COP28 Reflections and Final Thoughts

2 Min. Read Time

This week, we’ve expanded on our initial insights from COP28 and provided some additional reflections on the conference. Given that expectations going into COP2 were generally low in terms of producing concrete, actionable plans, our overall sentiment was that the outcome was still fairly encouraging despite some key topics left open-ended. Outside of all of the ongoing events at COP, a lot of progress and discussions happen on the sidelines. With the top climate leaders and experts altogether, COP has become a prime place for organizations, corporations, delegates, investors, etc., to network and form strategic partnerships around climate action. We had a whirlwind of productive meetings while in Dubai, and, as evidenced by public announcements at the conference, it appeared others did as well.

Corporate conversations (off stage and on stage) were very much focused on nature-positive investments, such as supporting biodiversity and other beyond carbon-positive externalities alongside carbon removal. We saw more country activity, with nations (e.g., Singapore) signing MOUs with other nations to buy credits in support of its Nationally Determined Contributions (NDC).

There were lots of exciting new climate initiatives launched and clean-tech progress announced. As discussed last week, the Loss and Damage Fund for developing nations announced on the first day was a major achievement. New decarbonization initiatives, like the Industrial Transition Accelerator (ITA), backed by Bloomberg Philanthropies, "will connect and elevate existing decarbonization initiatives within the public and private sectors to unlock investment and deliver emissions reduction projects that help new technologies reach commercial scale." Moreover, the Rockefeller Foundation announced that the energy transition accelerator they launched last year will officially start operating in March. Their transition program is designed to provide funding from the voluntary carbon market (VCM) to developing countries to transition to greener energy sources.

The integrity protocols, such as the Voluntary Carbon Markets Integrity Initiative (VCMI) claims code, seem to be gaining traction amongst the VCM community and, more broadly, among corporate issuers. The hopeful implication of this is that we may see more clarity around the accepted use of carbon credits as a “beyond value chain” addition to necessary supply chain emission reductions.

The failure to agree on Articles 6.2 and 6.4 (i.e., the carbon trading rules under the Paris Agreement) was disappointing but it does not mean that we won't still see progress on international carbon credits space. Bilateral trading between countries (A. 6.2) is already underway. Singapore scored the first carbon credit transfer deal with Papua New Guinea. Starting next month, high emitters in Singapore can use Papua New Guinea offset credits of up to 5 percent of their taxable emissions. As for the UN-supervised carbon marketplace, the work the Supervisory Body has already done still provides a general framework but they'll have to continue to work out some of the current more contentious issues. More and more nations are showing a growing interest in integrating carbon credits as a new domestic policy tool, so with more players in the market, the overall stakes are higher, and therefore getting proper regulation in place is critical.

It will be interesting to see how progress will pan out before the next COP, officially confirmed to be held in Azerbaijan from November 11 to 22 next year. A lot can happen in a year and we're excited for what is to come.

Carbon Market Roundup

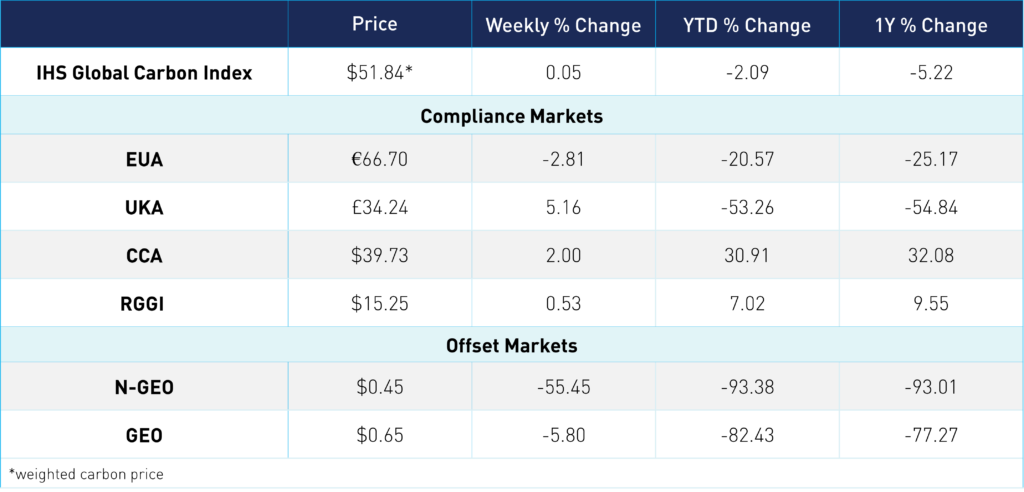

The global price of carbon is $51.84, mostly unchanged from last week. EUAs slipped slightly lower, down 2.8% at €66.70. UKAs trended up 5.2% to £34.24. CCAs are up 2% at $39.73, while RGGI prices are up 0.5% at $15.25. The offsets market came off its COP28 rally, with N-GEOs sharply falling sub-$1 to just $0.45 and GEOs moving down to $0.65.

Dec '23 carbon allowance futures are set to expire next week, with EUAs and UKAs last trading day on December 18 and CCAs and RGGI ending on December 22. Offsets contracts will expire the week after next, on Dec 26.