California Leads Climate Efforts with New Emissions Disclosure Bill

2 Min. Read Time

Businesses with annual revenues exceeding $1 billion that operate in California will be required to disclose their direct and indirect emissions under a new bill signed last week by state Governor Gavin Newsom. Some 5,300 companies must comply with this new mandate, which officially starts in 2026. The emissions scope includes anything from building operations to employee business travel to product shipping and transport. Downstream value-chain emissions from a company's suppliers (i.e., Scope 3 emissions) will be added in 2027.

This Senate Bill 253 is significant because it raises corporate transparency standards for emissions reporting and is likely to generate more activity in internal investments to bring down emissions. We can also expect to see increased buying of voluntary carbon credits to offset the impact of those emissions. Overall, the bill should help mobilize the private sector to take greater climate action.

Many companies already report their emissions, though this bill introduces more standardization for disclosures. Critics of the bill said it may duplicate federal disclosure measures currently under consideration in Washington and potentially penalize companies less familiar with emissions accounting.

Policymakers tabled an accompanying legislation intended to increase scrutiny and accountability for offset verifiers and issuers. If entities' offset credits were found not to represent real reductions, they would be penalized. Senate Bill 390 would require entities selling and retiring voluntary carbon credits to provide full disclosure about the carbon project and the claims being made by corporate buyers.

Leader in U.S. emissions reductions

California leads the way in reducing emissions in the U.S., operating the largest carbon cap-and-trade market in the U.S., addressing roughly 75% of its 300-million-ton carbon footprint. The market has cut greenhouse gas emissions by around 3% a year from 2015 to 2020, according to the Center for Climate and Energy Solutions, and is designed to lower them by 5% a year from 2021 to 2030.

In addition to direct measures, the state introduced new legislation this year requiring companies with over $500 million in sales to prepare reports detailing how climate change will affect their business. Many similar initiatives have been launched around the world, but California's is among the first to set in law.

The latest carbon credit disclosure rules come as carbon credit markets are sweeping across the globe. New cap and trade markets are being developed from Brazil to India as countries prepare for the start of a new global carbon market being set up by the United Nations.

The 2015 Paris Agreement asks all countries to set a nationally determined emissions reduction target and to implement measures to achieve them. Many countries have opted to engage in international emissions trading to meet part of their target. The so-called Article 6 market will allow countries that are exceeding their targeted reductions to generate carbon and sell national carbon credits to other nations falling behind their goals. There is also scope for private sector participation in these activities, with many companies racing to develop carbon projects ranging from mangrove restoration to rural electrification and clean cooking stoves.

Carbon Market Update

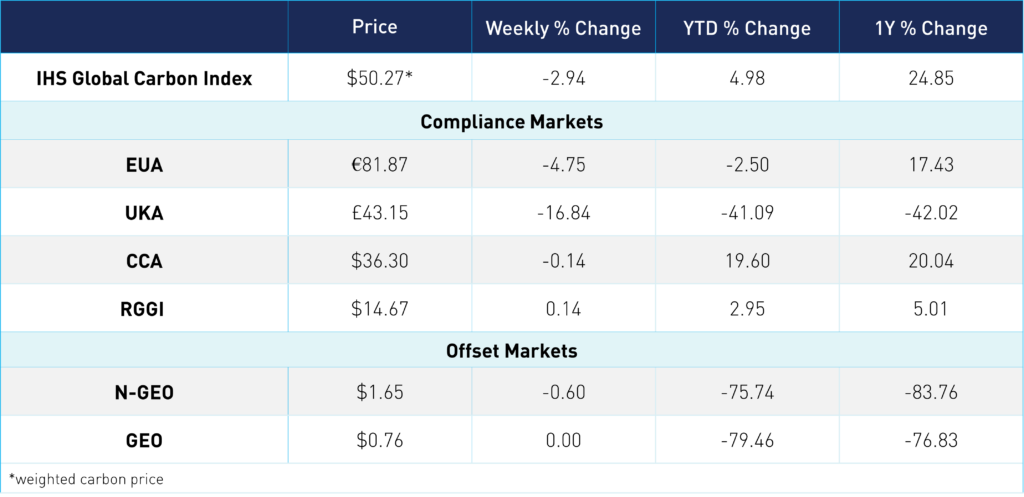

The global price of carbon is $50.27, down 2.9% from last week. EUAs are down 4.8%, at €81.87. UKAs backtracked, to end the week down 16.8% at £43.15. The buzz around the discussions on a UK version of a market stability reserve that propped up UKAs last week wore off, combined with weaker energy markets and EUAs slipping lower. US markets both traded in a tight range. CCAs were down 0.14% at $36.30, while RGGI was up 0.14% at $14.67. Offsets markets were fairly quiet this week. N-GEOs were down 0.60% at $1.65, and GEOs were flat at $0.76