Historic August EUA Rally Ends Slightly Early

3 Min. Read Time

EU carbon allowance prices have historically performed very well in August due to the reduced summer holiday auction schedule. Data from the main ICE Endex exchange show that since 2015, EU permits have risen by an average of 8% at the end of the month, one of the strongest average monthly performances of the year and one of the most consistent as well. Previously, only in 2019 did prices end August lower than where they began it, though in 2022, the final settlement was also just 0.7% lower.

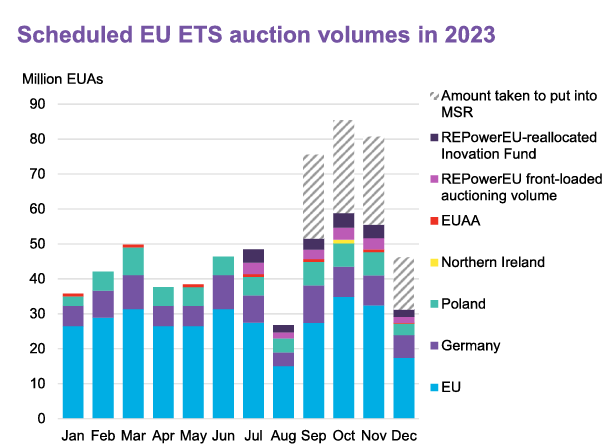

The typically strong market in August reflects the annual 50% cut in auction supply, which is done because the month is marked by the peak holiday season where many corporate officers at compliance companies are away from their desks. This drop in supply, as well as an overall decline in liquidity, means that prices are more vulnerable to sharp swings, and this August has been no exception. Prices have moved between €82 and €90, with the largest daily change reaching €2.38.

The height of the monthly rally this year was on August 22, when prices reached €89.87 or a return of nearly 6%. Prices have since come down to where they started the month, at roughly the €85 level. It's worth noting that there was a run up towards the second half of July, with prices rising nearly 10%. In July, prices initially were impacted by the pickup in strong renewable power generation and the introduction of 3.2 million allowances for REPowerEU funding. As the month went on, oppressive heatwaves created stronger AC demand and thus increased emissions from greater electricity use. Moreover, we are increasingly seeing stronger demand for allowances in the lead up to August in anticipation of the traditional price rally from the reduced auctions. With EUA prices starting at higher levels and the rally ending early, the overall August return was just 0.8%.

The price action this month has reflected to a considerable extent the actions of speculators, both strategic medium-term as well as day-traders and algorithmic trading systems. Some of the daily volatility has been the result of momentum trading, while on other occasions, movements in natural gas prices have triggered a response in EUAs. Participants have also watched closely the weekly positioning data from the main ICE Endex exchange, which has shown investment funds holding a net short position of between 6 million and 11 million EUAs over the four weekly reports. Typically any build in net short positions has led to a “short squeeze” in which traders test the conviction of funds’ bearish bets, but in August, this was not evident. Beyond speculator action, there was also continued strong renewable generation and more muted power demand. September will also see an additional 2.7 allowances added to the supply for REPowerEU, which is something we haven't had in past years and an additional consideration as August wrapped up.

The long-term outlook for European carbon remains firmly positive as the European Commission begins to implement its supply tightening “Fit for 55” reforms, while the short term is expected to see some impact from macroeconomic concerns, and experts have pointed to declines in power demand across Europe as well as reduced industrial output that may impact 2023 compliance demand. That said, the current market level represents a potential buying opportunity for EUAs at well below the levels forecast for the period after 2025.

The healthy long-term outlook for Europe is also complemented by developments in other parts of the world. This year has already seen a large number of major emerging economies announce the implementation of carbon trading regulations, as many of them seek to exploit the emerging demand for carbon credits from the voluntary market as well as the United Nations’ so-called Article 6 system. None of these new markets can accurately be called “cap-and-trade” markets like Europe or California’s systems, but they do represent a step in that direction.

Indonesia, for example, is setting up a market that will place a limit on company emissions but will require emitters to buy carbon credits – rather than government-issued allowances – for compliance. This version sets up the structures of a cap-and-trade system but will likely keep prices considerably lower by allowing companies to source credits from an almost unlimited volume of carbon offsets in other countries as well as Indonesia.

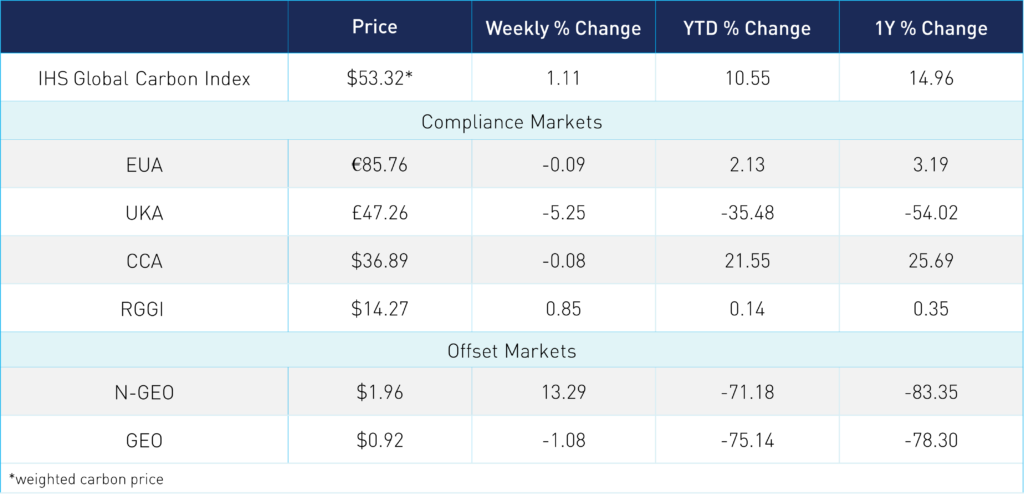

Carbon Market Roundup

The global price of carbon is $52.32, up 1.1% from the week prior. EUAs remained mostly unchanged, ending at €85.76, off by just 0.1%. UKAs started the week down after having the Monday holiday off and traded in a narrow range to close at £47.26, down an overall 5.3%. CCA prices picked back up Tuesday after seeing a few down days, and ended at $36.89, just 0.1% below last week. RGGI prices moved slightly higher into this week, up 0.9% at $14.27. N-GEOs rebounded, up 13.3% at $1.96 while GEOs fell slightly by 1.1% at $0.92.