UK Regulators Tighten Allowance Cap Among Other Reforms

2 Min. Read Time

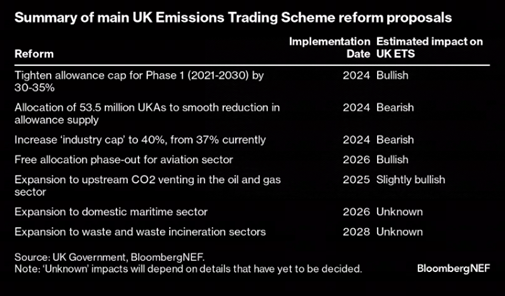

On July 3, the UK government published its long-awaited response to a public consultation on reforms to the UK Emissions Trading System (ETS), proposing a 31% cut in the market cap over the program’s Phase 1 period (2021-2030). The proposed new cap of 936 million tonnes compares to the original cap of 1.37 billion tonnes for the period. This cap reduction suggests a significant tightening in supply starting next year and should be bullish for the UK market. To put this in context, the annual cap will drop to just 50 million tonnes by 2030, which is half of the market’s emissions in 2022.

To avoid a sudden drop in market supply when the new cap is implemented, the government will hand out 53.5 million additional allowances from existing reserves to the market between 2024-2027.

The government will also increase the share of the overall cap set aside for free allocation to industry from 37% to 40%, thereby giving the industry more time to implement decarbonization while remaining protected from the risk of carbon leakage.

The scope of the UK ETS will also be extended to include domestic maritime emissions – in line with the recent decision to expand the EU ETS to cover regional shipping – and CO2 emissions from upstream oil and gas production.

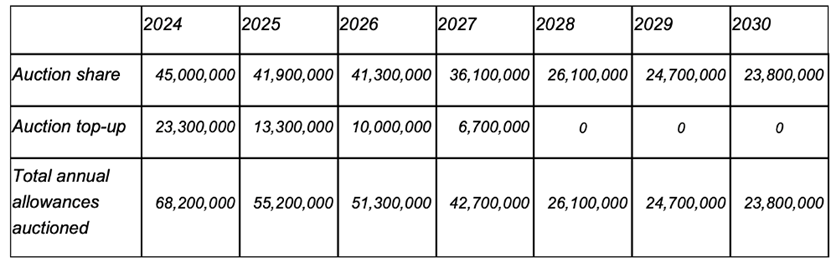

The consultation included proposals on the auction volumes to be offered over the remainder of the phase, showing that the number of UKAs offered would decline from 68.2 million in 2024 to 23.8 million in 2030.

The government also said it would conduct more consultations on further changes to the market coverage, expand the market to cover new sectors like waste, and review the overall market cap and the free allocation methodology. A separate consultation will consider introducing greenhouse gas removals into the market, offering a way for covered installations to purchase removals to offset their emissions.

A consultation on the second phase of the free allocation review is expected to be completed by the end of this year, and where the government will issue its response sometime in 2024. Changes to the free allocation methodology will be made by 2026 in time to be implemented for the 2026-2030 allocation period.

The publication of this response to the initial consultation kicks off a busy period for the government, regulator, and the final legislative proposals – likely to appear from next year –and will impact the market as it starts the second half of its first phase in 2026.

BloombergNEF published a summary of the reform proposals and their expected impact, listed below.

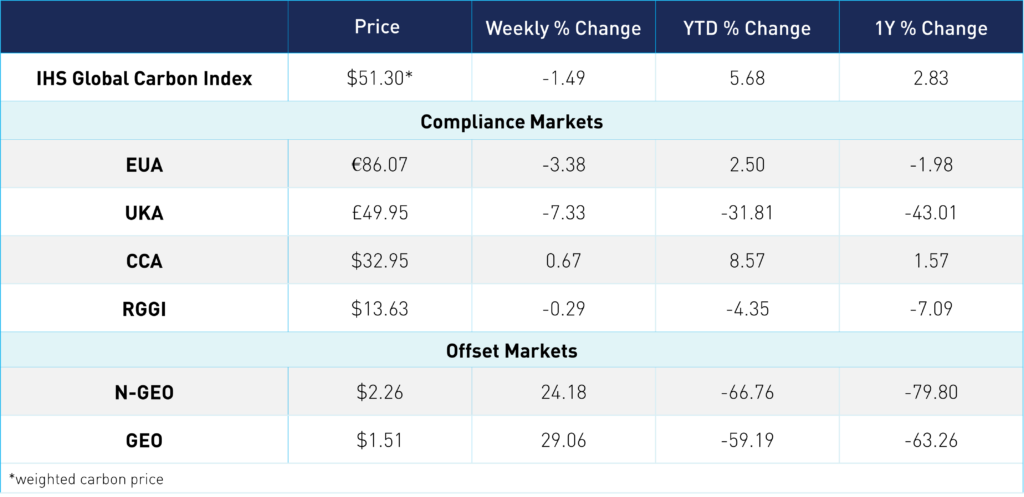

Carbon Market Roundup

The global price of carbon is $51.30, down 1.5% from last week. EUAs fell 3.4% over the week to €86.07. UKAs were down 7.3% at £49.95. The market rallied at the start of the week, up 8.2% higher, following the announcement of the new supply cut and additional reforms but lost most of Monday's gains over the course of the week. The US market remained relatively flat. CCAs have been battling the $33 level and have struggled to break out. Currently, CCAs are at $32.95, up a slight 0.7%, while RGGI is at $13.63, down 0.3% for the week. N-GEO prices broke out over the $2 level and have been steadily moving higher at $2.26. GEOs are also pushing higher, now trading at $1.51.