EUA Price Action Update

2 Min. Read Time

European carbon prices may be poised to bounce back after a four-week decline as winter approaches. This is because the onset of winter will likely lead to a decline in European gas stocks, raising fuel prices and encouraging power generators to use more coal.

EU emission allowances have fallen from an October 13 high of €85.95 to a low of €76.44 as investment funds have steadily built the largest-ever net short position, according to exchange data. As of November 3, managed funds held nearly 22 million EUAs in long positions but nearly 53 million tonnes in shorts. The steady selling by investment funds reflects a view that emissions are likely to have fallen in 2023, with fossil fuel-fired power generation down by more than 20% this year so far, according to data from the European Grid Association. Industrial emissions are also likely to have fallen, as Purchasing Manager Index levels have remained below 50 all year, reflecting a downbeat outlook. Actively managed investment funds have been betting against the market for 14 weeks straight, but they are likely to start covering their bearish bets soon, as the December futures contract goes to delivery in just 40 days.

Carbon’s price action has been strongly influenced by natural gas this year, as the energy sector has closely monitored the replenishment of gas storage across Europe while the region scrambled to replace lost Russian supplies. Inventories now stand at more than 99% full, a record for the time of year, and gas prices have held steady even as the region’s demand for gas has slumped on milder-than-normal weather. In the long term, prices for month-ahead TTF natural gas have fallen by more than 40% over the course of 2023 as storage levels have steadily recovered. But with winter approaching, the gas market remains on edge, as any supply outages or a period of colder-than-usual weather could draw down the region’s reserves and trigger a sharp uptick in prices.

EUA prices have demonstrated a fairly close correlation with natural gas prices this year. As gas prices rise, the fuel becomes less competitive for power generation compared to coal, which emits twice as much carbon dioxide. A shift from gas to coal in power generation, therefore, implies a doubling in demand for EUAs.

EUAs have also enjoyed a seasonal rally in the fourth quarter. Historical data show EUA prices have risen in Q4 since 2015, as industrials ramp up their compliance buying ahead of the end of the calendar year and short-positioned traders unwind their positions before the expiry of the December futures contract. Historically, in October, we see prices decline. However, they tend to rebound towards year-end, with prices rising in November and December every year since 2015, except for one year. Despite the weakening economy, analysts remain upbeat on the outlook for EUAs in the coming years. BloombergNEF predicts prices will average €93 in 2024, €104 by 2026, and eventually climb to €149 by 2030.

Carbon Market Roundup

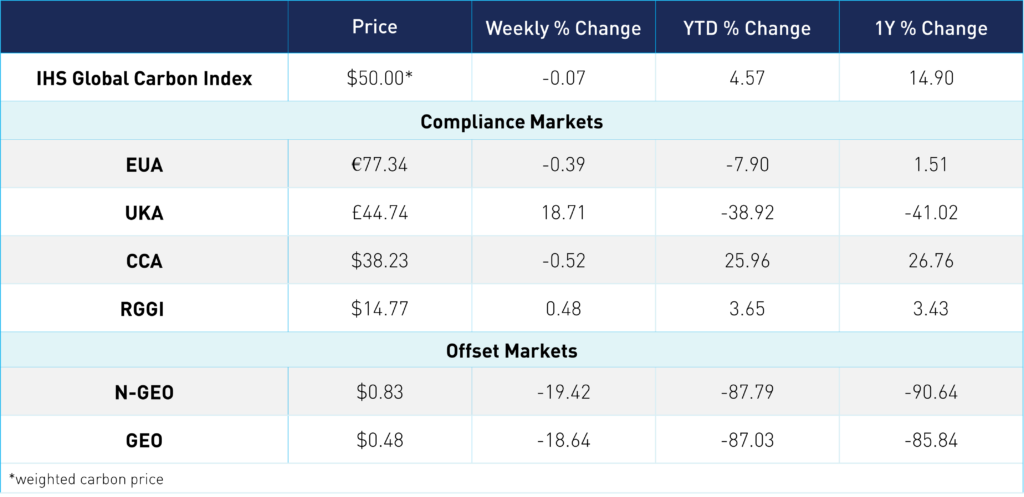

The global price of carbon is $50, down just 0.1% from last week. EUAs were mostly flat for the week, down 0.4% at €77.34. UKAs climbed higher, up 18.7% at £44.74. The UK market has been more volatile in recent weeks but is seeing some support from Energy UK, the trade association for the UK energy sector, finally backing linkage with the EU ETS primarily because of the impact of the EU Carbon Border Adjustment Mechanism (CBAM) on on the UK's power exports. CCAs finished the week flat, down 0.5% at $38.23. Prices hit a high of $38.85 on Monday, though closed lower in the subsequent days. RGGI traded in a narrow range, up 0.5% at $14.77. N-GEOs and GEOs both trended down for the week, at $0.83 and $0.48, respectively.