RGGI & Washington Quarterly Auction Recap

<1 Min. Read Time

The Northeastern US Regional Greenhouse Gas Initiative (RGGI) held its latest quarterly auction on Sep. 6, in which nearly 22 million RGAs were sold at $13.85/short ton, the second-highest clearing price since the market began in 2008. The sale was 2.2 times oversubscribed, compared to the previous sale’s ratio of 1.9 and an overall average of 2.27.

The auction price did not reach the $14.88 threshold at which an additional 11.3 million allowances would be offered from the market’s cost containment reserve, and those CCR permits will be held over until the next sale, scheduled for Dec. 6. In the sale, six large utilities and seven investors bid for at least 1 million RGAs, according to the market monitor.

Prices in the secondary market were slightly higher at the time of the sale, with the prompt future contract settling at $14.01/st on Sep. 6, but after news of the action outcome was released, September prices rose to as high as $14.51 on the ICE Futures exchange. Some of the bullish price action may also reflect expectations ahead of the next scheduled public review meeting. RGGI states are to hold another roundtable to review the options for market reform on Sep. 26.

Washington state also held its third allowance auction on Aug. 31. The sale offered a total of 8.6 million permits and cleared at a record $63.03/tonne, against a floor price of $22.20/tonne. The auction was 1.79 times oversubscribed, with compliance entities accounting for more than 85% of the purchasing, the state environment agency reported.

The auction bidding also triggered the release of a second tranche of permits from the Allowance Price Containment Reserve (APCR). Five million ACPR permits will be sold on Nov. 8 at a price of $51.90/tonne. Only covered entities will be permitted to participate in the sale, which is designed to force the price of allowances lower.

In August, the state sold two tranches of 527,000 permits at $51.90 and $66.68, respectively, after prices in the opening February sale also breached the price containment threshold. The scale of demand for these additional permits persuaded the state to boost the volume for the next reserve sale.

Secondary market prices fell sharply after the state announced the volume for the next APCR sale, dropping from a high of $67.30/tonne on Sep. 5 to $56.00/tonne a day later for December futures.

Carbon Market Recap

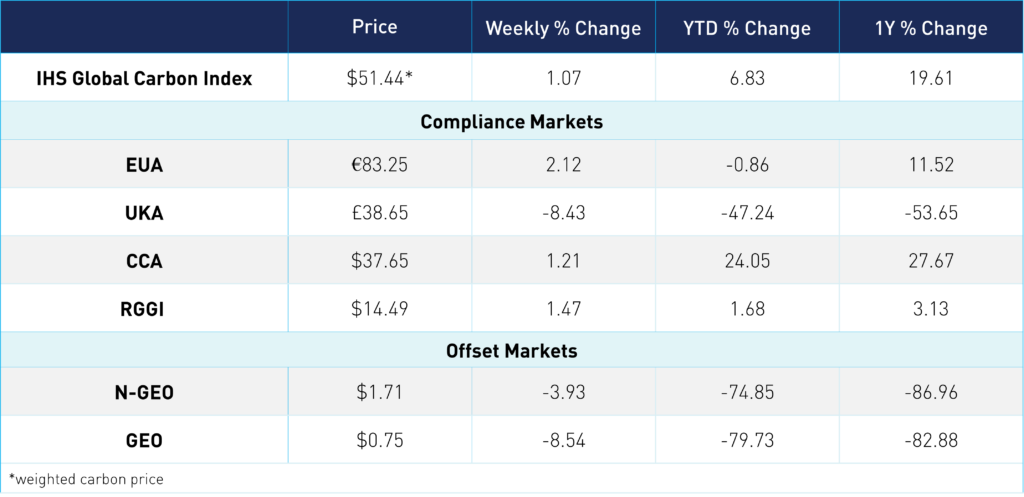

The global price of carbon is $51.44, up 1.1% for the week. EUAs were up 2.1% week over week at €83.25. UKAs trended down 8.4% at £38.65. CCAs were up 1.2% at $37.65 while RGGI was up 1.5% at $14.49. The offsets markets were both down for the week, with N-GEOs down 3.9% at $1.71 and GEOs down 8.5% at $0.75.