CCA Prices Jump to All-Time Ahead of Program Workshop

2 Min. Read Time

CCA prices jumped to all-time highs, hitting $36 in the run-up to Thursday's California Air Resources Board (CARB) public workshop on the cap and trade program. Prices began rallying last week after CARB unexpectedly announced the meeting date. Friday closed up 5% for the week at $34.50, and prices continued to push higher into this week. California Carbon Allowance (CCA) prices have typically rallied ahead of previous regulatory talks as traders buy CCAs as insurance against any bullish announcements.

The main focus of the cap-and-trade revisions is to align the market with California's 2022 Scoping Plan emissions reduction target, which established a 48% reduction below 1990 levels by 2030 (up from 40%), with an 85% cut by 2045. Regulators discussed potential annual cap reduction scenarios to meet this new target. Currently, California's 2023 market cap is estimated at 295 million tonnes and, under current regulation, will shrink by 4% or 13.5 million tonnes/yr to reach around 200 million tonnes in 2030. Experts suggest that in order to bring the market in line with the 48% target, significant cuts need to be made not only to the annual cap on emissions but also to the outstanding bank of unretired allowances.

Some environmental groups have suggested creating an emissions containment reserve that would absorb surplus permits when demand declines. This reserve would act in much the same way as the EU ETS' market stability reserve(MSR), which takes out 24% of the calculated market surplus each year by cutting an equivalent volume from the auction supply. The proposal and approval of the EU ETS' reserve in late 2017 boosted prices three-fold in the next calendar year.

Other topics include potential changes to holding limits to account for cap adjustments, corporate disclosure rules to address any risk of market manipulation, and how to incorporate mandated targets for carbon removal into the market system. An executive letter from Governor Gavin Newsom earlier this year set a goal of achieving 20 million tonnes of removals in 2030, and 100 million tonnes in 2045.

The cap-and-trade reform will also consider changes to the market's use of carbon offsets. Compliance installations may use carbon credits equivalent to 4% of their total emissions for compliance until 2025, a figure that rises to 6% between 2026 and 2030. There are a limited number of offset protocols that are eligible for compliance use, and a review of these also forms part of the reform process.

We will provide more color on the outcome of the workshop in next week's blog. The presentation deck from the meeting can be found here.

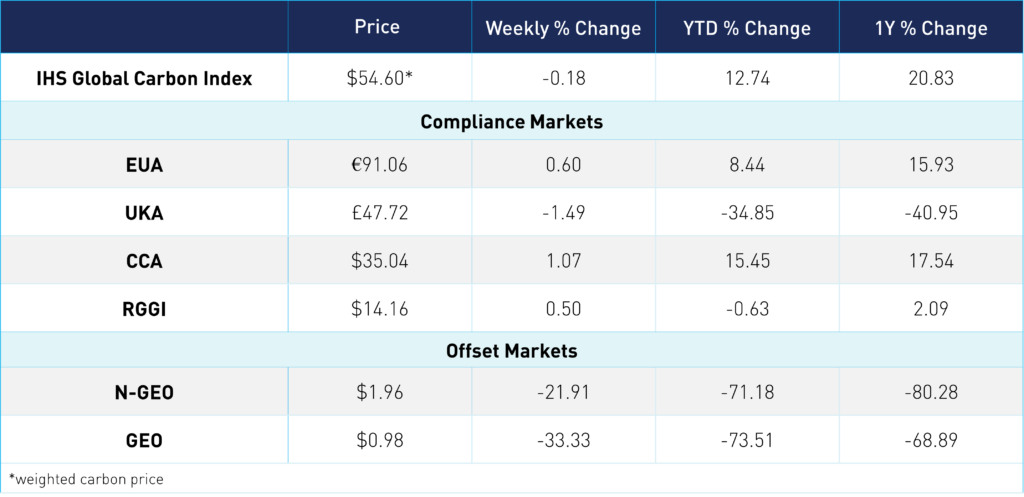

Carbon Market Roundup

The global price of carbon remained relatively flat at $54.60. EUAs held above €90 for the week and closed at €91.06, up an overall 0.60%. UKAs fell a slight 1.5% to close at £47.72. CCAs closed at $35.04, up 1.1% week over week. RGGI prices traded in a tight range, ending at $14.16. Meanwhile, the offset markets both trended down for the week, with N-GEOs at $1.96 and GEOs at $0.98.