importers will be required from 2026 to purchase EU CBAM certificates covering those emissions.

The goal of the CBAM is to ensure that domestic producers are not exposed to competition from international producers that are not subject to an equivalent carbon price, creating a level playing field that reduces the risk of producers relocating to countries without a carbon price.

The EU CBAM certificate price will be set by the prevailing auction price in the EU ETS, ensuring price equivalence, and the EU will reduce the number of free allowances handed out to domestic producers at the same time, ensuring that the cost of emissions is fully internalized by EU companies.

The UK government has indicated that it will not cut the handout of free UK carbon allowances to its industry. Instead, it will set the price of its own CBAM certificates lower than the prevailing UK Allowance price. We will need to wait for the British government to launch a consultation on the scope of its CBAM later this year to understand what exactly the government is thinking. At the moment, it’s merely significant that there’s been a CBAM announcement. Once we know *what* is being considered, we can speculate on the market impact.

Westminster will also consult on whether to introduce a Supply Adjustment Mechanism (SAM) to the UK ETS to match the EU ETS’ Market Stability Reserve (MSR). There is currently no mechanism for the regulator to adjust UKA supply in the event of a glut of permits, which is partly the cause for the UK market’s steep price fall in 2023. The SAM would help address oversupply by withdrawing some of the surplus allowances from the UK market, tightening supply, and creating conditions for upward price pressure.

Meanwhile, the EU ETS auction program for 2024 will begin on January 15, a week later than normal, after changes to the auctioning regulations were approved late in the year. The EU will offer 396 million EUAs between January and August, an increase of 22% on the total sold in the same period in 2023.

The auction calendar published by the European Energy Exchange shows a total of 684 million EUAs will be sold over the entire year. However, the final auction volumes for the last four months of the year are subject to the annual calculation of the market surplus in June and the withholding of EUAs by the Market Stability Reserve from September.

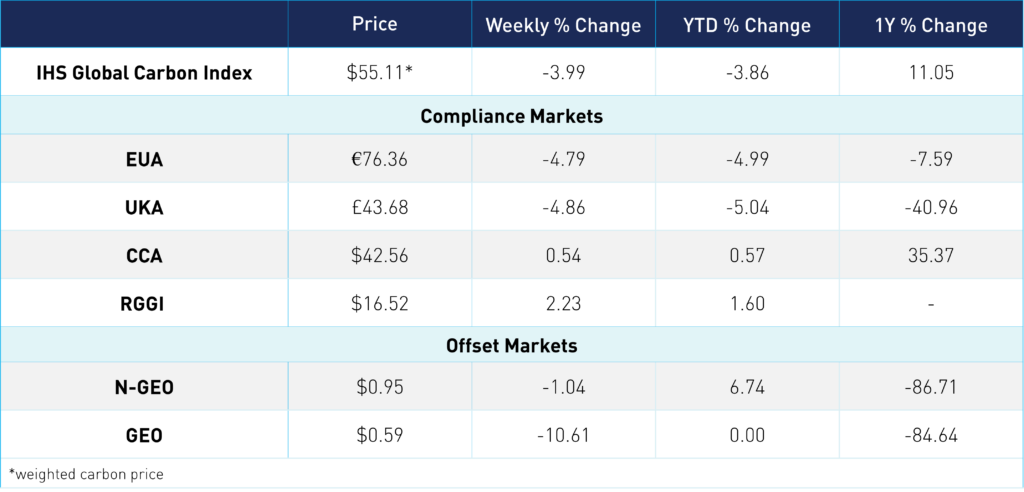

Carbon Market Roundup

The global price of carbon is $55.11, down 4% from the week prior. EUAs prices slipped lower at the start of the week. After regaining some ground on Wednesday, prices came back down to end the week 4.8% lower from last Friday at €76.36. UKAs fell 4.9% at £43.68. CCAs continued to trade sideways into the start of the week, though saw a slight rally intraday yesterday on thin volume, ending the week up 0.5% at $42.56. RGGI continues to push higher, up 2.2% at $16.52. N-GEOs are down 1.0% at $0.95, while GEOs are down 10.6% at $0.59.