Carbon Prices Stabilize Amid Peak Summer Holiday Season

2 Min. Read Time

Carbon prices have steadied in most major markets over the past few weeks, reflecting a period of calm during the peak summer holiday season, which has temporarily impacted trading volumes.

California Carbon Allowances are consolidating in the mid-$36s/tonne after the December 2023 contract peaked at a record $37.86 on ICE Futures at the end of July. Prices exhibited a bullish response to the state regulator's modeling, which suggested reforms to the system would include a sharp tightening of the market cap.

California’s cap-and-trade system is currently calibrated to achieve a 40% cut in emissions by 2030, but a July workshop presented alternative scenarios that could see the system ratcheting up to a 55% reduction by the end of the current decade.

On the east coast, RGGI prices have also settled down after rising to 2023 highs. The 11-member state participants within the system have been considering changes to the market since 2021 and are expected to set out scenarios for potential adjustments to the market cap.

December 2023 RGA futures are trading at around $14/short tonne and continue to show considerably less volatility than other markets. Experts point out that RGAs have tended to trade in sympathy with California prices despite the fundamental differences between the two systems.

The state of Virginia continues to progress towards a withdrawal from the cap-and-trade system by the end of the year, though the regulatory decisions continue to be challenged in the courts by Democratic lawmakers and environmental groups.

The European Union’s emissions trading system has settled in the €83-86/tonne range over the last week after prices dropped out of the €90s in late July. Trading activity has slowed in terms of liquidity, but prices have shown impressive resilience in the face of a poor macroeconomic outlook, with power generation and gas consumption both declining.

Data from the EU’s grid operator’s agency ENTSO-E shows the bloc’s total power generation over the period January-July was 5.8% down from a year earlier. Hard coal-fired output was 24% lower, lignite-fired power was down by 26%, and gas-fired electricity fell more than 18%. Only renewables have shown any growth, with seven-month output rising by 6.7% compared to 2022.

While Industrial power and gas demand are widely said to be declining, carbon prices have so far not fallen as far as some traders expect. The resilience is put down to the impact of changes to the market parameters, which will begin to take effect next year, such as the inclusion of maritime shipping emissions and the end of free allocation of EU Allowances to airline operators.

The UK Emissions Trading System has seen prices fall by more than 50% since March, setting a new low of £39.58 this week. Traders have pointed to disappointing statements from the government indicating that the upcoming market reforms will not address risks around oversupply and will continue to support the industry with free allowances even while the market’s cap is adjusted downward.

Finally, the voluntary carbon credit markets have seen recovery since the slump earlier this year after media scrutiny of some project types. Efforts by private-sector initiatives like the Integrity Council for the Voluntary Carbon Markets (ICVCM) have come up with guidelines and assessment criteria to determine quality thresholds for carbon credits. The first issuance of quality-approved credits is expected towards the end of this year.

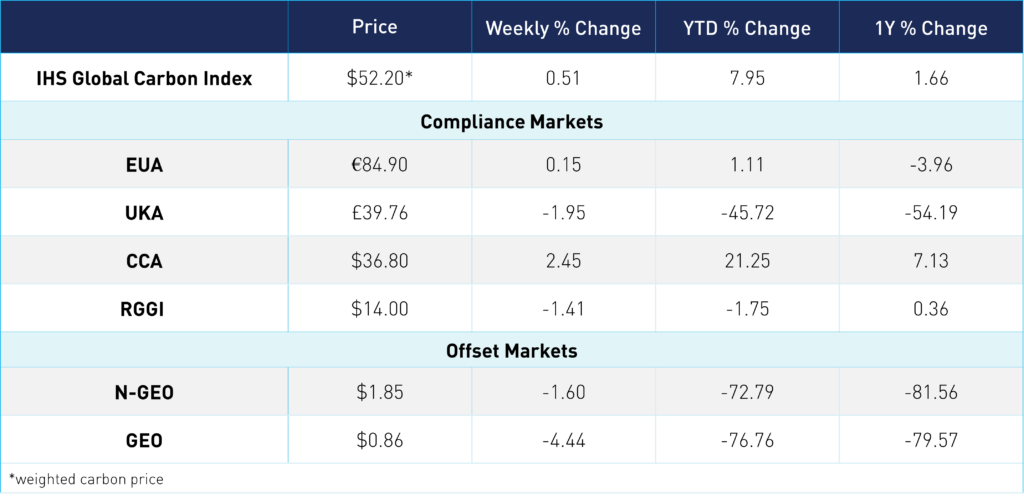

Carbon Market Roundup

The global price of carbon ended the week at $52.20. EUAs closed at €84.90, gaining 0.15% for the week, while UKAs closed at £39.76. CCAs closed at $36.80, up 2.45% week over week, while RGGI prices closed at $14.00. The offset markets both trended down for the week, with N-GEOs at $1.85 and GEOs at $0.86.