European Carbon Border Tariff Transition Phase Begins

2 Min. Read Time

The European Union's Carbon Border Adjustment Mechanism (CBAM) came into effect on October 1, the first time any jurisdiction has imposed a cost on the carbon content of imported raw materials. The CBAM requires importers to calculate and report the volume of greenhouse gases emitted in the production of the materials they bring into the EU.

The initial transitional stage only requires reporting emissions, but from 2026, importers will also need to buy so-called CBAM certificates to cover those emissions. The border levy will initially cover imports of cement, iron and steel, aluminum, fertilizers, hydrogen, and electricity, though it could be extended to more products later.

From 2026, importers will need to purchase CBAM certificates from the EU and surrender a number of certificates corresponding to the total volume of CO2 equivalent embedded in their annual imports. The cost of these CBAM certificates will be equivalent to the average weekly EU Allowance auction price at the time of purchase. Last week's five auctions cleared at an average price of €82.26/tonne.

As the cost of CBAM certificates begins to be borne by importers, the share of EU Allowances handed to EU industrials free of charge will decline until all imports and domestic EU production face the full cost of carbon. Previously, a share of free allowances was allocated to specific industries in the EU to help keep them competitive relative to regions without additional carbon costs.

As well as working towards the bloc's own carbon neutrality, the CBAM is explicitly intended to encourage other major economies and trading partners to decarbonize through direct measures such as shifting to zero-carbon energy or by introducing their own carbon price regimes.

Exports to Europe can avoid the CBAM charge if there are no carbon emissions in specific raw materials or if the exporting country operates a carbon pricing system that generates an equivalent price to that in the European Union. Foreign exporters from countries with a carbon pricing system will have to pay the difference between their market's carbon price and the EU's.

The two-year development of the CBAM has prompted a number of countries to start implementing carbon pricing. India has started to plan a market, though most recently, there have also been reports that the country will charge a climate-related tax on EU exports to ensure revenue remains within India and is not simply paid to the EU.

Other major carbon-intensive exporters, such as Indonesia, Malaysia, Brazil, Vietnam, and Mexico, are also setting up carbon pricing regimes. However, few are expected to generate a price equivalent to the European level in the near future. Moreover, most new national markets will likely be based on legal requirements for industrial companies to offset some or all of their carbon emissions, and cap-and-trade rules will probably not be employed for some time.

These markets will also act as a conduit for carbon credits to flow into the emerging UN market regulated by Article 6 of the Paris Agreement. A number of countries have already made agreements to buy and sell so-called Internationally Transferred Mitigation Outcomes (also called carbon credits in non-United Nations markets) that they will use towards their self-binding Paris climate targets.

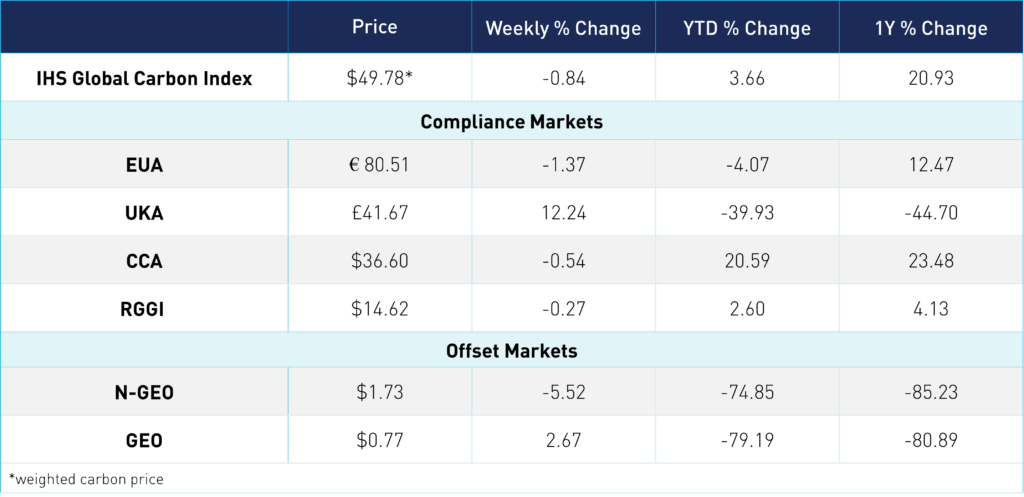

Carbon Market Roundup

The global price of carbon is $49.78, down 0.8% for the week. EUAs were down 1.4% at €80.51. UKAs were up 12.2% at £41.67. CCAs were mostly flat for the week, down 0.5% at $36.60. RGGI traded in a narrow range, down 0.3% at $14.62. N-GEOs were down 5.5% at $1.73, while GEOs were up 2.7% at $0.77.