Carbon Creates Buzz at Climate Week NYC

2 Min. Read Time

This week, carbon market participants from around the world have been attending the annual New York Climate Week (NYCW) in New York City, an event which coincides with the United Nations General Assembly and serves as a focal point for political as well as commercial discussions on the planet's climate challenge.

The UN General Assembly serves as a high-level framing of the week's agenda. This year, the assembly held a general debate on "Accelerating action on the 2030 Agenda and its Sustainable Development Goals towards peace, prosperity, progress and sustainability for all".

NYCW serves as a platform for a wide variety of events each year, and 2023 is no different. Politicians from Scotland to Panama, NGO leaders, and chief executives are addressing topics covering the built environment, food, finance, and nature.

The week is also one of the main meeting points for carbon market participants. Traditionally, the market focus is strongest at the International Emission Trading Association's North America Climate Summit, where traders, project developers, and regulators from markets ranging from California to Japan have come together to take stock of the progress toward 2030 goals and to set the scene for this December's UN Global Stocktake. Established under Article 14 of the Paris Agreement, the Global Stocktake reviews countries' and stakeholders' progress towards meeting the goals of the Paris Climate Change Agreement. They occur every five years, and the first-ever stocktake will conclude at COP 28.

At this year's UN Conference of Parties (COP 28) in Dubai, countries will assess whether their current carbon-reducing pledges – their Nationally Determined Contributions (NDC) – are enough to meet the mid-century net zero goal of the Paris Agreement. Generally, it's understood that the NDCs are nowhere near ambitious enough. As a result, the incoming COP president, Majid al-Suwaidi of the UAE, has said that this year's climate summit will focus on building consensus around a global carbon price or tax.

At NYCW conferences, there was a lot of talk about the voluntary carbon markets, addressing issues on quality and regulation. Amid media reports detailing the shortcomings of certain project types in the voluntary carbon markets, organizations have been prioritizing more stringent standards, pledging wide-ranging reviews on their processes and methodologies, while a new standard for reduced deforestation projects has also been launched.

The IETA Climate Summit featured analyst presentations on the outlook for compliance carbon prices in US markets, as well as a round table of regulators outlining their steps towards market reform. One development was around revisions to the Northeast US (RGGI) market. According to documents published ahead of the RGGI stakeholder meeting next week, member states are said to be "leaning towards" changing the compliance rules to require annual compliance rather than a three-year compliance period. This revision would require installations to surrender permits covering a whole year's emissions every year instead of the current system. Currently, power plants must surrender allowances covering 50% of their emissions in years 1 and 2 of each compliance period before handing in the remaining 50% in year 3. This change might "even out" the demand for permits and create a trading seasonality pattern that resembles the EU ETS more than California.

Luke Oliver, Head of Climate at KraneShares, and Eron Bloomgarden, Partner at CLIFI, also both spoke at the Sustainable Investment Forum, which covered everything from policy and macroeconomic impact on the energy transition to ways investors can allocate toward nature-based/sustainable asset classes, including carbon.

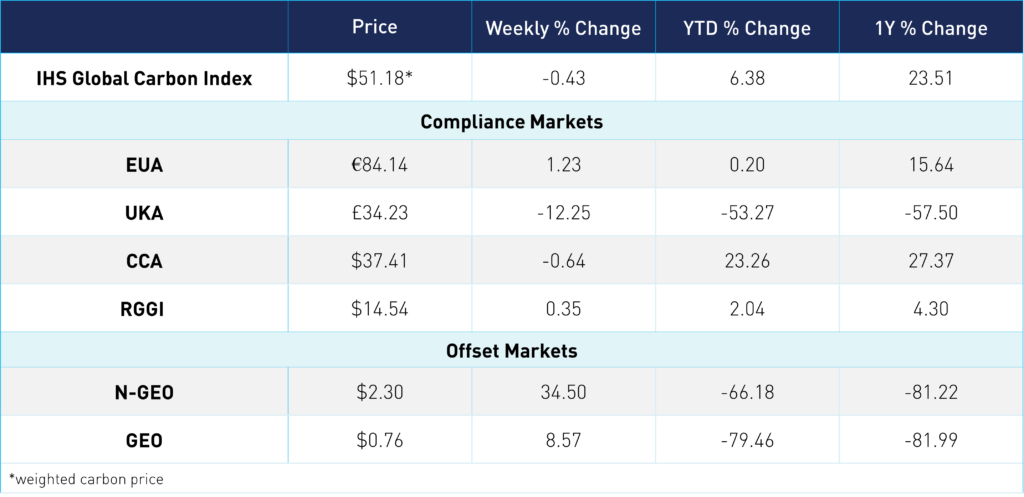

Carbon Market Roundup

The global price of carbon is $51.18, down 0.4% for the week. EUAs are up 1.2% at €84.14 week over week. Meanwhile, UKAs have fallen 12.3% at £34.23. CCAs are just below last week's price, at $37.41. On Tuesday, CCAs hit above their earlier high of $37.86 (Jul 31) but reversed down to end lower for the day. RGGI prices traded in a tight range, up just 0.4% at $14.54. Regulators released the slide deck for the upcoming program review on September 26, though the market reaction was fairly quiet. N-GEOs saw a strong rally this week, with prices up 34.5% at $2.30. GEOs also had some momentum, up 8.6% at $0.76.