Energy Aspects Updates US Carbon Price Forecasts

<1 Min. Read Time

Analysts at Energy Aspects have updated their forecasts for California and RGGI prices as regulators return from their summer break and address the ongoing reform process in both markets.

The analysts expect California prices to be stable at around $36-$37/tonne as the state Air Resources Board digests the outcome of recent stakeholder meetings and prepares for the next update. In the third quarter, we've seen prices steadily climbing, with CCAs posting a sharp rally toward the end of August into this month. Energy aspects predict an average price of around $35.74/tonne for the fourth quarter and $37.35/tonne for Q4.

The record-high auction price set last month is likely to keep prices high over the remainder of the year, as it shows market participants are ready to price in an ambitious reform package and a tighter market supply. Energy Aspects believes that the regulator is likely to set a reduction target of around 44% for 2030 – its base case – and analysts said any outcome that is more ambitious than this could boost prices. They now predict full-year verified emissions for 2023 will come in at around 281 million tonnes, increasing its forecast by 1.4 million tonnes, based on a lower-than-expected drop in diesel transport emissions, higher refinery output, and a moderately improved outlook for industry.

For the east coast RGGI market, Energy Aspects noted that prices in the secondary market have remained close to its forecast for the second half of 2023 at $14.00/short ton. The uncertainty around modifications to the market's regulatory Model Rule for the 2023 period has impacted liquidity. However, there's potential for prices to experience an upswing once the review schedule is solidified.

Reported emissions in the second quarter of 2023 were around 500,000 tons below Energy Aspects estimates, which indicated the annualized allowance deficit was down to 9.5 million tons. However, the company reiterated its estimate that the annual shortfall will top 14 million tons in 2024, and this will push prices high enough to trigger the cost containment reserve at $15.92 by the end of next year.

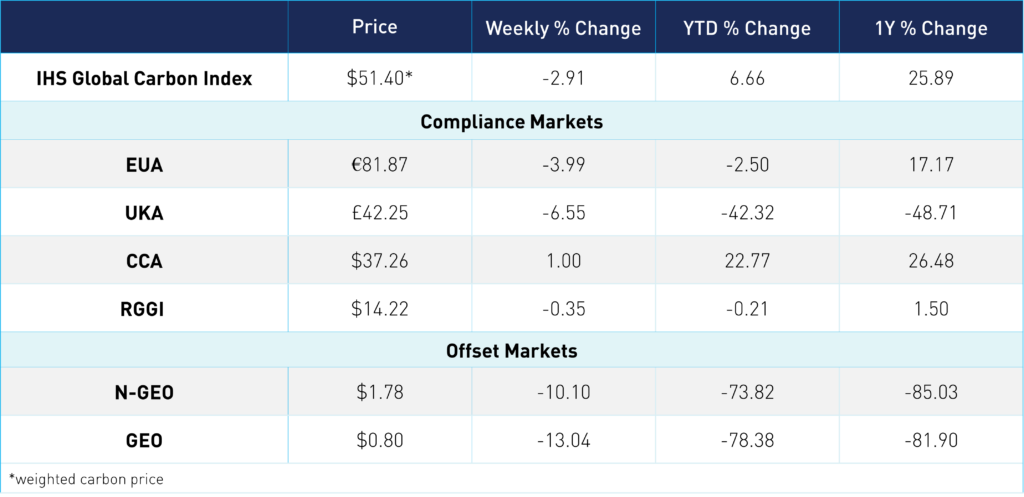

Carbon Market Roundup

The global price of carbon is $51.40, down 2.9% from last week. EUAs trended down just under 4% for the week, at €81.87. UKAs fell 6.6% to end the week at £42.25. CCAs have been slightly coming out of the long holiday weekend but have maintained the mid-low $37 level over the past several days while still under the earlier high of $37.86 in July. Overall, CCAs were up 1% week over week, currently at $37.26. RGGI prices slipped slightly during the week but recovered to end down just 0.4% at $14.22. N-GEOs and GEOs were both down over 10% for the week, at $1.78 and $0.80, respectively.