CCAs Hit YTD High, EUAs Showing Resilience

2 Min. Read Time

In the last several days, California carbon has been making advances and is gathering pace. CCAs hit a new year-to-date (YTD) high of $34.67. That's an increase of 14.2% YTD and 18.2% from their low of $29.34 on January 31. RGGI also moved above the $14 level for the first time since the start of the year, finally out of the mid-$13 range.

Several factors are playing into recent market moves: warmer weather increasing A/C usage and, therefore, more demand for energy, improvement in macro sentiment, and the CCA program review meeting scheduled for next week. RGGI's market is likely being boosted by CCA's momentum. There is also some positive sentiment around New York’s economy-wide carbon market possibly linking with RGGI following a series of webinars that started last month on the pre-proposal/ regulatory development phase for the program.

Meanwhile, European carbon allowances (EUAs) are currently just over €90, representing a year-to-date increase of 7.8%. Previously, EUAs were trading within a narrow range between the 200 and 50 day moving averages, i.e., €85.83-86.85, but we finally saw the market breakout higher on Tuesday.

EUAs are seeing some potential support from the annual supply cut scheduled for August. Since 2008 the EU has reduced the auction supply by 50% each August as the market winds down over the height of the summer holiday period. With less supply flowing into the market, prices tend to increase over the month. Data from the leading exchange ICE Endex show that since 2008, EUA prices have risen by an average of 9% over the month, though levels ended slightly lower in both 2019 and 2022.

Moreover, EUAs have remained relatively resilient despite facing some bearish impacts from the EU macro outlook and reduced industrial demand. Data from the European electricity grid association ENTSO-E shows that power generation from coal-fired plants declined by around 40% in the first six months of 2023, while output from gas-fired installations was down by 21% year-on-year. Meanwhile, supply from renewables has grown by almost 9% over the first half of 2023. Part of this stems from the European Union’s efforts to improve efficiency amid the loss of Russian gas supplies, while a worsening economic outlook has also trimmed demand from industry.

Carbon futures typically show a strong linkage to short-term fluctuations in energy prices. The month of June saw December 2023 EUAs and calendar 2024 TTF natural gas (the main benchmark for European nat gas) display a strong correlation of +0.78, compared to a year-to-date correlation of +0.41. Market observers point out that after rising to as much as €340/MWh last year, natural gas prices are now back at levels that make it competitive with coal as a fuel for short-term power generation. Consequently, carbon prices may rise with gas in order to maintain its advantage over coal.

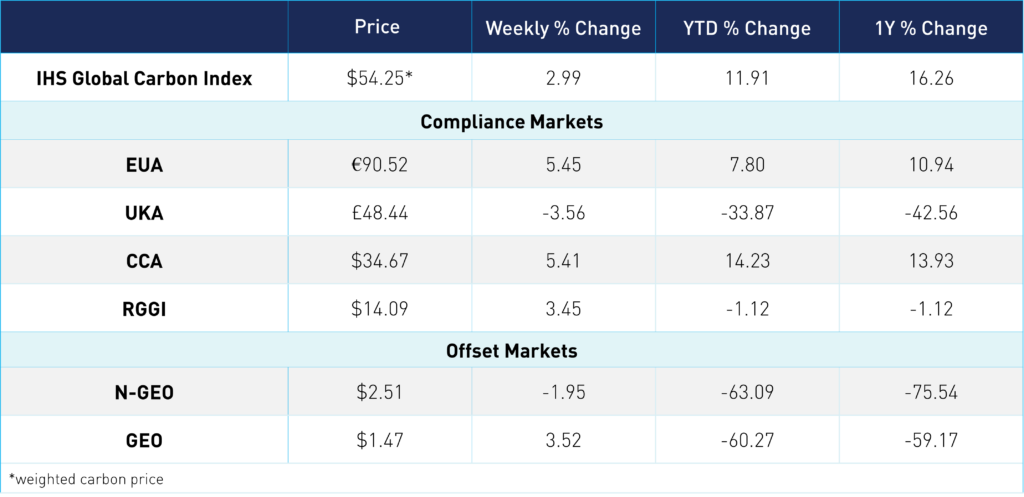

Carbon Market Roundup

The global price of carbon is $54.25, up 3.0% for the week. EUAs steadily increased throughout the week, up an overall 5.5% to close at €90.52. UKAs were down 3.6%, ending at £48.44. CCAs continue to push higher following their rally last week to close at $34.67, a 5.4% increase from the week prior. RGGI prices have hovered just above the $14 level since the start of the week, closing at $14.09, up a solid 3.5%. N-GEOs were down 2.0% at $2.51, while GEOs were up 3.5% at $1.47.