Global Carbon Markets to Top $800 Billion in 2023

2 Min. Read Time

The value of global carbon markets has continued to climb in 2023 despite the impact of Russia’s invasion of Ukraine, which pushed energy prices to record highs in Europe, according to a new report from Bloomberg New Energy Finance (BNEF). The combined value of the eight largest cap-and-trade markets around the world is set to top $800 billion this year, a 5% increase from 2022, despite a fall in trading volumes.

Europe’s Emissions Trading System remains the largest market, accounting for more than 75% of total value in terms of auctioned permits and futures trading, but its lead is shrinking. In 2017, the EU ETS represented over 90% of total compliance market value. This decline comes as more markets are auctioning permits, with Washington state joining the ranks of the EU, the UK, California, and RGGI this year. The BNEF study did not include New Zealand’s and South Korea’s ETS, which also feature allowance auctions.

The total volume of permits traded has fallen this year due mainly to a drop in forward hedging by European utilities, BNEF said. The significant rise in energy costs and the continuing price volatility have deterred many large energy users from contracting for forward power deliveries, meaning that utilities are not hedging as much carbon and fuel to lock in margins.

According to data from the main European futures market, ICE Endex, the total number of positions held for “risk-reducing” (hedging) has fallen by 32% compared to a year ago. In comparison, total futures positions are 23% lower than they were in 2021 when traded volume hit its peak.

The study nevertheless points out that more compliance markets are on the way, with carbon initiatives in countries ranging from Mexico to Indonesia. More countries are also preparing to participate in the United Nations-regulated Article 6 markets, which will facilitate emissions trading among nations to help them meet self-imposed emission reduction targets under the Paris Agreement. These markets will require mandatory participation by large emitters such as power stations. However, many of them will require plants to retire carbon offsets rather than permits, at least in the initial stages. UN panel is presently developing rules for the new Article 6 market and will present the proposed guidelines at COP28 in Dubai in December.

BNEF forecasts prices for EU Allowances are likely to reach €149/tonne in 2030, up 88% from their current levels, while levels in California are predicted to double to $63/tonne by the end of this decade.

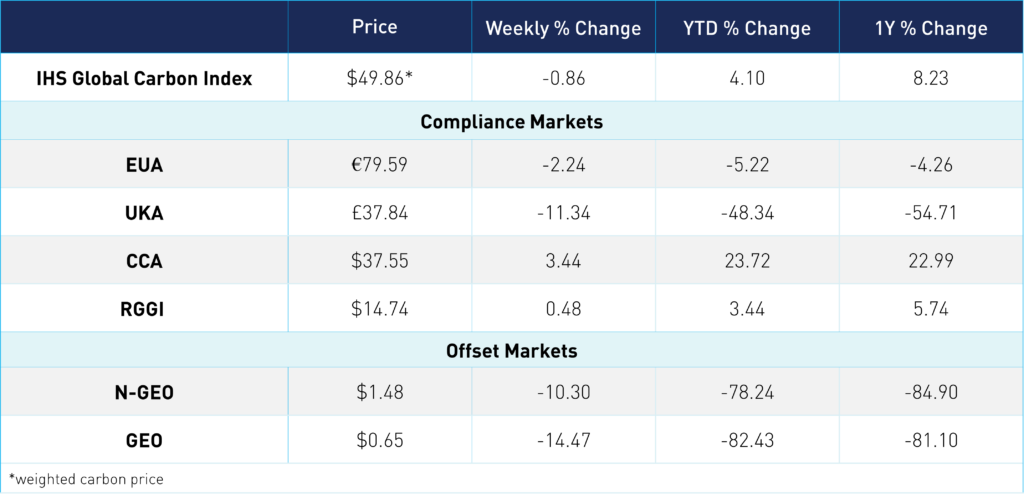

Carbon Market Update

The global price of carbon is $49.86, down a slight 0.9% from a week prior. EUAs are down 2.2% from last week, at €79.59. UKAs continued to slip lower, down 11.3% at £37.84. CCAs popped Thursday to close at $37.55, up 3.4% from the week before. RGGI prices were mostly flat, up 0.5% at $14.74. The offset contracts both moved lower, with N-GEOs down 10.3% at $1.48 and GEOs down 14.5% at $0.65.